FED: Slow Asset Winddown Continues; Emergency Loan Takeup Near Zero (1/2)

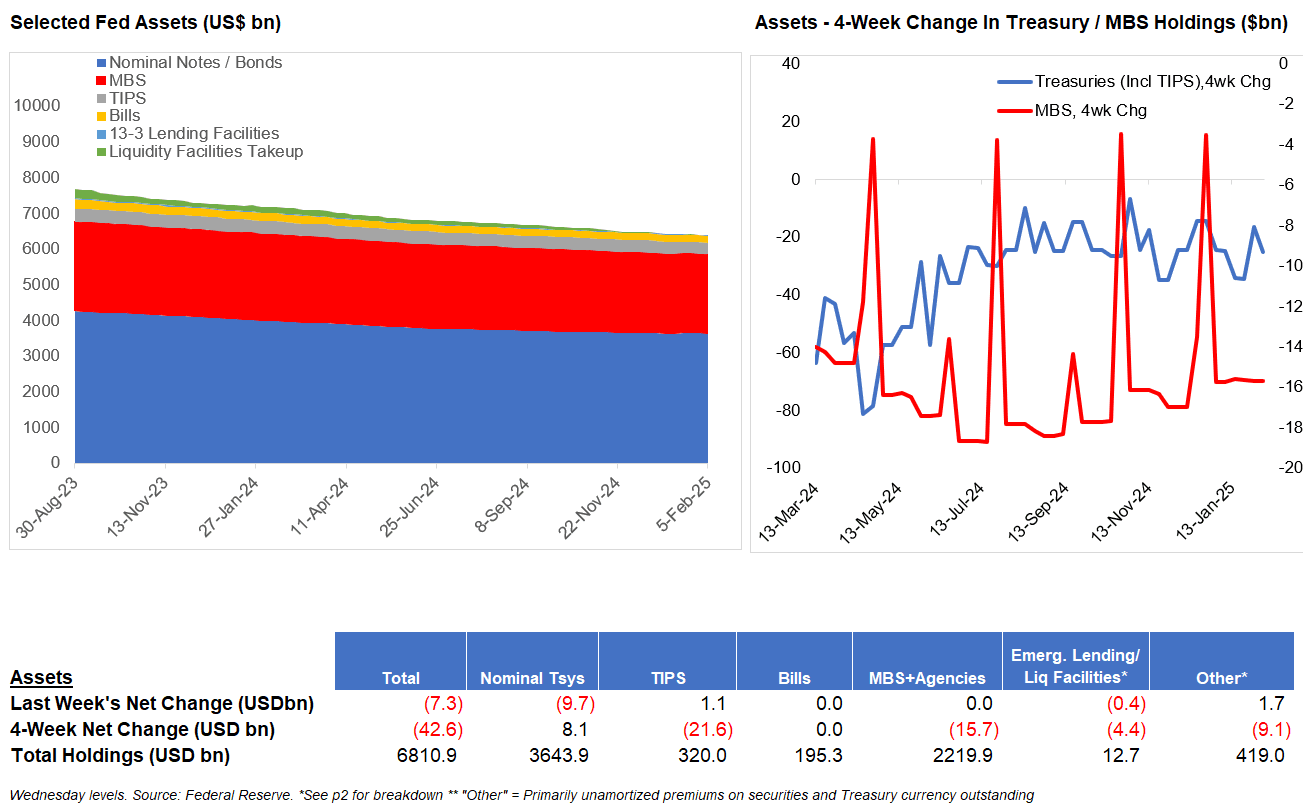

Federal Reserve assets fell $7.3B in the week to Feb 5, due largely to a reduction in Treasury holdings ($9.7B) on the week amid continued QT, per the Fed's H.4.1 release.

- The four-week net change in assets was negative $42.6B, roughly in line with the longer-term QT runoff pace of $40B ($25B Treasuries, $15B mortgage-backed securities).

- The size of the SOMA portfolio is back to September 2020 levels ($6.38T, up $2.4T vs pre-pandemic but down $2.0T from peak), with total assets back to May 2020 levels.

- In the past month, the drop in assets has been augmented by a further decline in emergency lending facilities ($4.4B): takeup of the the Bank Term Funding Program (BTFP) has fallen $3.1B over the past four weeks to virtually zero ($0.2B), compared with a peak of $168B in March 2023.

- And Pandemic lending 13-3 Programs. which peaked at $177B in 2021, are now down to $9.3B after a near-$1B drawdown in the past month.

Discount facility takeup remained limited, at $3.1B.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OIL: Large US Crude Stock Drawdown Last Week

Bloomberg reported that there was a US crude stock drawdown of 4.0mn barrels, more than expected, according to people familiar with the API data. They fell 3.1mn barrels at Cushing last week. Product inventories continued to rise though with gasoline up 7.3mn and distillate +3.2mn. The official EIA data is published later today.

NZD: NZD/USD Fails Above 20-day EMA Resistance Again, Higher US Yields Weigh

NZD/USD's rebound ran out of steam in the 0.5690/95 region in Tuesday trade. We pulled back and then took another leg lower amid positive US data. We track near 0.5630/35 in early Wednesday dealings, down close to 0.15% for Tuesday's session, a relative outperformer in the G10 space. The USD indices rose 0.40% for the DXY, +0.17% for the BBDXY.

- For NZD/USD, once again we couldn't sustain moves above the 20-day EMA (0.5673). Recent lows sub 0.5600 remain intact.

- Both US ISM Services data and Jolts Job opening beat consensus expectations. USD indices firmed, although notably the DXY still sits just below the levels before the release of the WaPo tariff article during Monday trade.

- US yields were higher across the benchmarks, led by the back end of the curve, the 10yr climbing to 4.69%, up 6bps. This is fresh highs back to early May/late April 2024. US equity markets were weaker though, another modest weight on higher beta FX.

- Overnight the whole milk powder auction price fell, down 2.1% at the GDT auction. Still, we remain at elevated levels from an historical standpoint.

- Coming up a little later we have the Dec ANZ commodity price series. The Nov rise was 2.9% m/m. Also note Australian monthly CPI is out. The AUD/NZD cross has been range bound, last near 1.1060, with the pair drawing selling interest above 1.1100.

FED: MNI FOMC Minutes Preview: December 2024

We've just published our preview of the December FOMC Minutes (PDF here):

- The minutes to the December 2024 FOMC meeting (released Wednesday Jan 8 at 1400ET) should provide further context for what Chair Powell dubbed a “closer call” but ultimately the “right call” to cut rates by 25bp.

- There are several elements to watch for in the minutes, including the degree to which anticipated Trump administration policies affected participants' forecasts, the shift in the perceived balance of risks, and how "close" a call it was to cut rates at all in December.

- MNI's preview of the Minutes includes what to watch for upon release; MNI's FOMC Hawk-Dove Spectrum; key highlights of FOMC participant commentary since the December meeting; and sell-side analyst expectations.