US: Trump's Post-Tariff Approval Slides, Workers Not Convinced By Tariffs - WaPo

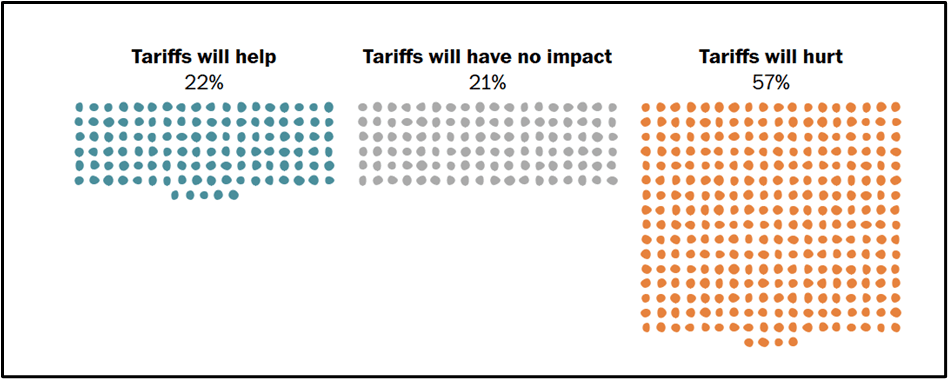

A new Washington Post survey of manufacturing workers has found that, “more than twice as many manufacturing workers say tariffs would hurt rather than help their job and career, 57 percent versus 22 percent, while another 21 percent said they would have no impact.”

- The Post notes: “A slim majority of workers who voted in the 2024 election backed Trump, but fewer than half of this group said tariffs will help them. Kamala Harris voters overwhelmingly say tariffs will have a negative impact on their jobs and careers.”

- Silver Bulletin notes that Trump's approval rating is on a clear downtrend in polls taken after his April 2 tariff announcement. "The trend is pretty clear at this point: Donald Trump is getting less popular." 50.7% disapprove - 45.4% approve (net -5.2%).

- Recent polls: YouGov (4/7 - 4/10): -13% Rasmussen (4/3 - 4/9): -5% Quinnipiac (4/3 - 4/7): -12% Navigator Research (4/3 - 4/7): -9% HarrisX (4/4 - 4/7): -2%, per Silver Bulletin.

Figure 1: “Do you think tariffs will help or hurt your job and career, or will they have no impact?”

Source: Washington Post

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: US CPI Prompts Short-Term Volatility, Daily Adjustments Contained

- Lower-than-expected US inflation data prints prompted an initial bout of US dollar weakness on Wednesday, with the USD index registering session lows in the immediate aftermath. However, this proved to be short-lived, as feedthrough to the Fed’s preferred PCE reading was seemingly less dovish than the headline readings, and the DXY took little time to fully reverse to the day’s strongest levels.

- A subsequent third swing lower for the greenback leaves the DXY close to unchanged levels as we approach the APAC crossover, with a lot of the action remaining in the equity space as the e-mini S&P 500 future posts a punchy 2.2% daily range.

- The main FX action was in USDJPY, which exhibited a 100 pip range within the short post-data timeframe, initially falling to 148.20 before surging to a high of 149.19, briefly extending the bounce from yesterday’s lows to 1.8%. Technically, a bear cycle remains in play for USDJPY, and that latest recovery appears corrective in nature. Spot has subsequently turned lower, and key short-term resistance remains unchanged further out at 151.30, Mar 3 high.

- A much more contained session for EURUSD, with the pair failing to punch above yesterday’s peak of 1.0947. It is worth noting the pair has completed its recovery to the US election related highs at 1.0937, with the bounce from last week’s lows totalling 5.55%. Given the severity of the moves and technicals now indicating an overbought condition, the potential for a pullback may be growing.

- The Canadian dollar is among the best performers in G10, following the Bank of Canada’s well forecast 25bp cut. The BOC said dangers from a U.S. trade war led it to cut borrowing costs for a seventh consecutive meeting, and expressed caution about further moves as the immediate hit to growth may be followed by unwelcome inflation. USDCAD is down 0.35% at 1.4380 and support to watch lies at 1.4242, the Mar 6 low.

- US PPI and jobless claims headline the economic calendar on Thursday.

MNI: US FEB TREASURY BUDGET -$307.0B

- MNI: US FEB TREASURY BUDGET -$307.0B

EURUSD TECHS: Northbound

- RES 4: 1.1083 High Oct 2 2024

- RES 3: 1.1040 High Oct 4 2024

- RES 2: 1.0961 76.4% retracement of the Sep 25 ‘24 - Feb 3 bear leg

- RES 1: 1.0947 High Mar 11

- PRICE: 1.0908 @ 14:53 GMT Mar 12

- SUP 1: 1.0766/1.0604 Low Mar 6 / 20-day EMA

- SUP 2: 1.0517 50-day EMA and a short-term pivot level

- SUP 3: 1.0360 Low Feb 28 and a key support

- SUP 4: 1.0317 Low Feb 12

EURUSD traded higher Tuesday, extending the current bull cycle and once again, this marks a continuation of the reversal on Feb 3. Note that MA studies have recently crossed and are in a bull-mode position, highlighting a dominant uptrend. Bulls have their sights on 1.0961 next, a Fibonacci retracement. Initial key support to watch lies at 1.0517, the 50-day EMA. The uptrend is overbought, a pullback would allow this set-up to unwind.