CANADA: USDCAD Through 1.42 On Export Tariff Report

USDCAD touches a fresh post-April 2020 high of 1.4211 following a Bloomberg article citing official sources that Canada is looking at imposing export taxes on major commodity exports to the US (including oil, uranium, and potash) in retaliation for potential tariffs imposed by the incoming Trump administration.

- Also per Bloomberg, such export taxes would be a "last resort", with the first retaliatory measures likely to be tariffs on imports from the US and export controls on some products.

- As such we wait to see if resistance at 1.4196 (1.764 proj of the Oct 17 - Nov 1 - 6 price swing) is decisively broken. Reminder that our tech analyst identifies 1.4246 (2.00 proj of the Oct 17 - Nov 1 - 6 price swing) as key next resistance.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

USDJPY TECHS: Trend Needle Points North

- RES 4: 157.86 High Jul 19

- RES 3: 156.67 76.4% retracement of the Jul 3 - Sep 16 bear leg

- RES 2: 155.27 2.00 proj of the Sep 16 - 27 - 30 price swing

- RES 1: 154.77 High Nov 12

- PRICE: 154.76 @ 17:01 GMT Nov 12

- SUP 1: 151.76 20-day EMA

- SUP 2: 149.84 50-day EMA

- SUP 3: 149.09 Low Oct 21

- SUP 4: 147.35 Low Oct 8

The USDJPY trend condition is unchanged and remains bullish with price trading closer to its recent highs. Resistance at 153.88, the Oct 28 high, has been breached, reinforcing a bullish condition. Sights are on 155.27, a Fibonacci projection. Initial firm support is 151.76, the 20-day EMA. A break of this average would signal the start of a short-term corrective cycle. Support at the 50-day EMA, lies at 149.84.

US: Trump Advisors May Push For "Calibrated Approach To Tariffs" WSJ

The Wall Street Journal has published a piece arguing that Trump’s tariff agenda is unlikely to be as politically damaging as the price shock during the first half of Biden’s term.

- WSJ notes: “Early on [in Biden's term], wages lagged behind inflation, eating away at purchasing power. But even once wages caught up, the psychological damage remained.

- “That psychological toll might be why voters rated their state’s economy well but the country’s poorly. Inflation, like illegal immigration, fed into a sense of national disorder, for which blame naturally fell more on the president than local leaders. This might help explain why congressional Democrats escaped a shellacking in the 2022 midterms and outperformed Harris last week.”

- On the risk of similar blowback for Trump's agenda: “Trump needs to guard against the inflationary consequences of his own policies. Economists think his tariff plan, if fully implemented (which is far from a certainty), could raise consumer prices about 1%. That is nothing like the 21% of the past four years, but it’s the wrong direction.

- “Trump’s Wall Street advisers know this, and as a result, they might press for a calibrated approach to tariffs. In his first term, Trump exempted sensitive products, such as those made by Apple. Expect similar exemptions now—perhaps for food and fuel. Markets for now appear sanguine.”

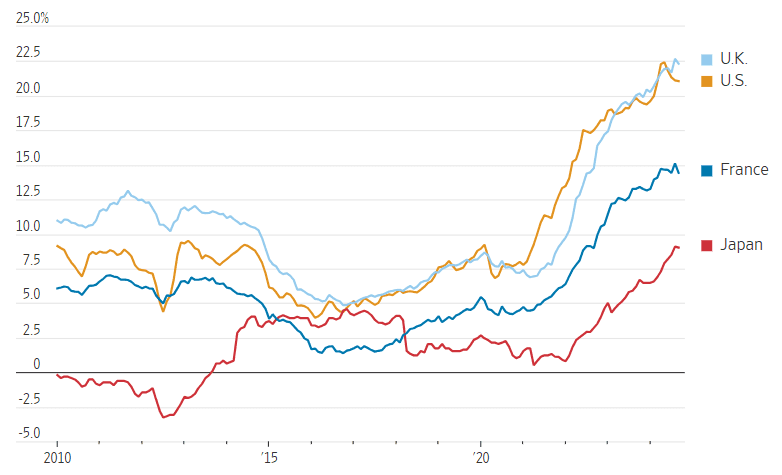

Figure 1: Change in Consumer Prices over 48 Months, Four Countries That Experienced Incumbent Electoral Losses

Source: Wall Street Journal

EURGBP TECHS: Bear Trend Extension

- RES 4: 0.8523 High Aug 22

- RES 3: 0.8499 61.8% retracement of the Aug 8 / Oct 18 bear leg

- RES 2: 0.8464 High Sep 11 and a key resistance

- RES 1: 0.8373/0.8448 50-day EMA / High Oct 31 and reversal trigger

- PRICE: 0.8323 @ 16:59 GMT Nov 12

- SUP 1: 0.8260 Low Nov 11

- SUP 2: 0.8250 Low Apr 14 ‘22

- SUP 3: 0.8203 Low Mar 7 2022 and a major support

- SUP 4: 0.8200 Round number support

EURGBP recovered Tuesday, bouncing off the fresh cycle low printed at the start of the week. Price has breached a key short-term support at 0.8295, the Oct 18 low. The move down confirms a resumption of the downtrend. Note that moving average studies remain in a bear-mode position, highlighting a dominant downtrend. Sights are on 0.8250, the Apr 14 2022 low. Key short-term resistance and a reversal trigger is at 0.8448, the Oct 31 high.