AUSTRALIA: Underemployment Signals Tight Labour Market, Vacancies Easing Though

The RBA doesn’t just focus on employment and the unemployment rate but also other labour market indicators, including the underemployment rate, youth unemployment rate, vacancies and hours worked. On average indicators suggest that labour market conditions were little changed over Q1 compared to Q4 and that they remain tight. The central bank has said that it is currently unsure how tight the jobs market is given moderating price and wage inflation.

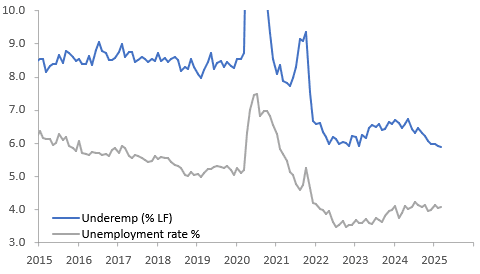

- Underemployment in March was stable at 5.9% but the Q1 average was 0.16pp below Q4 signalling a tightening of the labour market. The underutilisation rate was also unchanged in March at 9.9% while Q1 was 0.1pp down on Q4.

Australia underutilisation %

- The RBA sees the youth unemployment rate as a lead indicator of the jobs market as a whole. It rose to a peak of 9.9% in August but has trended down since then and fell another 0.1pp in March to 8.9%, the lowest in 18 months.

- Hours worked are currently difficult to interpret as February fell due to the drop in the number of older people returning to work and March due to extreme weather events. Thus, it is likely to be monitored closely over coming months for the underlying trend.

- Q1 vacancies fell 4.5% q/q to be down 9.2% y/y bringing the ratio to unemployment down to 53.4% but still almost 20pp above the series average and Q3 2024. SEEK job ads fell 3% m/m in March to be down 0.3% q/q in Q1, signalling continued gentle moderation in the labour market.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Steady Ahead Of Tomorrow’s Policy Decision Double Header: BoJ & FOMC

JGB futures are weaker, -8 compared to settlement levels, after giving up early strength.

- Today, the local calendar has been empty, with the Tertiary Industry Index and Tokyo Condominiums for Sale data due later.

- Nevertheless, the focus remains on tomorrow’s BoJ Policy Decision. The BoJ is expected to keep its policy rate at 0.50% in March, with no urgency for another hike after its January increase.

- Analysts expect a gradual rate hike to 0.75% by July or September and 1.0% by early 2026, depending on SME wage trends. Market pricing reflects uncertainty, with only half of a 25bps hike factored in for June and a full hike not priced until October. (see MNI BoJ Preview here)

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session. The focus is on Wednesday’s FOMC decision. The majority of analysts expect the FOMC to leave its Dot Plot funds rate medians unchanged in March compared with the December meeting.

- Cash JGBs are little changed across benchmarks out to the 30-year and 1.5bps cheaper beyond. The benchmark 10-year yield is 0.4bps higher at 1.517% versus the cycle high of 1.58%.

- Swap rates are 1-4bps higher out to the 30-year and flat beyond. Swap spreads are wider out to the 30-year.

ASIA STOCKS: A Strong Day for Regional Stocks Whilst Indonesia Plunges.

Indonesia’s ongoing equity market malaise turned into a bloodbath today as the Jakarta composite cratered on fiscal concerns, weak FX and government intervention in the central bank.

- Indonesia’s Jakarta Composite is down -6.8% as year to date losses approach 15%. The move lower was enough to trigger trading halts whilst bonds and the currency suffer.

- In China however a strong day for the major indices with the Hang Seng leading the way up +1.80%, CSI 300 +0.15%, Shanghai +.10% and Shenzhen +0.30%

- In Korea, the KOSPI had a slow start to the day and never recovered, despite the positivity in China, and has traded around flat all day.

- Malaysia’s FTSE Malay KLCI however took guidance from China’s strength and has rallied throughout to be up +1.00%

- As India’s trading day gets under way, the NIFTY 50 is opening very strong, up 1% following yesterday’s gain of +0.50%.

FOREX: USD Index Ticks Up With Middle East Tensions, Yen Underperforms Though

The USD has recovered some ground in the first part of Tuesday trade, the BBDXY index last near 1264.05, up close to 0.15% versus end NY levels from Monday's session.

- In the cross asset space, risk aversion has crept back into US equity futures, led by the tech side (down 0.55%). Eminis are off around 0.40%. There may be concerns around Middle East tensions, after Israel attacked Hamas in Gaza, while the US administration has stated it will continue to attack the Houthis in Yemen until the group stocks attacking sea traffic.

- Oil has nudged higher, while gold is up over 0.50%, last near $3016.

- Still, traditional FX safe havens like yen, aren't rallying versus the USD. USD/JPY was last 149.55/60, off around 0.25% in yen terms and through the 20-day EMA resistance point for the pair. Session highs were at 149.73. Helping cap gains may have been the softer US yield tone, although losses aren't much beyond 1bps at this stage.

- AUD/USD is a little lower, last near 0.6370, down close to 0.20%. NZD/USD is back to 0.5815/20, with the Kiwi continuing to outperform the AUD. The AUD/NZD cross is back to 1.0955 fresh YTD lows. Lower AU-NZ yield differentials are a factor, while relative commodity price trends have also been moving in NZD's favor.

- EUR/USD was last back near 1.0910/15.

- Later US February housing data, IP/capacity and trade prices print. Euro area January trade, March ZEW survey and Canadian February CPI are also released.