OIL: Shandong Crude Imports from Iran Boosted Amid Sanctions Fears: Vortexa

Apr-10 11:27

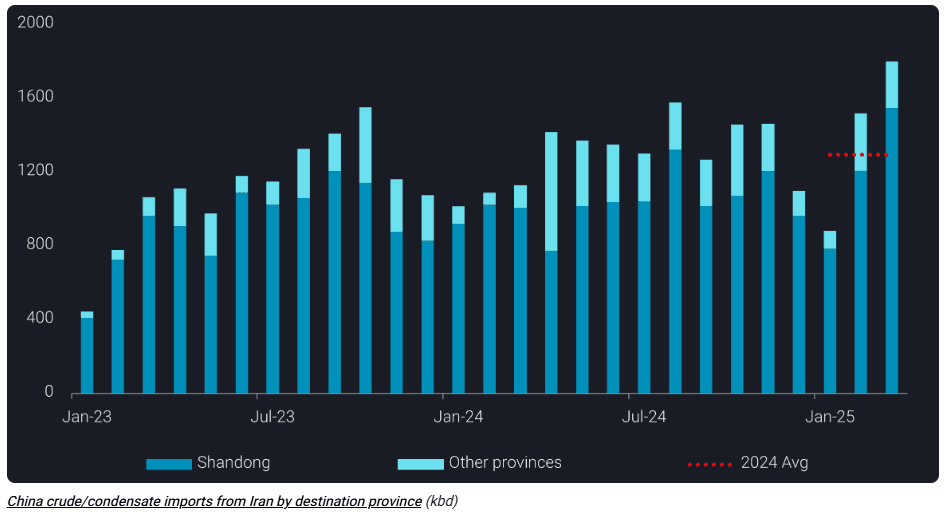

China’s seaborne crude imports rebounded to the highest since October 2023 at 10.6mb/d in March as Iranian crude imports surged to a record 1.8mb/d amid sanctions concerns, Vortexa said.

- Arrivals into the Shandong region were over 1.5mb/d and nearly 50% higher than the 2024 average.

- Shandong’s onshore crude inventories saw the fastest monthly stock build on record, rising by over 20mbbl in March.

- Refiners have accelerated stockpiling as sanctions targeting additional Iran-linked tankers have deepened concerns about potential disruptions to Iranian crude flows.

- The current high inventory levels enable Shandong teapots to demand steeper discounts for upcoming deliveries.

- Imports are expected to slow in April although improved domestic refining margins due to falling benchmark prices are supporting the discounted feedstock demand.

- Iranian crude floating storage in the South China Sea fell from 33mbbl to 30mbbl during March.

Source: Vortexa

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OUTLOOK: Price Signal Summary - USDJPY Bears Remain IN The Driver's Seat

Mar-11 11:19

- In FX, a bullish theme in EURUSD remains intact and the pair is again trading higher, today. This once again marks a continuation of the reversal on Feb 3. Note that MA studies have crossed and are in a bull-mode position, highlighting a dominant uptrend. Sights are on 1.0937, the Nov 5 / 6 2024 high. Initial key support to watch lies at 1.0501, the 50-day EMA. The uptrend is overbought, a corrective pullback would allow this set-up to unwind. First support is 1.0766, the Mar 6 low.

- The trend in GBPUSD is unchanged, it remains bullish and the pair is holding on to its recent gains. MA studies have recently crossed into a bull-mode position, highlighting a stronger uptrend. The pair has pierced 1.2924, the 61.8% retracement of the Sep 26 ‘24 - Jan 13 bear leg. A clear break of this level would open 1.2990, the Nov 8 2024 high. Initial firm support is 1.2605, the 50-day EMA. A pullback would be considered corrective. First support lies at 1.2768, the Mar 5 low.

- The trend needle in USDJPY points south and this week’s fresh cycle lows reinforce current conditions. The move down has resulted in a breach of 146.95, 61.8% of the Sep 16 ‘24 - Jan 10 bull leg. Sights are on 145.92, the Oct 4 2024 low. Moving average studies remain in a bear-mode set-up, highlighting a dominant downtrend. Key short-term resistance is 151.30, the Mar 3 high. Clearance of this level is required to signal a base.

OPTIONS: Larger FX Option Pipeline

Mar-11 11:18

- EUR/USD: Mar13 $1.0800(E1.3bln), $1.0850-60(E1.2bln)

- USD/JPY: Mar13 Y148.00($1.2bln)

- AUD/USD: Mar14 $0.6125(A$1.1bln)

- USD/CAD: Mar14 C$1.4700($1.2bln)

- USD/CNY: Mar12 Cny7.2000($1.0bln), Cny7.2200($1.0bln)

EQUITIES: EU Bank outright Put Option trade

Mar-11 11:13

SX7E (19th Dec) 185p, sold at 17.30 in 18k vs 8.82k at 187.00