RIKSBANK: VIEW: Nordea See No More Rate Cuts

Nordea do not expect any more Riksbank rate cuts through December 2026, with the January final inflation report prompting a notable upward revision of their inflation forecast. Their previous Riksbank forecast was for a final 25bp cut to 2.00% in May.

- “Our revised inflation path is above the Riksbank’s forecast and well above the 2% target, underlining that the Riksbank is done cutting rates”.

- “Unemployment was very high in January, but we see the reading as an outlier. Other hard data and indicators, such as SPES’ figures and NIER’s Tendency Survey, rather point to a stabilisation of the labour market situation”.

- “The SEK has strengthened recently and conditions are in place for further appreciation, albeit gradually”.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE ISSUANCE: EGB Supply

France and Lithuania have both announced syndication mandates while Germany and France are both still due to hold auctions this week. We pencil in further syndications from Finland and Spain. Already this week, the EFSF has held a syndication and Slovakia has held an auction. We look for estimated gross issuance for the week at E55.6bln, up from E42.2bln last week.

- On Monday, France announced a mandate for a new long 15 year OAT maturing 25 May 2042. We had thought that May 2042 was the most likely 15-20 year OAT that would be sold and pencil in a E5-8bln transaction size with upside risks of E9-10bln. We now expect the transaction to take place today.

- MNI had pencilled in a French syndication for next week (rather than this week due to the MT/IL auction on Thursday).

- Also on Monday, Lithuania announced a dual-tranche mandate for a new 5-year LITHUN EMTN maturing January 2030 and a new 15-year LITHUN EMTN maturing January 2040. We expect the transaction to take place today.

- Lithuania’s gross borrowing requirement for 2025 is E8.8bln of which E6.0bln is expected to be raised from EMTNs. This increases the scope for a larger Lithuanian syndication than we have seen in recent years (and note this will be the first dual-tranche Lithuanian transaction to see two new issues since April 2020).

- We pencil in E750mln to E1.5bln to be sold in each tranche, with a total deal size at least matching the E2.0bln sold in the April 2020 syndication (and the possibility of E2.5-3.0bln).

- Today, Germany will hold a Green auction to sell E1bln of the 2.10% Apr-29 Green Bobl (ISIN: DE000BU35025) and E1bln of the 2.30% Feb-33 Green Bund (ISIN: DE000BU3Z005).

For more details on issuance this week and next week see the full document here: EZ250121.pdf

EUROSTOXX50 TECHS: (H5) Holding On To Its Gains

- RES 4: 5298.50 1.500 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 3: 5261.57 1.382 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 2: 5215.87 1.236 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 1: 5202 High Jan 20

- PRICE: 5167.00 @ 06:25 GMT Jan 21

- SUP 1: 5113.00/5040.00 Low Jan 17 / High Dec 9

- SUP 2: 5020.28/4931.00 20-day EMA / Low Jan 13

- SUP 3: 4829.00 Low Dec 20 and key short-term support

- SUP 4: 4775.00 Low Nov 29

A bull cycle in the Eurostoxx 50 futures contract remains intact. Last week’s climb resulted in a breach of 5054.00, the Jan 8 high, to confirm a resumption of the uptrend. The contract is holding on to its gains. The focus is on a climb towards 5215.87, a Fibonacci projection point. Key short-term support has been defined at 4931.00, the Jan 13 low. A break of this level would be bearish.

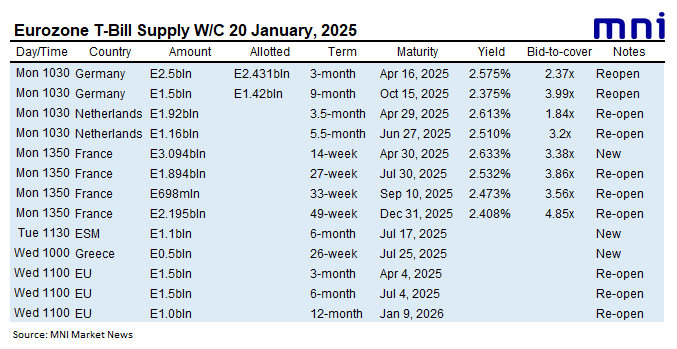

EUROZONE T-BILL ISSUANCE: W/C January 20, 2025

The ESM, Greece and the EU are all due to sell bills this week, whilst Germany, the Netherlands and France have already issued this week. We expect issuance to be E20.3bln in first round operations, up from E18.0bln last week

- Today, the ESM will sell up to E1.1bln of the new 6-month Jul 17, 2025 bills.

- Tomorrow, Greece will issue E0.5bln of the new 26-week Jul 25, 2025 GTB.

- Also tomorrow, the EU will sell up to E1.5bln of the 3-month Apr 4, 2025 EU-bill, E1.5bln of the 6-month Jul 4, 2025 EU-bill and E1.0bln of the 12-month Jan 9, 2026 EU-bill.

Re-sent to correct the days above

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.