TARIFFS: Speaker Johnson Uses House Rules Committee To Block Tariff Bills

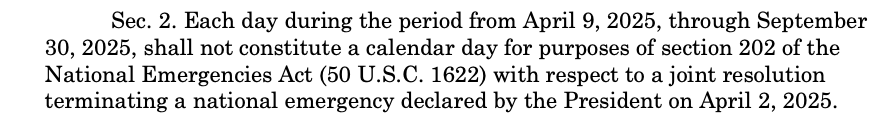

Laura Weiss at Punchbowl News reporting on X that House Speaker Mike Johnson (R-LA) is using a rule for the budget resolution - on course for a vote today - to turn off the mechanism via which lawmakers can force legislation to the floor, "for any resolution dealing with the April 2 trade emergency." Jake Sherman at Punchbowl notes: "This makes it impossible for anyone to file disapproval resolutions on tariffs through Sept 30."

- The move effectively closes the door for a bipartisan group of lawmakers to take action to targeting the emergency resolution President Trump used to justify his unilateral tariffs. The Grassley-Cantwell bill in the Senate has attracted seven Republican co-signers and a sizeable group of Republicans are reportedly considering signing onto a corresponding House bill introduced by Republican Rep Don Bacon (R-NE).

- Weiss notes that, "a group of House Dems led by Meeks, Neal, Larsen introduced a privileged resolution yesterday to terminate this emergency and block Trump’s big wave of tariffs." That is the third such attempt by lawmakers to rein in Trump tariff authority.

Figure 1: Rules for Budget Reconciliation Regarding Tariffs (Punchbowl News)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Expiries for Mar11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0540-50(1.2bln), $1.0800-15(E752mln), $1.0875(E504mln)

- USD/JPY: Y146.45-65($1.0bln), Y148.70($543mln)

- EUR/GBP: Gbp0.8325-35(E626mln)

- AUD/USD: $0.6300-10(A$946mln), $0.6385(A$2.5bln)

- NZD/USD: $0.5645(N$652mln)

- USD/CAD: C$1.4390-00($943mln), C$1.4470($617mln)

US TSYS/OVERNIGHT REPO: SOFR Steady In Range, Could Drift Lower

Secured rates softened slightly Friday, with SOFR dipping 1bp to 4.34% per NY Fed data.

- SOFR's been steady in the 4.33-4.35% area in March, following the usual month-end dynamics in late-February (4.39% Feb 28th).

- Secured rates are generally expected to drift lower, with key dates to watch on Tuesday 11th (cash returning to market due to bill redemptions which should help the downward drift in rates) and Monday 17th (mid-month coupon Treasury auction settlements which could put upward pressure on rates).

- Effective Fed Funds were steady once again at 4.33%.

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 4.34%, -0.01%, $2477B

* Broad General Collateral Rate (BGCR): 4.33%, -0.01%, $959B

* Tri-Party General Collateral Rate (TGCR): 4.33%, -0.01%, $940B

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 4.33%, no change, volume: $110B

* Daily Overnight Bank Funding Rate: 4.33%, no change, volume: $284B

CAD: CAD/JPY's Clear Downside Momentum Exposes Bear Trigger

Weakness across CAD today (triggered partly by softer oil prices, but also by slipping global equities and tariff risk) is keeping the currency at the softer end of the G10 table, while solid JPY trade is pressuring CAD/JPY toward key support.

- Today's 101.68 low coincides with key support of Y101.67 - the mid-2024 pullback low prompted by the BoJ's JPY-buying intervention last year. Clearance here would be resolutely bearish for the cross, opening levels last seen in 2023 and leaving the next key support at Y100 psychologically, and Y99.93, the 76.4% retracement for the upleg posted off the 2023 low.

- The clear downward near-term momentum in the cross follows the Rengo pay tally from last week - underlining pay demands at their highest level in over 30 years for the 2025 Shunto round. While the March BoJ decision sees only an outside of a rate hike - but the May 1st meeting could be more consequential, for which the decision could be contingent on the Tankan survey on April 1, reports from the Bank’s branch managers' meeting on April 7, the updated Rengo tally in April, and CPI.

- Should these factors fall into line, there's still much further for May BoJ pricing to go - a move that would certainly underpin this JPY strength.