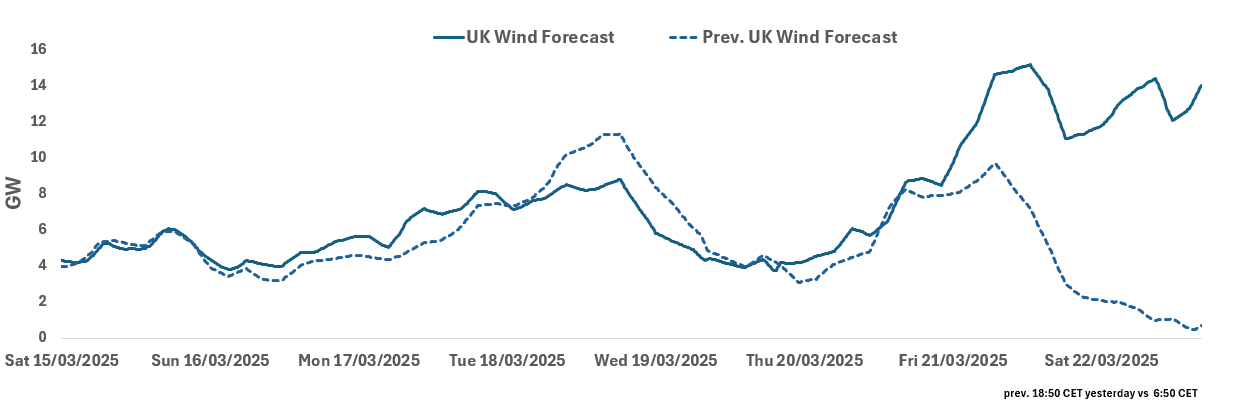

RENEWABLES: UK Morning Wind Forecast

See the latest UK renewables forecast for base-load hours from this morning for the next seven days. UK wind is forecast to be the lowest next week on 19 March (Wed) at a 17% load factor – which could see prices climb to a weekday high.

UK: Wind for 15-22 March

- 15 March: 5.04GW

- 16 March: 4.47GW

- 17 March: 6.61GW

- 18 March: 7.99GW

- 19 March: 4.79GW

- 20 March: 5.82GW

- 21 March: 12.35GW

22 March: 12.71GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: France new 30-year OAT: Guidance

- EUR Benchmark (MNI expects a E8-10bln size) of the new May-56 OAT

- Guidance: FRTR 3.25% 25/05/55 (MID) + 7bps area

- Issuer: Republic of France

- Ratings: Aa3 (Moody’s Stable)/AA- (S&P Stable)/AA- (Fitch Negative)/AAh (DBRS Stable)

- Format: OAT (in dematerialised book entry form), RegS Cat 1, 144A eligible, CACs

- Maturity: 25 May 2056

- Settlement: 19 February 2025 (T+5)

- Coupon: Fixed, annual ACT/ACT, payable each 25 May. Full first coupon on 25 May 2025

- Bookrunners: BNPP (DM and B&D) / Citi / DB / JPM / SG

- Timing: Books open, today's business

USDCAD TECHS: Support Remains Intact For Now

- RES 4: 1.5000 Psychological round number

- RES 3: 1.4948 High Mar 2003

- RES 2: 1.4814 High Apr 2003

- RES 1: 1.4600/1.4793 Round number resistance / High Feb 3

- PRICE: 1.4291 @ 07:59 GMT Feb 12

- SUP 1: 1.4270 Low Feb 5

- SUP 2: 1.4261 Low Jan 20 and a key support

- SUP 3: 1.4178 High Nov 6 ‘24

- SUP 4: 1.4120 Low Dec 11

USDCAD is trading in a tight range and closer to its recent lows. For now, the latest move down appears corrective and the primary uptrend remains intact. The Feb 3 cycle high reinforces and strengthens bullish conditions. The break higher confirmed a resumption of the uptrend and opens 1.4814 next, the Apr 2003 high. Key support to watch lies at 1.4261, the Jan 20 low. A clear breach of this level would alter the picture and signal a reversal.

AUDUSD TECHS: Testing Resistance At The 50-Day EMA

- RES 4: 0.6429 High Dec 12

- RES 3: 0.6384 High Dec 13

- RES 2: 0.6331 High Jan 24 and a key resistance

- RES 1: 0.6301/09 50-day EMA / Intraday high

- PRICE: 0.6290 @ 07:54 GMT Feb 12

- SUP 1: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6000 Round number support

- SUP 4: 0.5931 1.764 proj of the Sep 30 - Nov 6 - 7 price swing

AUDUSD continues to trade at its recent highs. Despite the latest bounce, the trend structure remains bearish. The Feb 3 fresh cycle low confirmed a continuation of the downtrend and maintains the price sequence of lower lows and lower highs. A resumption of the bear leg would open 0.6045, a Fibonacci projection. Key resistance is at 0.6301 (pierced), the 50-day EMA, and 0.6331, the Jan 24 high. A clear break of both levels would be bullish.