OIL: Sharp US Crude Stock Build As Canadian Flows Rise To Beat Tariffs

Oil prices were lower as the US saw a large inventory build and the Fed kept rates unchanged. Also the appointed US commerce secretary Lutnick suggested that tariffs on Canada and Mexico could still be avoided. The USD index rose 0.1%.

- WTI fell 1.0% to $73.01/bbl to be down 2.2% this week but still 2.5% higher in January. It reached a low of $72.33 following the EIA data. It remained above support at $72.22, 50-day EMA. Key resistance is at $79.48, 12 April 24 high.

- Brent is 0.9% lower at $76.83/bbl to be down 2.1% this week but up 3% this month. It fell to a low of $76.31, above support at $76.07, 50-day EMA. Initial resistance is at $82.63, January 15 high.

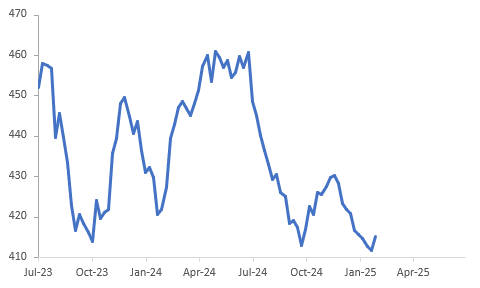

- The EIA reported a crude inventory build of 3.46mn barrels last week, slightly less than Bloomberg consensus. It was the first rise since mid-November as there has been a sharp increase of flows from Canada to beat the February 1 tariffs. Gasoline stocks rose 2.96mn while distillate fell 4.99mn. Refinery utilisation is down 2.4pp to 83.5%, which is usual at this time of year.

- Oil is the most important Canadian export to the US and over half of US crude imports come from Canada.

- The sanctions environment remains very unclear but Macquarie is warning that there’s a risk that the impact on supply of the latest US sanctions targeting Russian banks, which process transactions for the oil sector, is being underestimated. Measures targeting the shadow fleet are already driving purchasers to look at other sources pushing up prices for Middle Eastern crude.

- OPEC+ meets on February 3 and the US’ plan to increase output is to be discussed, according to Kazakhstan’s energy minister. US President Trump has also told the group to increase production to reduce oil prices.

US EIA crude stocks ex SPR

Source: MNI - Market News/Refinitiv

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BONDS: NZGBS: Richer With US Tsys, Early Close Ahead Of Holiday

In local morning trade, NZGBs are flat to 4bps richer after a strong NY session for US tsys.

- US tsys finished near session bests on Monday following much weaker than expected Chicago PMI data. Chicago Business Barometer™, produced with MNI slipped 3.3 points to 36.9 in December. This is the third consecutive monthly decline, with the index at its lowest since May 2024, and below the 2024 average.

- Higher-than-expected pending new home sales (2.2% vs. 0.8% est) and a jump in Dallas Fed mfg index data (3.4 vs. -3.0 est) tempered US tsys support midmorning. The Mar'25 10Y contract (TYH5) traded around 108-30 (+16) through the second half, with the US 10Y yield 9bps lower at 4.53% after the bell.

- The local calendar is empty today and will remain so until the release of CoreLogic Home Values on January 2.

- It will be an abbreviated trading session today before the New Year’s Day holiday.

- Swap rates are 4-6bps lower, with a flatter 2s10s curve.

- RBNZ dated OIS pricing is flat to 3bps softer across meetings, with August 2025 leading. 55bps of easing is priced for February, with a cumulative 125bps by November 2025.

ASIAN MARKETS: New Year’s Eve Holidays

Many markets in the APAC region are either closed today as well as tomorrow or have early closes today. Here is a list.

- Japan, South Korea and Thailand are closed.

- New Zealand closes at 12:45 local time and Australia at 14:10 AEDT.

- Other early finishes include Hong Kong at 12:00, Philippines at 11:55 and Singapore at 12:00.

- In other parts of the world, Germany and Italy have holidays, the UK closes at 12:30 and France at 14:05.

FOREX: Weaker Equities Drive US$ Off Lows & Stronger Yen

The USD was weaker as Treasury yields fell with BBDXY falling to a low of 1300.63 but then recovering to finish up 0.1% driven by the US equity sell off, which also benefited the yen.

- USDJPY trended lower through the European/US sessions to be down 0.7% at 156.80 after a low of 156.67 earlier. Bullish conditions remain though with initial resistance at 158.08 and support at 155.89.

- Commodity currencies were stronger against the greenback with CAD appreciating the most. USDCAD fell 0.4% to 1.4355.

- Aussie and Kiwi also strengthened with AUDUSD up 0.1% to 0.6220 after reaching 0.6247, the bearish trend persists though, and NZDUSD slightly higher at 0.5638 off the intraday high of 0.5664. AUDNZD is flat at 1.1033 after falling to a low of 1.1008.

- European FX underperformed with both the euro and pound down 0.2% against the US dollar at 1.0400 and 1.2548 respectively. NOK bucked the trend and was one of the stronger G10 performers helped by rising oil prices.

- Equities were weak with the S&P down 1.1% and Euro stoxx -0.6%. Oil prices are higher with Brent up 0.4% to $74.10/bbl. Copper fell 0.8% and iron ore is stronger rising above $101/t.

- Data today includes December South Korean CPI and China’s December PMIs.