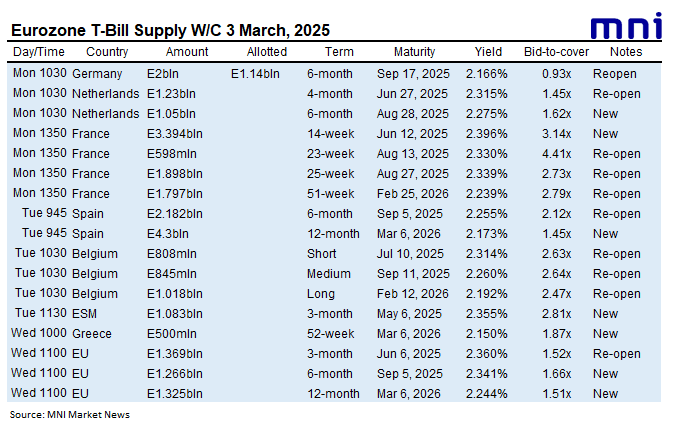

EUROZONE T-BILL ISSUANCE: W/C 3 March, 2025

Germany, the Netherlands, France, Spain, Belgium, the ESM, Greece and the EU already held auctions this week. Issuance was E26.7bln in first round operations, up from E18.8bln last week.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROSTOXX50 TECHS: (H5) Short-Term Reversal Highlights A Correction

- RES 4: 5381.13 1.764 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 3: 5335.43 1.618 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 2: 5327.00 High Jan 31 and the bull trigger

- RES 1: 5245.00 Intraday high

- PRICE: 5215.00 @ 06:20 GMT Feb 4

- SUP 1: 5112.00 Low Jan 3

- SUP 2: 5056.82 50-day EMA

- SUP 3: 4991.00 Low Jan 15

- SUP 4: 4931.00 Low Jan 13 and a key short-term support

A sharp reversal lower in the Eurostoxx 50 futures contract on Monday signals the end of the recent bull run - for now - and the start of a corrective cycle. Price gapped lower and traded through the 20-day EMA, at 5159.26. A continuation of the bear leg would pave the way for a move towards the 50-day EMA, at 5056.82. On the upside, key resistance and the bull trigger has been defined at 5327.00, the Jan 31 high.

EURGBP TECHS: Bearish Threat

- RES 4: 0.8474 High Jan 20 and a key resistance

- RES 3: 0.8421 High Jan 27

- RES 2: 0.8374 20-day EMA

- RES 1: 0.8363 High Jan 3

- PRICE: 0.8305 @ 06:30 GMT Feb 4

- SUP 1: 0.8248 Low Feb 3

- SUP 2: 0.8223 Low Dec 19 and a key support

- SUP 3: 0.8203 Low Mar 7 ‘22 and a lowest point of a multi-year range

- SUP 4: 0.8163 123.6% retracement of the Dec 19 - Jan 20 bull leg

EURGBP traded in a volatile manner on Monday. The bear cycle that started Jan 20 remains in play and Monday’s initial sell-off has strengthened a bearish threat. A resumption of weakness would pave the way for a move towards the first key support at 0.8223, the Dec 19 low. On the upside, the 20-day EMA is seen as a key short-term resistance - at 0.8374. A breach of the average would highlight a bullish development.

SCHATZ TECHS: (H5) Clears Resistance

- RES 4: 107.233 76.4% retracement of the Dec 2 - Jan 15 bear leg

- RES 3: 107.170 High Dec 20

- RES 2: 107.081 61.8% retracement of the Dec 2 - Jan 15 bear leg

- RES 1: 107.045 High Jan 3

- PRICE: 106.890 @ 06:07 GMT Feb 4

- SUP 1: 106.805 Low Jan 3

- SUP 2: 106.703 20-day EMA

- SUP 3: 106.515 Low Jan 30

- SUP 4: 106.435 Low Jan 15 and key support

Schatz futures traded sharply higher Monday, marking an extension of the bull cycle that started Jan 15. The contract has traded through a number of important resistance points and the latest impulsive gains highlight a stronger reversal. The focus is on 107.081, a Fibonacci retracement point. On the downside, initial firm support to watch lies at 106.703, the 20-day EMA. First support is 106.805, Monday’s intraday low.