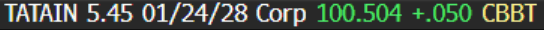

EM ASIA CREDIT: Tata Steel (TATAIN, NR/BBB/NR) buys more equity from T Steel

Tata Steel (TATAIN, NR/BBB/NR)

"*TATA STEEL - ACQUISITION OF $300M STAKE IN T STEEL HOLDINGS" - BBG

- Tata Steel has purchased an additional equity stake in wholly owned subsidiary, T Steel Holdings, for $300m equivalent. Neutral for spreads

- This is line with the previously announced plan (May '24) to support refinancing and restructuring at Tata Steel UK for up to $2.1bn.

- There have been several equity purchases, currently totaling $1.6bn.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

NEW ZEALAND: Core Eases But Non-Tradeables Proving Sticky

The RBNZ’s sector factor model estimate of Q4 core inflation eased 0.2pp to 3.1% y/y, close to the top of the 1-3% target band. Q3 was revised down 0.1pp to 3.3%. Given that headline was impacted by volatile components such as air fares, the move lower in underlying inflation is good news and another 50bp rate cut in February remains the base case. But underlying non-tradeables inflation is proving sticky and will continue to be watched closely.

NZ core CPI y/y% (RBNZ sector factor model)

- Moderation in core non-tradeable inflation remains slow and it was down only 0.1pp to 4.6% y/y, the lowest since Q1 2022 but still elevated. The series average is 3.3%. Its moderation from the peak remains significantly less than the overall core, but restrictive monetary policy and weak demand should help to bring it still lower.

- Core tradeables inflation was only 0.2% y/y in Q4 after 0.4%. The headline number picked up driven by volatile second-hand car prices. The drop in the underlying measure signals that weak discretionary spending is weighing.

NZ core CPI y/y% (RBNZ sector factor model)

AUSSIE BONDS: Weaker & Near Session Cheaps On A Data-Light Day

ACGBs (YM -5.0 & XM -4.5) are weaker and near Sydney session lows.

- Australia’s Dec. Leading Index fell 0.02% m/m to 97.17.

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session after yesterday’s bull-flattener.

- Cash ACGBs are 4-5bps cheaper with the AU-US 10-year yield differential at -14bps.

- Swap rates are 4bps higher, with EFPs slightly tighter.

- The bills strip has bear-steepened, with pricing -1 to -5.

- The Australian economy will expand 0.4% in Q4 24 and +0.5% in Q1 25, according to the latest results of a Bloomberg News survey conducted from Jan. 16 to Jan. 21. 48 economists joined this survey and forecast the cash rate to be unchanged at 4.35% at the end of Q1 25 and 4.10% by the end of Q2 25.

- RBA-dated OIS pricing is flat to 3bps firmer across meetings today. A 25bp rate cut is more than fully priced for April (109%), with the probability of a February cut at 69% (based on an effective cash rate of 4.34%).

AUD: A$ Range Trading But Stronger Against Kiwi Following NZ CPI

AUDUSD has been trading in a narrow range today falling to 0.6255 and then rising to 0.6277 driven by movements in the greenback as there has been little new information so far (USD index is slightly higher). It is currently down 0.15% to 0.6265 continuing its downtrend.

- The 6-month annualised rate of the December Westpac lead index was slightly slower at 0.25% after 0.33%. This measure leads growth relative to trend by 3 to 9 months and it was positive throughout Q4 signalling some improvement in growth over H1 2025.

- AUDNZD is 0.2% higher at 1.1076 after Q4 NZ CPI printed broadly in line with expectations but showed a greater slowing in non-tradeables inflation. The data strengthened the view that the RBNZ will cut rates again by 50bp at its February 19 meeting.

- Aussie is relatively flat against other major currencies with AUDJPY around 97.55, AUDEUR 0.6018 and AUDGBP 0.5078.

- Equities are mixed with the ASX up 0.4% and S&P e-mini +0.2% but Hang Seng down 0.6% and CSI 300 -0.3%. Oil prices are range trading with WTI around $75.76/bbl. Copper is 0.4% lower and iron ore around $104/t.

- Later US December leading index prints and ECB President Lagarde and Bundesbank’s Nagel speak.