EM CEEMEA CREDIT: TURKEY: Household 12M Inflation expec Unch at 59.3%

Turkiye (TURKEY:B1pos/BB-/BB-)

Household 12-Month Inflation Expectation Unchanged at 59.3%

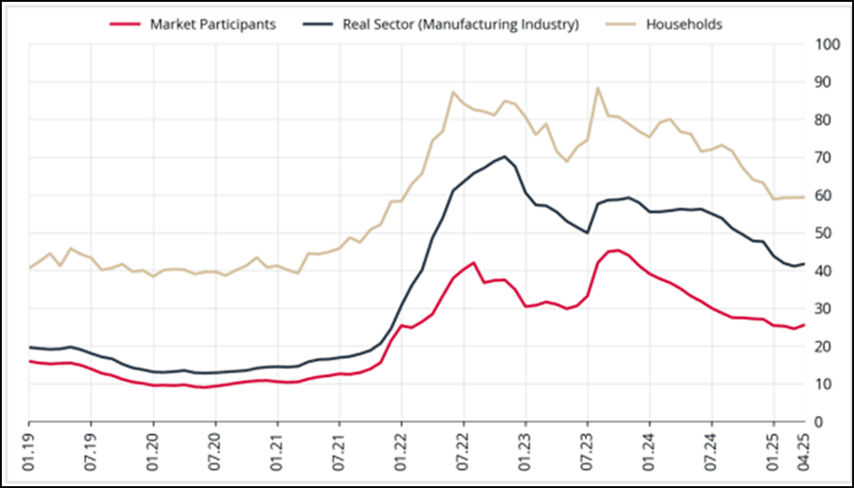

- Turkey's 12-month household inflation expectation was unchanged at 59.3% in April from March, according to the CBRT. The real-sector's inflation expectation rose slightly to 41.7% from 41.1%. There remains a significant wedge between expectations of households and market participants, with the 12-month ahead expectation for the latter up 1ppt to 25.6% in April.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

USD: A Volatile session for the Yen, the Pound falls.

- Most G10 Pair/Crosses are still mostly trading within ranges, but the Yen is again seeing some volatile two way price action just looking at this early Week.

- Just looking at this Week's low/high for the USDJPY, it has rallied 174 pips on Monday, then fell 139 pips Yesterday, to now a 107 pips up from Yesterday's low, to put the Yen as the worst early performer within G10s.

- Resistance there is still at 150.96 50-day EMA and a key short-term resistance.

- The Pound is the early small mover following the UK Inflation data coming just below expectations, but the main event for the UK today is the Spring Statement.

- Cable has just lost some 24 pips since the Data release, but is testing another intraday low to challenge the 1.2900 figure, although the first support comes at 1.2886.

EQUITY TECHS: E-MINI S&P: (M5) Retracement Mode Remains Intact

- RES 4: 5970.87 61.8% retracement of the Feb 19 - Mar 13 bear leg

- RES 3: 5924.59 50-day EMA

- RES 2: 5864.25 Low Jan 13 and a recent breakout level

- RES 1: 5837.25 High Mar 25

- PRICE: 5826.50 @ 07:22 GMT Mar 26

- SUP 1: 5650.75/5559.75 Low Mar 18 / 13 and the bear trigger

- SUP 2: 5483.50 2.00 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 3: 5396.00 2.236 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 4: 5341.87 2.382 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

S&P E-Minis are trading at their recent highs. The trend condition is bearish and the latest recovery appears corrective. MA studies remain in a bear-mode set-up, highlighting a dominant downtrend. However, this week’s gains have resulted in a breach of the 20-day EMA. This signals scope for a continuation higher near-term - towards 5864.25, the Jan 13 low. A reversal lower would refocus attention on 5559.75, the Mar 13 low and bear trigger.

WTI TECHS: (K5) Pierces Resistance

- RES 4: $76.57 - High Jan 15 and the bull trigger

- RES 3: $72.91 - High Feb 11 and key resistance

- RES 2: $70.98 - High Feb 25

- RES 1: $69.68 - High Mar 25

- PRICE: $69.22 @ 07:19 GMT Mar 26

- SUP 1: $64.85 - Low Mar 5 and the bear trigger

- SUP 2: $63.73 - Low Sep 10 ‘24 and a key medium-term support

- SUP 3: $60.00 - Psychological round number

- SUP 4: $59.40 - 2.00 proj of the Jan 15 - Feb 4 - 11 price swing

Despite recent gains, a bearish trend condition in WTI futures remains intact. However, a key pivot resistance at $69.12, the 50-day EMA, has been pierced. A clear breach of this hurdle would strengthen a bullish theme and open $70.98, the Feb 25 high. For bears, a reversal lower would expose the bear trigger at $64.85, the Mar 5 low. Clearance of this level would resume the downtrend and open $63.73 next, the Oct 10 ‘24 low.