US NATGAS: Socal Gas Prices Rises 4% on Day

Socal natgas prices are higher today amid forecasts for colder weather and a move back to storage withdrawals yesterday.

- SoCal Border is up 13 cents/MMBtu (3.94%) to $3.43/MMBtu, according to the EIA, while NGI data shows Socal City Gate up 10 cents/MMBtu and Socal Topock up 16.5 cents/MMBtu

- Total state-wide demand in California is currently at 5.1bcf/d, down by around 0.2bcf/d. Demand is 1.21bcf/d below the 30-day average, Bloomberg data showed.

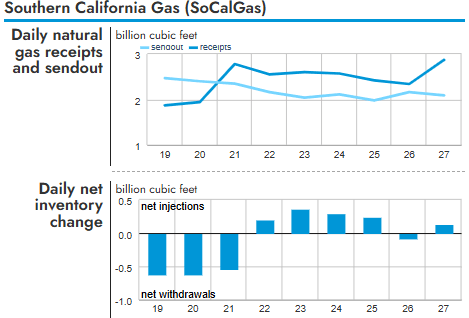

- Daily natural gas sendout in Socal is down to 2.09 bcf/d today, while receipts are 2.87 bcf/d, the EIA shows. Receipts have outpaced sendout everyday since Feb. 20.

- The daily net inventory change in SoCal is seen building by 0.13 bcf, having flipped back to a draw of 0.08 bcf yesterday, the EIA showed.

- Most of the gains in pipeline inflows come from the El Paso, Kern River, and Ruby lines, according to Bloomberg.

- Temperature forecasts for Los Angeles are mixed, showing higher temperatures today, but moving colder for the processing three days, according to the EIA and NOAA.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GBPUSD TECHS: Tests Resistance At The 50-Day EMA

- RES 4: 1.2667 High Dec 19

- RES 3: 1.2610 38.2% retracement of the Sep 26 ‘24 - Jan 13 swing

- RES 2: 1.2576 High Jan 7

- RES 1: 1.2520/23 50-day EMA / High Jan 27

- PRICE: 1.2438 @ 16:19 GMT Jan 28

- SUP 1: 1.2387/2294 20-day EMA / Low Jan 23

- SUP 2: 1.2229 Low Jan 21

- SUP 3: 1.2100 Low Jan 10 and the bear trigger

- SUP 4: 1.2087 0.764 proj of the Sep 26 - Nov 22 - Dec 6 price swing

A bull cycle in GBPUSD remains in play. The pair has cleared the 20-day EMA, marking an extension of the reversal that started Jan 13. Attention is on the 50-day EMA, at 1.2520 and an important resistance. Clearance of the average would highlight a stronger bull cycle. Medium-term trend signals are unchanged, they remain bearish. A reversal lower would refocus attention on 1.2100, the Jan 10 low and bear trigger.

STIR: FED Reverse Repo Operation

RRP usage rebounds to $112.760B this afternoon after falling to $92.863B yesterday - the lowest level since mid-April 2021. The number of counterparties rises to 28 from 26 prior.

BONDS: MNI Europe Pi: OATs Continue Short Drift, Gilts And BTPs Flat (2/2)

Elsewhere in European positioning:

- OAT: OAT is in very short positioning, maintaining the longer-term drift in that direction since mid-September (was "short" in our last update). Recent trade suggests shorts cover, however.

- GILT: Gilt structural positioning has shifted to flat vs long previously, with recent price volatility only briefly seeing a dip toward shorts. The most recent week saw some short covering.

- BTP: BTP has exited structural longs for our first update since summer 2025, with our current reading at flat. Longs were reduced in the most recent week of trade.