EUROPEAN COUNCIL: Summit Gets Underway 20 March w/Ukraine Top Of Agenda

The latest European Council summit gets underway in Brussels on 20 March, with EU leaders set to discuss a number of major issues for the Union related to security and finance. Top of the agenda is the war in Ukraine and efforts to both support Kyiv and ensure the EU has a prominent voice as part of ceasefire/peace plan talks. Leaders will also discuss the huge 'ReArm Europe/Readiness 2030' package following the publication of a white paper on 19 March. It should be noted that leaders are not set to formally vote on the defence spending proposals at this summit, with the plans still in their early stages.

- The other main foreign policy issues to be discussed is the Middle East amid a breakdown in the Gaza ceasefire, massacres of Alawites and other minorities in Syria, and the risk of a notable escalation in Houthi attacks on shipping in the Red Sea as the US launches strikes on sites in Yemen.

- On the economic front, EU leaders will hold talks on the next multiannual financial framework (the long-term EU budget) running 2028-2034 and the associated 'Own Resources' (the EU's main source of funds from member state budgets). They will also discuss competitiveness, and hold a Euro Summit in an inclusive format (with non-eurozone leaders present) that will hear from ECB President Christine Lagarde.

- The summit is due to start at 1100CET (0600ET, 1000GMT). Prior to this, there will be doorstep interviews from all leaders, raising the prospect of a flurry of political headlines hitting wires.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GERMAN DATA: Weekly Activity Continues Recovery Amidst Less Restrictive Policy

- ECB officials have been looking to downplay neutral rate deliberations, with the deposit rate at 2.75% and staff research pointing to neutral range of 1.75-2.25% (which the market sees reaching the top of this band in June and mid-point in October).

- ECB President Lagarde, whilst aligning herself to this 1.75-2.25% range, has been keen to point out that this hasn’t been meaningfully discussed in Governing Council meetings, being “entirely premature” for debate whilst policy is currently restrictive (a term our policy team sees remaining in place - see MNI SOURCES: ECB Likely To Tweak Language, Keep "Restrictive" - Feb 4).

- However, with Lagarde pledging the bank “will be looking out of the window” as part of its clear data dependent stance, we watch for high frequency metrics that suggest policy could be starting to be less restrictive.

- Germany is a good starting point here, clearly underperforming its major Eurozone country counterparts for some time now (not least Q4 real GDP growth at -0.2% Y/Y vs 0.9% for the Eurozone, with Spain 3.5% Y/Y, France 0.7% Y/Y and Italy 0.5% Y/Y).

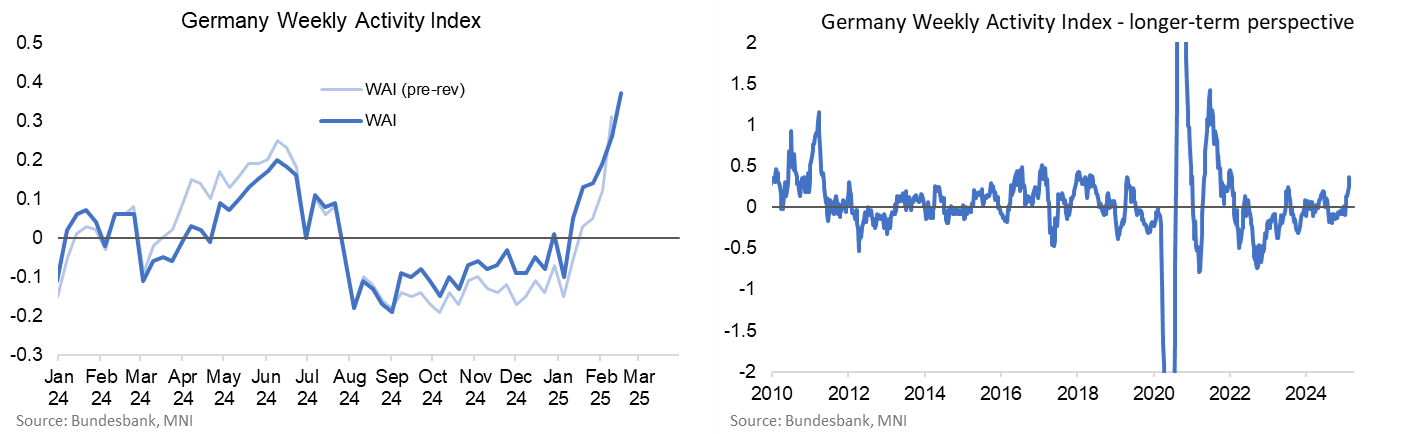

- To this end, we note an impressive increase in the Bundesbank’s weekly activity index since January, an indicator that collates a range of non-traditional inputs.

- Rising to 0.37 in today’s weekly update from a downward revised 0.26 (initial 0.31), it set a fresh high since early 2022. It indicates trend-adjusted economic activity in the 13 weeks to Feb 16th was 0.4% higher than in the preceding 13 weeks, translating to quarterly GDP growth of 0.9% per the press release.

- We caution putting too much weight on this measure, not least because of its wide-ranging revisions (see chart) and GDP tracking (see press release), but it nevertheless bears watching other more traditional releases for a similar improvement in the months ahead.

OPTIONS: Larger FX Option Pipeline

- EUR/USD: Feb19 $1.0500(E1.6bln); Feb20 $1.0400-10(E2.7bln), $1.0430-35(E3.0bln), $1.0520-25(E1.5bln); Feb21 $1.0400(E1.5bln)

- USD/JPY: Feb19 Y155.00-20($1.7bln); Feb20 Y154.00($3.0bln)

- NZD/USD: Feb19 $0.5450(N$1.7bln)

- USD/CAD: Feb21 C$1.4500($1.2bln), C$1.4600($1.7bln)

- USD/CNY: Feb20 Cny7.2000($1.9bln), Cny7.2500($1.4bln), Cny7.3700($1.3bln)

STIR: SONIA / Euribor Z5 Spread Tightens In Tandem With The Long End

The SONIA / Euribor Z5 implied yield spread has tightened 2.5bps today to 186bps, mirroring moves in the long-end.

- After opening up to 5.0 ticks lower at the open, SONIA futures are now little changed on versus Friday’s settlement levels. Euribor futures are -1.0 to -3.5 ticks through the blues, with the strip steepening a little.

- ECB-dated OIS price 77bps of easing through year-end, corresponding to an implied deposit rate of 1.98%. Meanwhile, BOE-dated OIS price 57bps of easing through December, implying a Bank Rate of 3.93%.

- Earlier this morning, BOE Governor Bailey said the slightly stronger-than-expected flash Q4 GDP print does not alter the general story for the UK economy, while re-iterating the Bank’s gradual and careful approach to rate cuts.

- Tomorrow’s data calendar is headlined by the UK December/January labour market data. MNI’s full inflation/labour market preview will be released later today.

- ECB Executive Board Member Cipollone will also speak on the ECB’s balance sheet at an MNI Event at 1400GMT/1500CET (sign up here).