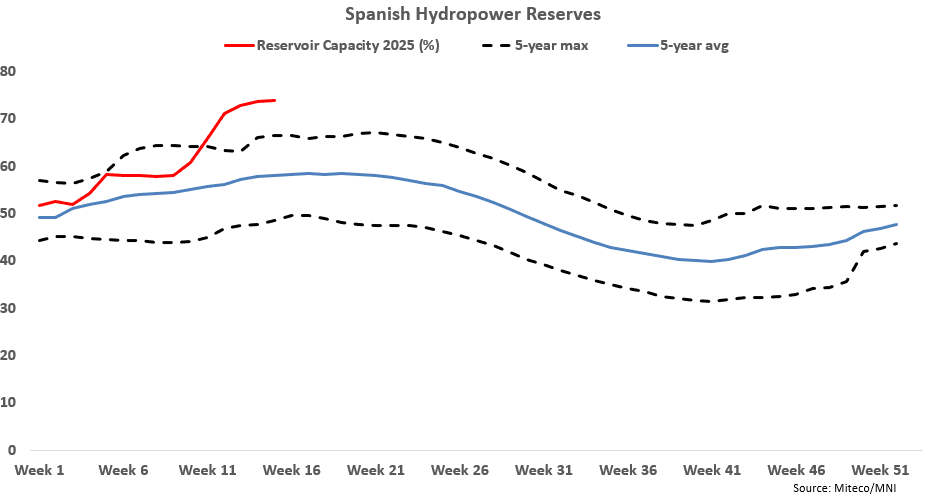

POWER: Spanish Hydro Stocks Rise Sixth Consecutive Week

Spanish hydropower reserves last week - calendar week 15 – slowed down the increase to 0.2 percentage points to 74% of capacity, marking the sixth consecutive weekly increase, data from Spain’s Environmental Ministry showed.

- Stocks increased by 0.9 points the week prior.

- The surplus to the five-year average was broadly unchanged on the week at 16 points, while the surplus to last year’s level slightly edged down to 7.4 points, from 7.8 points the week before.

- Power demand in Spain last week declined by 436MW to 25.12GW.

- Planned maintenance at the 1GW Trillo 1 nuclear plant has been extended until 3 May, from 15 April previously scheduled.

- Power production at the 1.06GW Cofrentes 1 nuclear plant has been reduced on 15-17 April for nuclear flexibility. The 1.03GW Asco 1 nuclear reactor had an unplanned outage early on 15 April that is scheduled to last until 18 April.

- There was little precipitation in Huesca, near the hydro-intensive region, last week.

- Looking ahead, the latest ECMWF forecast suggests precipitation in Huesca to pick up to 34.7mm this week, compared with the seasonal average of 11.4mm.

- Mean temperatures in Madrid this week are forecast between 8.5C and 13.2C – with temperatures below the seasonal normal on most days.

- Wind output in Spain for the remainder of this week (Wed-Sun) is forecast at 5.4GW to 11.45GW during base load according to SpotRenewables.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: March Economic Projections: Higher Inflation, Weaker Growth, Same Rates

The MNI Markets Team’s expectations for the updated Economic Projections in the March SEP are below.

- The unemployment rate is likely to rise slightly for 2025 alongside a downgrade in GDP growth, while the 2025 core and headline PCE inflation projections are set to rise again. Changes to later years will likely be limited, however.

- More detail on the shift in Fed funds rate medians is in our meeting preview - we will add more color next week.

FED: Market Pricing Nearly 3 2025 Cuts As Conditions Tighten

Amid rising government policy uncertainty, sentiment among businesses and consumers has fallen sharply since the start of the year, while equities and the dollar have reversed their post-election rise. Overall, financial conditions have tightened, even if stress is not yet mounting, e.g. no major widening of credit spreads (the accompanying chart shows the Fed’s financial conditions impulse index but only through January).

- Combined with growth fears, this has affected expectations for the Fed’s rate path, with around 18bp more cuts expected in 2025 compared with what was seen after the January FOMC. 65bp of cuts are priced for the year as a whole. 2025 cut pricing reached 71bp before the February inflation data and 76bp before the February payrolls report.

- A rate cut is seen with near zero probability for March’s meeting, but the first full cut is just about priced for June, with a second nearly priced by September.

- Chair Powell has no reason to endorse or refute these expectations – he’s likely to be happy with a press conference that ends with little discernable change in pricing.

CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX

- CANADA'S CARNEY ANNOUNCES ELIMINATION OF THE CONSUMER CARBON TAX