FOREX: USD/JPY Eyeing 153.00 Test, AS US-JP Yield Differentials Push Higher

Dec-13 00:46

Outside of a slightly weaker yen backdrop, early G10 FX trends are relatively stable in the first part of Friday dealing. The BBDXY index was last little changed, close to 1288.00.

- USD/JPY initially fell post the stronger than expected Q4 Tankan print, but there was little follow through. From lows of 152.46 we rebounded to 152.90/95 and hold close to these levels in latest dealings.

- Japan yields are slightly lower in the first part of dealing, with the Tankan result not seen as shifting BoJ near term thinking. US-JP yield differentials continue to track higher, the 10yr spread back to +327.5bps (recent lows were at 309bps).

- Upside targets for USD/JPY will likely rest at 153.66, a Fibonacci retracement.

- There is steady trends elsewhere, with AUD/USD around 0.6370, NZD/USD at 0.5770. EUR is near 1.0475.

- US equity futures are higher, particularly for tech, post firmer earnings late in Thursday US trade. US yields are down slightly in the first part of Friday trade.

- We have an RBA speech coming up a little later (Assistant Governor Hunter for Economics), along with Japan Oct industrial production. Otherwise the calendar is largely empty for the rest of today.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSTRALIA DATA: Wage Inflation Moderates To Lowest Since End-2022

Nov-13 00:46

Q3 WPI printed below expectations at 0.8% q/q and 3.5% y/y after 0.8% q/q and 4.1% y/y, lowest since Q4 2022. More details to follow. See ABS press release here.

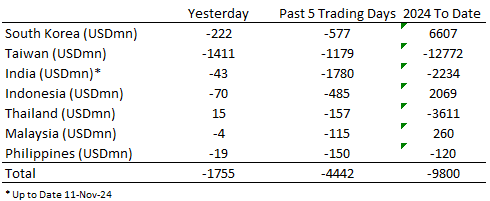

ASIA STOCKS: Foreign Investors Sell Asia Tech Stocks

Nov-13 00:41

Taiwan saw the largest outflows since early September on Tuesday, the outflows look largely linked to TSMC with investors likely taking profits following the strong performance post earnings a few weeks ago.

- South Korea: Recorded outflows of -$222m yesterday, with a 5-day total of -$577m. YTD flows remain positive at +$6.607b. The 5-day average is -$115m, worse than the 20-day average of -$170m and the 100-day average of -$94m.

- Taiwan: Posted outflows of -$1.411b yesterday, totaling -$1.179b over the past 5 days. YTD flows remain negative at -$12.772b. The 5-day average is -$236m, worse than the 20-day average of -$12m and the 100-day average of -$168m.

- India: Experienced outflows of -$43m yesterday with a 5-day outflow of -$1.780b. YTD flows are negative at -$2.234b. The 5-day average is -$356m, worse than the 20-day average of -$328m but better than the 100-day average of +$12m.

- Indonesia: Posted outflows of -$70m yesterday, bringing the 5-day total to -$485m. YTD flows remain positive at +$2.069b. The 5-day average is -$97m, worse than the 20-day average of -$39m but better than the 100-day average of +$25m.

- Thailand: Recorded inflows of +$15m yesterday, with a total outflow of -$157m over the past 5 days. YTD flows are negative at -$3.611b. The 5-day average is -$31m, worse than the 20-day average of -$26m and the 100-day average of -$8m.

- Malaysia: Experienced outflows of -$4m yesterday, contributing to a 5-day outflow of -$115m. YTD flows are positive at +$260m. The 5-day average is -$23m, worse than the 20-day average of -$14m but better than the 100-day average of +$3m.

- Philippines: Saw outflows of -$19m yesterday, with net outflows of -$150m over the past 5 days. YTD flows remain negative at -$120m. The 5-day average is -$30m, worse than the 20-day average of -$9m but better than the 100-day average of +$4m.

Table 1: EM Asia Equity Flows

AUSTRALIA DATA: Australia Q3 Wage Price Index +0.8% Q/Q

Nov-13 00:39

- The seasonally adjusted WPI rose 0.8% this quarter and 3.5% over the year.

- Both the private sector and the public sector rose 0.8%, seasonally adjusted, for the quarter.

- In original terms, the largest industry contributors to quarterly wages growth were Healthcare and social assistance (+1.7%), Retail trade (+2.1%), and Administrative and support services (+2.1%).