NORWAY: Tentative Evidence Of Recovery In Manufacturing IP

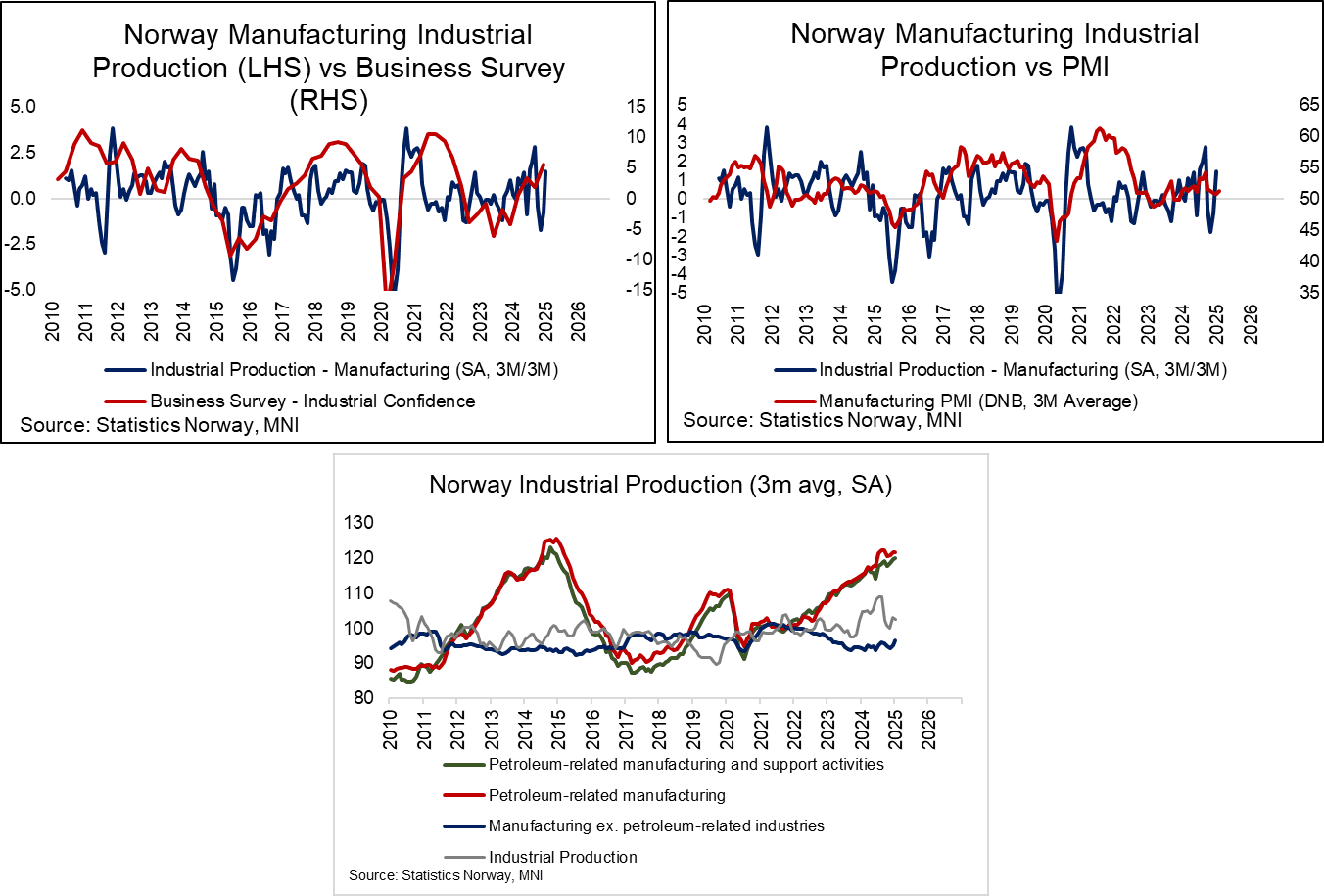

Norwegian manufacturing industrial production fell 1.5% M/M in January after two months of positive sequential readings prior. However, on a 3m/3m basis production rose 1.5%, due to soft prints through August-October. Headline IP fell 1.7% M/M (vs -0.1% prior), corresponding to a -6.5% Y/Y rate.

- On a 3m/3m basis, strength was seen in intermediate (2.7% vs 1.4% prior) and capital (1.4% vs -0.2% prior) goods, but consumer goods production remains soft (-1.2% vs -2.1% prior). The latter development is likely reflective of subdued Norwegian mainland demand.

- Industrial sentiment indices (the manufacturing PMI and Statistics Norway’s industrial confidence survey) are both in expansionary territory. While the majority of this confidence likely stems from the strong performance of the offshore sector post-covid, there is tentative evidence of an incremental recovery in the manufacturing IP component since mid-2024.

- A continuation of this recovery in the “onshore” sector will be necessary, as the tailwind from the oil and gas sector to economic growth is expected to fade over the next few years, due to a pullback in investment growth expectations.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SWEDEN: Jan Services PMI Details Not Overly Strong

The January services PMI just about remained in expansionary territory at 50.1 (vs 51.2 prior). The series is reasonably volatile month-to-month, but has generally trended higher alongside the Economic Tendency Indicator’s services sentiment series since the start of 2024.

- This contrasts with the manufacturing PMI, which has diverged from the Economic Tendency Indicator’s manufacturing sentiment series in recent months.

- The composite PMI was 50.9 (vs 51.5 prior), the third consecutive month in expansionary territory.

- The details of the services release were not overly strong. Production was 50.1 (vs 50.0 prior), while new orders dipped to 49.5 (vs 50.1 prior). The employment index softened to 45.6 (vs 47.7 prior).

- Meanwhile, supplier input prices rose notably to 65.5 (vs 61.9 prior), the highest since August 2023.

MNI: FRANCE DEC INDUSTRIAL PRODUCTION -0.4% M/M, -1.7% Y/Y

- MNI: FRANCE DEC INDUSTRIAL PRODUCTION -0.4% M/M, -1.7% Y/Y

- FRANCE DEC MANUFACTURING OUTPUT -0.7% M/M, -2.6% Y/Y

EQUITY TECHS: E-MINI S&P: (H5) Bear Threat Remains Present

- RES 4: 6178.75 High Dec 6 and key resistance

- RES 3: 6162.25 High Jan 24

- RES 2: 6147.75 High Jan 31

- RES 1: 6069.00 High Feb 3

- PRICE: 6031.75 @ 05:02 GMT Feb 5

- SUP 1: 5935.50 Low Feb 3

- SUP 2: 5892.37 76.4% retracement of the Aug 5 - Dec 6 bull leg

- SUP 3: 5842.50 Low Jan 14

- SUP 4: 5809.00 Low Jan 13 and a key resistance

Monday’s initial sell-off in the S&P E-Minis contract and breach of support at 5948.00, the Jan 27 low, strengthens a bearish threat and cancels - for now - a recent bullish theme. An extension down would open 5892.37, a Fibonacci retracement point. Initial resistance is at 6069.00, Tuesday’s intraday high. Gains are considered corrective, however, a stronger rally would expose key resistance at 6178.75, the Dec 6 high.