EM ASIA CREDIT: Vanke (VNKRLE, Caa1/B-/CCC+) $ bonds lower, despite cpn payment

Vanke (VNKRLE, Caa1/B-/CCC+)...$ bonds lower, despite exp cpn payment

Vanke is expected to have made a coupon payment today on the CNY Vanke 3.98% 1/28 (+2.4pts). In contrast, no such optimism on the back of this for USD bonds, which are quite a bit lower. The VNKRLE 3 ½ 11/12/2029 (Caa1/B-/CCC+) for instance is 6.4pts lower with a cash price of 44. This might represent some pull back, given how far the bonds had rallied in the last few sessions, but also some skepticism regarding the repayment of near-term maturities.

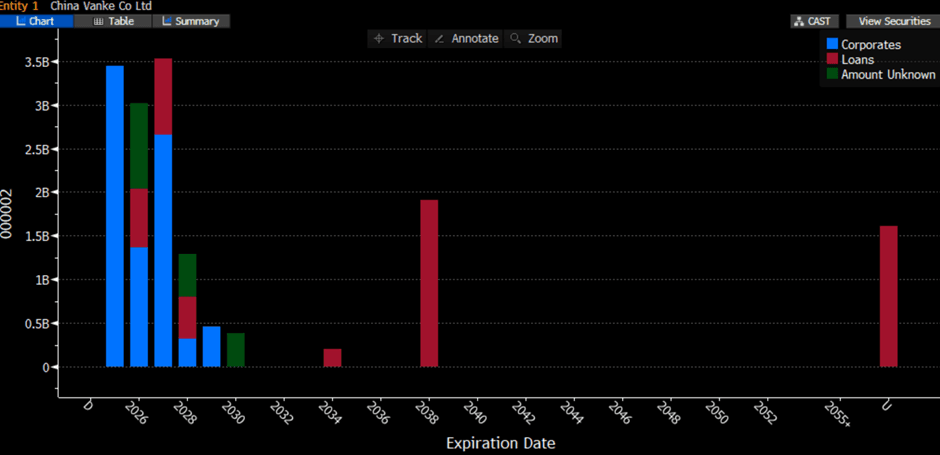

Vanke has a large maturity wall this year ($3.5bn equivalent, see below), with the upcoming CNY3bn VANKE 2.95 01/27/25 maturing next Monday ($412m equivalent) being a key moment.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: Just Over 60bp Of BoE Cuts Priced Through '25

GBP STIRs little changed to start the week, with the marginal marks lower in the final UK GDP data limiting spill over from the downtick in wider core global FI markets.

- SONIA futures little changed across the strip as a result.

- BoE-dated OIS showing ~61bp of cuts through ’25, next cut more than 80% discounted through March and more than fully discounted through May.

- Little of note on the UK calendar for the remainder of the week, which will leave focus on macro headline flow.

- A reminder that the Christmas holiday period will result in adjusted trading hours, as well as depleted liquidity and volume.

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Feb-25 | 4.536 | -16.4 |

Mar-25 | 4.495 | -20.5 |

May-25 | 4.374 | -32.6 |

Jun-25 | 4.328 | -37.2 |

Aug-25 | 4.224 | -47.6 |

Sep-25 | 4.184 | -51.6 |

Nov-25 | 4.118 | -58.2 |

Dec-25 | 4.087 | -61.3 |

EQUITY TECHS: E-MINI S&P: (H5) Monitoring Resistance At The 20-Day EMA

- RES 4: 6178.75 High Dec 6 and key resistance

- RES 3: 6163.75 High Dec 16

- RES 2: 6067.90 20-day EMA

- RES 1: 6050.75 High Dec 20

- PRICE: 6028.00 @ 07:26 GMT Dec 23

- SUP 1: 5866.00 Low Dec 20

- SUP 2: 5811.65 38.2% retracement of the Aug 5 - Dec 6 bull leg

- SUP 3: 5784.00 Low Nov 4

- SUP 4: 5698.25 50.0% retracement of the Aug 5 - Dec 6 bull leg

A sell-off in the S&P E-Minis contract on Dec 18 highlights a short-term top and a corrective cycle. The move down resulted in a breach of the 20- and 50-day EMAs. A resumption of weakness would open 5811.65, 38.2% of the Aug 5 - Dec 6 bull leg. Support at 5921.00, Nov 19 low, has been pierced. A clear break of it would strengthen a bearish threat. Initial resistance is 6067.90, the 20-day EMA. A clear break of it would be a bullish development.

AUDUSD TECHS: Southbound

- RES 4: 0.6550 High Nov 25

- RES 3: 0.6491 50-day EMA

- RES 2: 0.6429 High Dec 12

- RES 1: 0.6337/6382 Low Dec 11 / 20-day EMA

- PRICE: 0.6253 @ 07:28 GMT Dec 23

- SUP 1: 0.6199 Low Dec 19

- SUP 3: 0.6158 1.236 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6100 Round number support

- SUP 4: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

The trend needle in AUDUSD continues to point south and the pair is trading closer to its recent lows. Last week’s move down maintains the price sequence of lower lows and lower highs. Note that moving average studies are in a bear-mode position too, highlighting a dominant downtrend. Scope is seen for an extension towards 0.6158 next, a Fibonacci projection. Initial firm resistance to watch is 0.6382, the 20-day EMA.