STIR: /SWAPS: GBP 1y1y Hovers Above ‘25 Low, Fresh Catalyst Needed, Greene Eyed

Apr-25 13:22

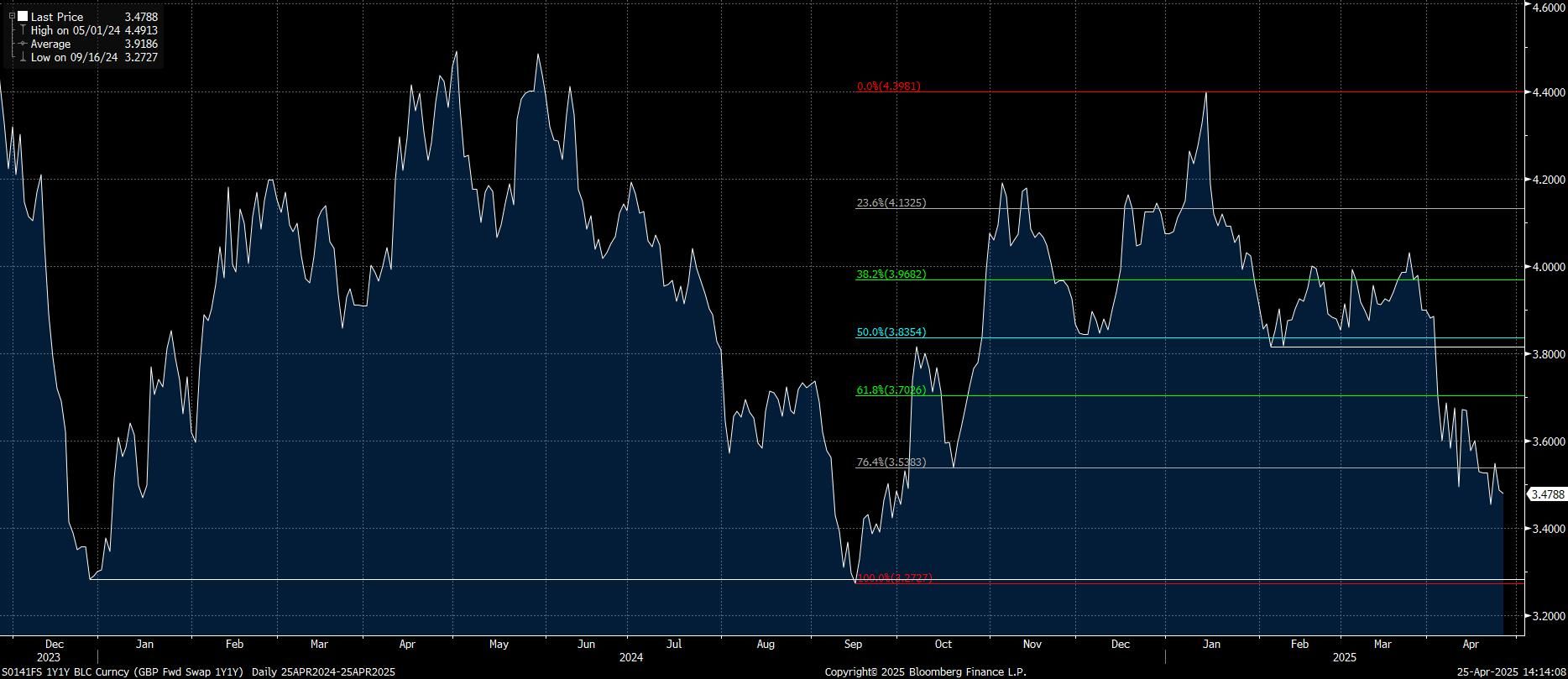

The market will likely need to become more willing to price a deeper or swifter BoE cutting cycle to extend the recent move lower in GBP 1y1y. This comes after the contract registered the lowest close since early October on Tuesday, extending the pullback from the January highs to ~95bp in the process.

- We previously identified SFIM5/M6 as perhaps the most obvious point of pressure for further dovish repricing in GBP STIRs, with the sell off in SFIM5/Z5 explaining much of the recent weakness in the longer dated spread.

- Looking out over a slightly longer horizon, the market remains reluctant to meaningfully price in odds of cuts during H2Sour26 and beyond given the BoE’s gradual cutting cycle and measured language deployed to date.

- This could make 1y1y a prime candidate for dovish expressions, if the data and macro environment permit.

- A received position in 1y1y would also benefit from an expedited cutting cycle, assuming the market doesn’t quickly price in a meaningful policy error i.e. the need for hikes further down the line.

- Extension of the recent dovish move would target the double bottom support area at the December ‘23/September ’24 closing lows (3.2822%/3.2727%), although we are cognisant of the size of the dovish repricing already witnessed year-to-date and note that a fresh catalyst is probably needed to promote an extension of the move.

- Pre-weekend UK focus falls on comments from BoE's Greene (15:15 BST). She will speak on “inflation, growth and monetary policy” after already sounding a little less hawkish earlier in the week.

Fig. 1: GBP 1y1y Swap (%)

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

UK DMO UPDATE: CGNCR Forecast for 2025/26 a Little Lower than Expected

Mar-26 13:21

- CGNCR for 2025-26 is GBP142.7bln (median we had seen was GBP146.0bln) - this is where the marginally lower gilt remit than the median exp comes from.

- T-bill issuance: GBP5bln increase in stock (that's broadly in line with exp)

GILTS: Recovery With Remit Below Median, Unallocated Bucket Size Jumps

Mar-26 13:20

{GB} GILTS: Gilts rally from lows as the remit for FY25/26 comes in below the median of sell-side estimates (GBP299.2bln vs. median GBP303bln and a range of GBP292-321bln).

- That allows futures to retest session highs, while curves move away from session steeps.

- Recovery limited by the uptick in the unallocated bucket size in the gilt remit, which we assume is likely to end up in mediums/longs. This also muddies the maturity profile of the planned issuance a little.

US: MNI POLITICAL RISK - Trump's Mixed Messages On April 2 Tariffs

Mar-26 13:20

Download Full Report Here

- The Trump administration is in damage control as the Signal chat scandal enters its third day. The story is likely to overshadow Defense Secretary Pete Hegseth’s Asia trip, where he is scheduled to meet with Japanese and Philippine leaders to shore up Indo-Pacific relations.

- Trump advisor Elon Musk and members of his Department of Government Efficiency (DOGE) team will sit for an interview with Fox News’ Brett Baier today.

- Trump told Newsmax he intends to limit the number of exceptions to his reciprocal tariff regime, slated to go into effect on April 2.

- Copper prices surged to record highs after reports that duties on the metal could be imposed within several weeks, far quicker than anticipated.

- India is reportedly open to cutting tariffs on more than USD$23 billion of imports to fend off Trump's reciprocal tariffs.

- House Speaker Mike Johnson (R-LA) and Senate Majority Leader John Thune (R-SD) agreed on a loose framework for legislating Trump's agenda. Thune agreed to address the debt limit in the reconciliation package, a move that will rankle with deficit hawks and add a layer of complexity to negotiations.

- Trump said yesterday it is possible Russian President Vladimir Putin is “dragging his feet” on a ceasefire deal despite a tentative agreement towards a maritime truce in the Black Sea.

- Poll of the Day: Consumer confidence declined for the fourth month straight in March.

Full Article: US DAILY BRIEF