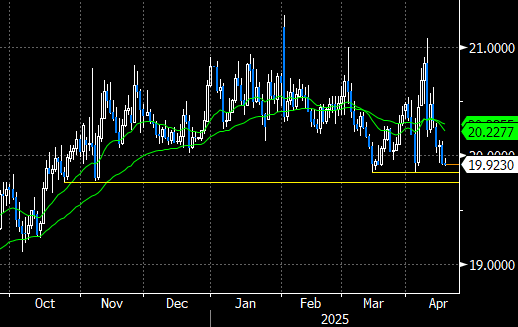

MEXICO: USDMXN Edging Towards Major Support

Apr-17 10:54

- US equity futures are holding onto their session gains following positive signs emanating from US/Japan talks late Wednesday. While dollar indices are a touch higher, the firmer risk backdrop is allowing higher beta currencies to consolidate their most recent recoveries, which is also providing a bid for the Mexican peso.

- On the tariff front, no news appears to be good news at this point for Mexico and any progress on negotiations between US/Mexican officials will be eagerly awaited by markets. With this in mind, President Claudia Sheinbaum said on Wednesday that she had sent a diplomatic memo to the United States about security collaboration at the two countries' shared border.

- The steep pullback on Apr 9 in USDMXN dragged the pair back to the middle of a broad range it has been trading inside since mid-January. The pair has continued to trade lower this week and is now testing the lower bound of this range. Key support lies at 19.8392, the Apr 3 low, and a breach of this level would highlight a reversal initially targeting a move towards 19.7556.

- There will be no presidential daily briefing today owing to the start of the long Easter weekend in the country. Retail Sales and Bi-Weekly CPI are the next highlights on the economic calendar, due across Wednesday and Thursday next week.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OUTLOOK: Price Signal Summary - EUROSTOXX 50 Support At The 50-Day EMA Is Intact

Mar-18 10:53

- In the equity space, the trend condition in S&P E-Minis remains bearish and fresh cycle lows last week reinforced current conditions. Moving average studies are in a bear-mode set-up highlighting a dominant downtrend. Sights are on 5483.50, a 2.00 projection of the Dec 6 ‘24 - Jan 13 - Feb 19 swing. Note that the short-term trend condition is oversold. Recent gains are considered corrective and the bounce is allowing this set-up to unwind. Firm resistance to watch is 5967.23, the 50-day EMA. The 20-day EMA is at 5847.41.

- EUROSTOXX 50 futures have recovered from their recent lows. The M/T trend direction remains up and the recent pullback is considered corrective. Support to watch is the 50-day EMA, at 5319.81. It has recently been pierced. A clear break of this average would highlight a stronger short-term bear threat and suggest scope for a deeper retracement towards 5202.00, the 50.0% retracement of the Dec 20 ‘24 - Mar 3 bull leg. A continuation higher would open the 5600.00 handle.

STIR: Bar To Rehn Not Voting For An April Cut Feels High

Mar-18 10:52

Our sense from this morning’s MNI Connect event with Bank of Finland Governor Rehn is that the bar to him not voting for a cut in April is quite high. In other words, notable hawkish surprises to upcoming flash PMI (March 24) data, flash inflation data (April 1), and the Bank Lending Survey (April 15) will be required for him to support holding rates at 2.50%.

- Rehn stressed downside growth risks emanating from US trade frictions, while noting that any growth impulse from increased European defence spending would take time to be realised. Meanwhile, he appeared quite relaxed about the balance of risks to inflation.

- We view Rehn as an important barometer of the median Governing Council view, often striking a centrist/dovish leaning tone.

- However, movements in near-term ECB implied rates were only modest (13.5bps of easing priced through April vs 13bps before the event), with the aforementioned data releases keeping the decision a close call. There continue to be 46bps of easing priced through year-end (i.e, a deposit rate of just over 2%).

- Euribor futures remain -0.5 to -3.0 ticks through the blues, weighed by today’s softness in core EGBs.

| Meeting Date | ESTR ECB-Dated OIS (%) | Difference Vs. Current Effective ESTR Rate (bp) |

| Apr-25 | 2.282 | -13.5 |

| Jun-25 | 2.106 | -31.1 |

| Jul-25 | 2.063 | -35.4 |

| Sep-25 | 1.993 | -42.4 |

| Oct-25 | 1.981 | -43.6 |

| Dec-25 | 1.958 | -45.9 |

| Feb-26 | 1.958 | -45.9 |

| Mar-26 | 1.967 | -45.0 |

| Source: MNI/Bloomberg. | ||

US TSYS: Marginally Twist Steeper, Potential Spillover Factors Watched

Mar-18 10:44

- Treasuries are back to little changed on the day after a modest rolling over in equities, leaving benchmark tenors within +/-1bp of yesterday’s close.

- The Kremlin has said Putin and Trump are due to speak between 0900-1100ET today and we earlier saw Bloomberg report that Putin wants all arms to Ukraine to be halted as part of a ceasefire agreement.

- Today sees a string of second tier US data releases plus potential spillover from Canada CPI at 0830ET and the German Bundestag vote on fiscal reform also expected to start from ~0830ET (with Treasuries currently outperforming EGBs after yesterday's underperformance).

- TYM5 trades at 110-20+ (+ 01) on more limited cumulative volumes of 275k having remained within yesterday’s range throughout.

- Support at 110-12+ (Mar 6/13 low) remains intact whilst the trend condition remains bullish with resistance at 111-25 (Mar 11 high).

- Data: Import prices Feb (0830ET), Housing starts/building permits Feb (0830ET), NY Fed services Mar (0830ET), IP/Cap util Feb (0915ET)

- Coupon issuance: US Tsy $13B 20Y Bond reopen - 912810UJ5 (1300ET)

- Bill issuance: US Tsy $48B 52W & $70B 6W bill auctions (1130ET)