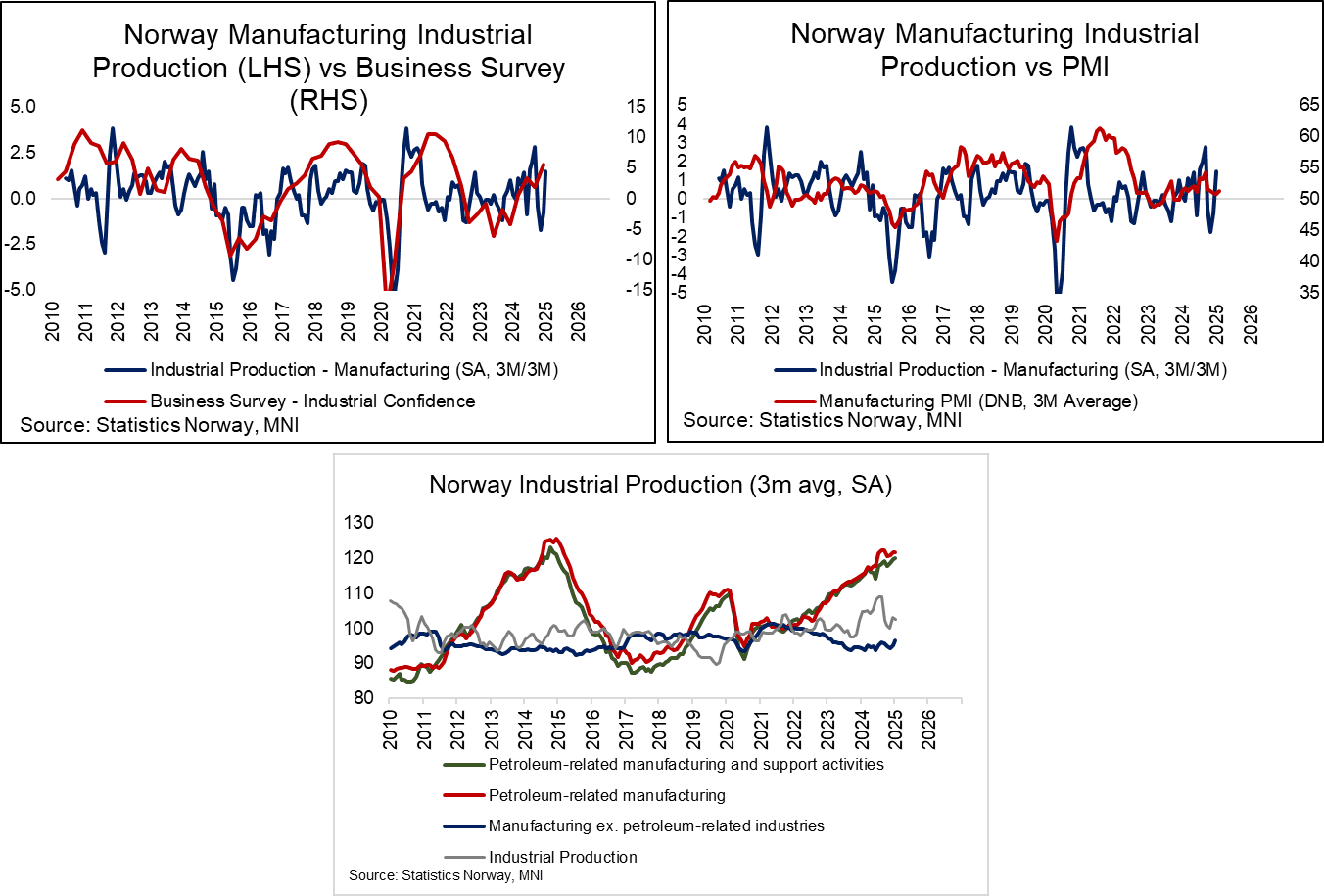

NORWAY: Tentative Evidence Of Recovery In Manufacturing IP

Norwegian manufacturing industrial production fell 1.5% M/M in January after two months of positive sequential readings prior. However, on a 3m/3m basis production rose 1.5%, due to soft prints through August-October. Headline IP fell 1.7% M/M (vs -0.1% prior), corresponding to a -6.5% Y/Y rate.

- On a 3m/3m basis, strength was seen in intermediate (2.7% vs 1.4% prior) and capital (1.4% vs -0.2% prior) goods, but consumer goods production remains soft (-1.2% vs -2.1% prior). The latter development is likely reflective of subdued Norwegian mainland demand.

- Industrial sentiment indices (the manufacturing PMI and Statistics Norway’s industrial confidence survey) are both in expansionary territory. While the majority of this confidence likely stems from the strong performance of the offshore sector post-covid, there is tentative evidence of an incremental recovery in the manufacturing IP component since mid-2024.

- A continuation of this recovery in the “onshore” sector will be necessary, as the tailwind from the oil and gas sector to economic growth is expected to fade over the next few years, due to a pullback in investment growth expectations.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: FRANCE DEC INDUSTRIAL PRODUCTION -0.4% M/M, -1.7% Y/Y

- MNI: FRANCE DEC INDUSTRIAL PRODUCTION -0.4% M/M, -1.7% Y/Y

- FRANCE DEC MANUFACTURING OUTPUT -0.7% M/M, -2.6% Y/Y

EQUITY TECHS: E-MINI S&P: (H5) Bear Threat Remains Present

- RES 4: 6178.75 High Dec 6 and key resistance

- RES 3: 6162.25 High Jan 24

- RES 2: 6147.75 High Jan 31

- RES 1: 6069.00 High Feb 3

- PRICE: 6031.75 @ 05:02 GMT Feb 5

- SUP 1: 5935.50 Low Feb 3

- SUP 2: 5892.37 76.4% retracement of the Aug 5 - Dec 6 bull leg

- SUP 3: 5842.50 Low Jan 14

- SUP 4: 5809.00 Low Jan 13 and a key resistance

Monday’s initial sell-off in the S&P E-Minis contract and breach of support at 5948.00, the Jan 27 low, strengthens a bearish threat and cancels - for now - a recent bullish theme. An extension down would open 5892.37, a Fibonacci retracement point. Initial resistance is at 6069.00, Tuesday’s intraday high. Gains are considered corrective, however, a stronger rally would expose key resistance at 6178.75, the Dec 6 high.

USD: Early selling interest noted

- The Dollar sees a flat session overall against G10, but there's a couple of standout Currencies, the Yen is up another 0.74%, and the Kiwi continues to recover from its worst printed levels since 2022, now has now bounced 2.77% in the past 2 sessions.

- The Yen stands out once again the fall in Yield combined with a Wage beat in Japan overnight sees the Currency up 0.74% into the European session.

- The next immediate support in USDJPY was seen at 153.16, so far holding, although did print a 153.10 low overnight and we are testing that area once again now.

- A clear break through the 153.00 figure will open to 152.55 61.8% retracement of the Dec 3 - Jan 10 bull leg.