EM CEEMEA CREDIT: STCAB / QTELQD: JV for terrestrial fiber network

Feb-27 13:21

Ooredoo (QTELQD; A2/A/-)

Saudi Telecom (STCAB; Aa3/Apos/A+)

“STC, Ooredoo Oman to Set up Fiber Optic Network for Saudi, Oman” – BBG

- Refers to SONIC project for international terrestrial fiber optic network, connecting Saudi Arabia and Oman.

- Project is reported to be at head of terms agreement stage, with implementation timetable for 24 months to complete, with first phase to take some 12 months.

- Project is supposed to complement under construction sub-sea connectivity.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BONDS: MNI Europe Pi: Longs Evaporate In The New Year

Jan-28 13:19

Europe Pi Positioning Analysis PDF Here

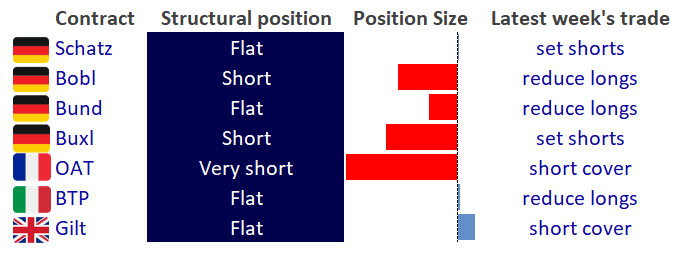

- Structurally long positioning has evaporated across European futures contracts since the beginning of the year.

- At the start of 2025, Gilt and BTP had been in long territory but already showed signs of moving flat.

- Meanwhile, French contracts are even more clearly short than prior, while Germany remains flat/short.

- The most recent week of trade was indicative of short setting and long reduction across most Eurex contracts.

STIR: Repo Reference Rates

Jan-28 13:15

- Secured Overnight Financing Rate (SOFR): 4.34% (+0.00), volume: $2.338T

- Broad General Collateral Rate (BGCR): 4.32% (-0.01), volume: $899B

- Tri-Party General Collateral Rate (TGCR): 4.32% (-0.01), volume: $868B

- (rate, volume levels reflect prior session)

FOREX: AUDUSD Extends Weekly Decline to 1.2%, Q4 CPI Data Awaited

Jan-28 13:15

- Monday’s risk off session and the more optimistic tone for the US dollar today have prompted AUDUSD to extend its pullback this week. The pair has dropped 1.2% from last Friday’s close, keeping medium term bearish conditions intact.

- Recent gains stalled at resistance around the 50-day EMA (intersecting at 0.6325), and the subsequent reversal lower suggests the possible end of the correction between Jan 13 - 24.

- The NAB Business Survey report was out overnight and highlighted softer wage pressures, with labour cost growth at 1.4%, ahead of key quarterly inflation data scheduled on Wednesday that may prompt the RBA to consider rate cuts. Q4 CPI is expected to show a drop to 2.5% from 2.8% y/y prior. RBA-date OIS is pricing in an 80% chance of a 25bps cut at the Feb meeting, firming 2bps overnight.

- A continuation lower for AUDUSD would bring the focus back on 0.6131, the Jan 13 low and the bear trigger. On the upside, a clear breach of the 50-day average is required to signal scope for a stronger recovery.

Related bullets

Related by topic

QTELQD

Qatar

EU Communications

Credit Sector

STCAB

Saudi Arabia