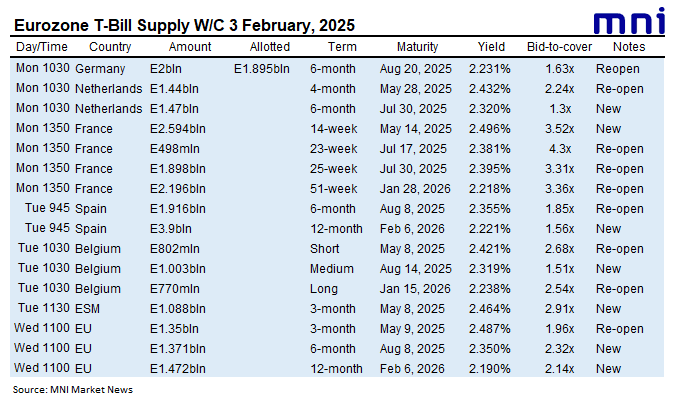

EUROZONE T-BILL ISSUANCE: W/C February 3, 2025

Germany, the Netherlands, France, Spain, Belgium, the ESM and the EU have already issued this week. Issuance was E25.8bln in first round operations, up from E19.3bln last week.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE T-BILL ISSUANCE: W/C January 6, 2025

The EU and Italy are due to sell bills this week, whilst Germany, the Netherlands, France, Spain, Belgium, Finland, and the ESM have already issued bills. We expect issuance to be E37.2bln in first round operations, up from E0.5bln last week.

- Today, the EU will sell up to E1.5bln of the 3-month Apr 4, 2025 EU-bill, E1.5bln of the new 6-month Jul 4, 2025 EU-bill and E1.5bln of the new 12-month Jan 9, 2026 EU-bill.

- On Friday, Italy will issue E8.0bln of the new 12-month Jan 14,2026 BOT.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

SCHATZ TECHS: (H5) Bear Cycle Remains In Play

- RES 4: 107.365 High Dec 12

- RES 3: 107.170 High Dec 20

- RES 2: 107.002 20-day EMA

- RES 1: 106.785/965 High Jan 6 / 3

- PRICE: 106.750 @ 06:17 GMT Jan 8

- SUP 1: 106.685 Low Jan 6

- SUP 2: 106.680 Low Nov 20 (cont)

- SUP 3: 106.645 Low Nov 18 (cont)

- SUP 4: 106.625 2.00 proj of the Dec 2 - 6 - 12 price swing

The current bear cycle in Schatz futures remains intact and recent weakness, including Monday’s fresh cycle low, reinforces this theme. The Jan 3 sell-off confirmed a resumption of the bear leg and sights are on 106.680, the Nov 20 ‘24 low (cont). Initial firm resistance is seen at 107.002, the 20-day EMA. A clear break of it would highlight a potential reversal. For now, short-term gains would be considered corrective.

GBPUSD TECHS: Bearish Theme

- RES 4: 1.2811 High Dec 6 and key resistance

- RES 3: 1.2729 High Dec 17

- RES 2: 1.2672 50-day EMA

- RES 1: 1.2550/2607 20-day EMA / High Dec 30

- PRICE: 1.2489 @ 06:32 GMT Jan 8

- SUP 1: 1.2353 Low Jan 2

- SUP 2: 1.2300 Low Apr 22 2024

- SUP 3: 1.2266 Low Nov 14 2023

- SUP 4: 1.2261 2.0% 10-dma envelope

The trend condition in GBPUSD remains bearish. The sharp sell-off on Jan 2 confirmed a resumption of the medium-term downtrend. The move down maintains the bearish price sequence of lower lows and lower highs and note that MA studies are in a bear-mode position, highlighting a downtrend. The latest recovery is for now, considered corrective. Initial firm resistance is at 1.2550, the 20-day EMA (pierced). The bear trigger is 1.2353, the Jan 2 low.