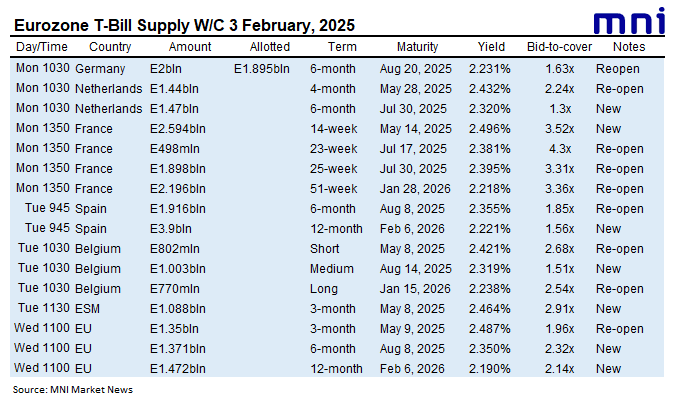

EUROZONE T-BILL ISSUANCE: W/C February 3, 2025

Germany, the Netherlands, France, Spain, Belgium, the ESM and the EU have already issued this week. Issuance was E25.8bln in first round operations, up from E19.3bln last week.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE T-BILL ISSUANCE: W/C January 6, 2025

Spain, Belgium, Finland, the ESM, the EU and Italy are due to sell bills this week, whilst Germany, the Netherlands and France have already issued bills. We expect issuance to be E37.6bln in first round operations, up from E0.5bln last week.

- This morning, Spain will issue a combined E5.5-6.5bln of the 6-month Jul 4, 2025 letras and the new 12-month Jan 9, 2026 letras.

- Also this morning, Belgium will look to sell E3.8-4.2bln of the 4/6/11-month TCs: an indicative E1.0bln each of the 4-month May 8, 2025 TC and the new 6-month Jul 10, 2025 TC, and an indicative E2.0bln of the new 11-month Dec 11, 2025 TC.

- Thirdly today, Finland will sell up to a combined E2bln of the 7-month Aug 13, 2025 RFTB and the 10-month Nov 13, 2025 RFTB.

- Next today, the ESM will issue up to E1.1bln of the new 3-month Apr 3, 2025 bills.

- Finally today, the EU will sell up to E1.5bln of the 3-month Apr 4, 2025 EU-bill, E1.5bln of the new 6-month Jul 4, 2025 EU-bill and E1.5bln of the new 12-month Jan 9, 2026 EU-bill.

- On Friday, Italy will issue a new 12-month BOT alongside potentially another existing BOT. Details will be announced later today.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

CHINA PRESS: December New Yuan Loans Seen To Rise Sharply

China’s new yuan loans are expected to reach CNY900 billion in December, compared to November’s CNY580 billion, as banks quicken loan disbursement to whitelisted real estate projects at year-end and residents’ medium- to long-term loans may rise on recent housing market recovery, the Securities Daily reported citing Wang Qing, analysts with Golden Credit Rating. Aggregate finance may come in at CNY2.3 trillion, basically the same as November’s CNY2.34 trillion, supported by high level of government bond financing, Wang added. The central bank is set to release the latest data during the January 10-15 period.

CHINA PRESS: Local Governments To Quicken Special Bond Sales

Local governments are expected to increase and accelerate the issuance of special bonds early this year to boost domestic demand, the Economic Information Daily reported. As of January 6, local governments have planned to issue a total CNY680 billion local government bonds in Q1, of which special bonds account for CNY240 billion, the newspaper said. Funding demand remains high as a large number of major infrastructure projects will be started this year and local authorities need to supplement their financial resources for swapping out off-balance-sheet debts and buying up unsold homes for affordable housing, the daily said citing analysts.