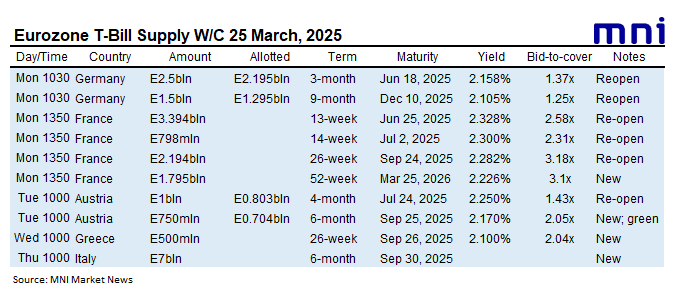

EUROZONE T-BILL ISSUANCE: W/C March 24, 2025

Italy is still due to sell bills this week, while Germany, France, Austria and Greece have already come to the market this week. We expect issuance to be E21.4bln in first round operations, up from E19.4bln last week.

- Today, Italy will come to the market to sell E7bln of the new 6-month Sep 30, 2025 BOT.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE T-BILL ISSUANCE: W/C February 24, 2025

Austria and Italy are both due to sell bills this week, whilst Germany and France have already issued. We expect issuance to be E18.8bln in first round operations, a little lower than the E19.0bln last week.

- Today, Austria will look to issue E1bln of the 2-month Apr 24, 2025 ATB and E2bln of the 3-month May 30, 2025 Green ATB.

- Finally tomorrow, Italy will conclude issuance for the week with a BOT auction. On offer will be E2bln of each of the 2-month May 14, 2025 BOT and the 5-month July 31, 2025 BOT.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

EURGBP TECHS: Trading Closer To Its Recent Lows

- RES 4: 0.8378 High Feb 6 and a key resistance

- RES 3: 0.8361 50.0% retracement of the Jan 20 - Feb 3 bear leg

- RES 2: 0.8335 50-day EMA

- RES 1: 0.8321 20-day EMA

- PRICE: 0.8292 @ 06:30 GMT Feb 25

- SUP 1: 0.8265/8248 Low Feb 21 / 3 and bear trigger

- SUP 2: 0.8223 Low Dec 19 and a key support

- SUP 3: 0.8203 Low Mar 7 ‘22 and a lowest point of a multi-year range

- SUP 4: 0.8163 123.6% retracement of the Dec 19 - Jan 20 bull leg

EURGBP continues to trade closer to its recent lows. A resumption of weakness would expose the key short-term support at 0.8248, the Feb 3 low. Clearance of this level would strengthen a short-term bearish condition. Note that the early February bounce does highlight a possible bullish reversal theme. Clearance of 0.8378, the Jan 6 high and a key short-term pivot resistance, would be a positive development for bulls.

EUROSTOXX50 TECHS: (H5) Trend Structure Remains Bullish

- RES 4: 5606.00 3.000 proj of the Dec 20 ‘24 - Jan 8 - 13 price swing

- RES 3: 5588.38 2.0% 10-dma envelope

- RES 2: 5574.57 2.382 proj of the Nov 21 - Dec 9 - 20 ‘24 price swing

- RES 1: 5555.00 Alltime high (cont), Feb 18

- PRICE: 5457.00 @ 06:09 GMT Feb 25

- SUP 1: 5387.59 20-day EMA

- SUP 2: 5295.00 Low Feb 6

- SUP 3: 5229.26 50-day EMA

- SUP 4: 5112.00 Low Feb 3 and a key support

The trend condition in the Eurostoxx 50 futures contract remains up and last week’s climb to a new alltime high on the continuation contract, reinforces a bull theme. Note too that moving average studies are in a bull-mode set-up, highlighting a dominant uptrend and positive market sentiment. Sights are on 5574.57 next, a Fibonacci projection. Initial firm support to watch is 5387.59, the 20-day EMA. A pullback would be considered corrective.