OIL PRODUCTS: US Gulf Coast Refineries Reduce Mexican Orders By 17% In March

Mar-06 08:30

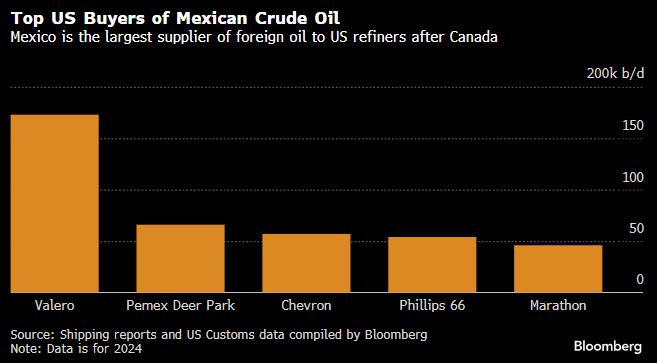

US Gulf Coast refineries have reduced their orders for Mexican crude oil for March by 17% compared to February levels, Bloomberg reports.

- Orders stand at 410k b/d for March.

- All the orders were placed by the end of February, before Trump confirmed this week that his 25% tariffs on Mexican goods, including crude oil, would be enacted, Bloomberg reports.

- Pemex plans to export 749k b/d in March, down 9.7% from February.

- Without the rollover of barrels from February, exports would have fallen to around 500k b/d, Bloomberg reports.

- Pemex’s oil output fell to the lowest in at least 40 years in January amidst quality issues and declines at ageing fields.

- Tariffs on Mexican crude are likely to raise gasoline prices around the US and cause supply-chain issues for refineries. 40% of the crude oil processed at US refineries is imported, with Mexico the 2nd largest foreign supplier after Canada, according to Bloomberg.

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

RIKSBANK: January Minutes May Provide Signal On Rate Outlook

Feb-04 08:18

The Riksbank January meeting minutes are due today at 0830GMT/0930CET. This release may provide a clearer signal on the rate outlook than the decision itself, given the non-committal policy statement guidance.

- The January rate decision (25bp cut to 2.25%) was unanimous, though Governor Thedeen suggested in the press conference that the minutes would highlight “nuances” in opinions amongst Board members.

- Key focus will be on whether the three doves from the December meeting minutes (Breman, Jansson and Bunge) still see a case for more cuts in H1 2025, and whether the March decision should be considered live.

- We expect Thedeen and Seim to continue offering a more cautious outlook for policy rates. In the January press conference, Thedeen said that the Riksbank’s “best assessment” was that there would be no more rate cuts (in line with the December MPR rate path). However, this assessment was heavily caveated, with the Governor citing significant uncertainty to the outlook (e.g. from potential trade barriers and economic fragmentation) and the need to assess incoming data in the context of the December projections.

STIR: SFRZ5/Z6 Sold

Feb-04 08:11

SFRZ5/Z6 4K given at -0.5.

GILTS: Weaker On Canadian Tariff Reprieve

Feb-04 08:10

Gilts sell off at the open, adjusting to Canada’s short-term tariff reprieve that has been covered in detail elsewhere.

- Futures as low as 92.67 before a recovery to 92.80.

- The recent corrective bullish cycle in the contract extended yesterday.

- Initial support and resistance located at the 20-day EMA (92.11) and yesterday’s high (93.54), respectively.

- Yields 1.5-3.0bp higher, curve bear steepens.

- GBP STIRs still operate around pre-gilt open levels, ~80bp of BoE cuts priced through year-end.

- The DMO will come to market with GBP4.25bln of the 4.375 Mar-30 gilt this morning.

- Little else of note on the UK calendar, which will leave focus on cross-asset cues and tariff-related headlines.

- Our BoE preview will be published later today.