USDJPY TECHS: Uptrend Accelerates

Oct-21 12:43

- RES 4: 153.64 1.618 proj of the Aug 2 - 8 - 11 price swing

- RES 3: 153.39 3.764 proj of the May 24 - Jul 14 - Aug 2 price swing

- RES 2: 152.30 High Jul 1990

- RES 1: 152.00 Round number resistance151.20

- PRICE: 151.90 @ 13:42 BST Oct 21

- SUP 1: 150.00/149.56 Former psychological resistance / Low Oct 20

- SUP 2: 148.19/147.06 Low Oct 18 / 14

- SUP 3: 146.52 20-day EMA

- SUP 4: 144.72/143.53 Low Oct 7 / 5

The USDJPY uptrend has accelerated today with the pair extending gains above 150.00 - the break of 150.00 has reinforced bullish conditions. The climb maintains the positive price sequence of higher highs and higher lows and opens 152.00 and 152.30, the July 1990 high. Note that the trend is in overbought territory but this is clearly not a concern for bulls at this stage. Firm trend support lies at 146.52, the 20-day EMA. 150.00 is first support.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EQUITIES: Nasdaq future leads Indices to session high

Sep-21 12:36

- Nasdaq future lifted in 1k (cumulative), helps Emini through session high.

- Tech stocks in Europe are back to flat while Travel/Leisure and Banks are the losing stocks.

- Similar for the UK, with Bank stocks lower for the session.

US EURODLR OPTIONS: Put spread seller

Sep-21 12:30

SFRZ2 95.75/95.50ps 1x2 sold at 2.75 in 1.5k

US EURODLR FUTURES: Further Frontloading Of Curve Ahead of FOMC

Sep-21 12:27

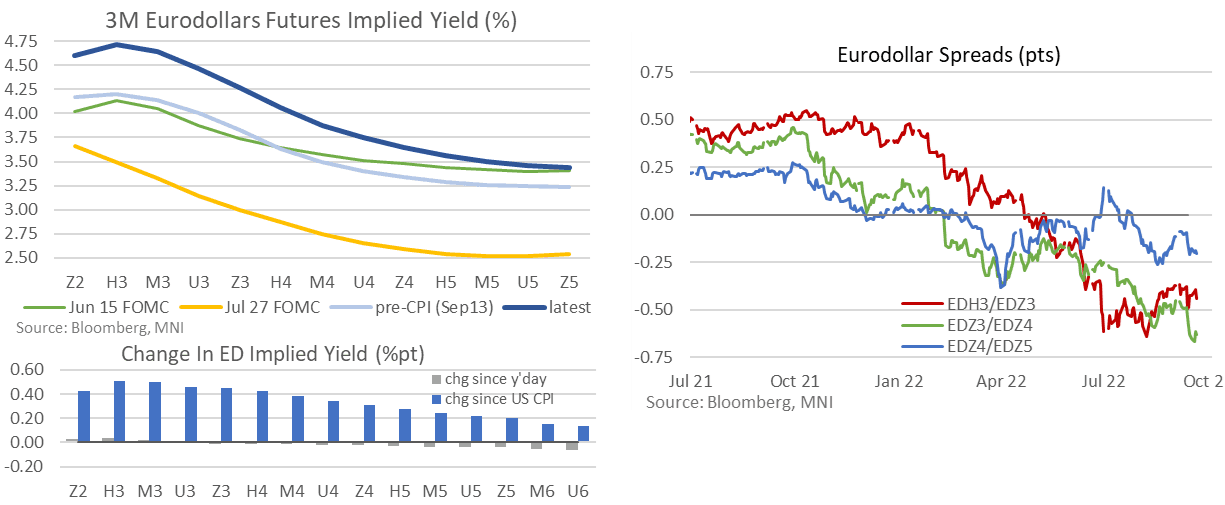

- Eurodollar yields see a front-loading of the curve, with EDZ2-H3 yields climbing 2.5-3bps and EDZ3-2024 yields dipping 1.5-2.5bps.

- It pushes EDH3/EDZ3 to -0.44 but within recent ranges whilst EDZ3/EDZ4 at -0.63 maintains levels close to recent lows, seen since last week’s CPI strength drove the substantial front-loading of the curve with H3 yields some 50bps higher than before CPI.