EU BASIC INDUSTRIES: Week in Review

Feb-28 12:35

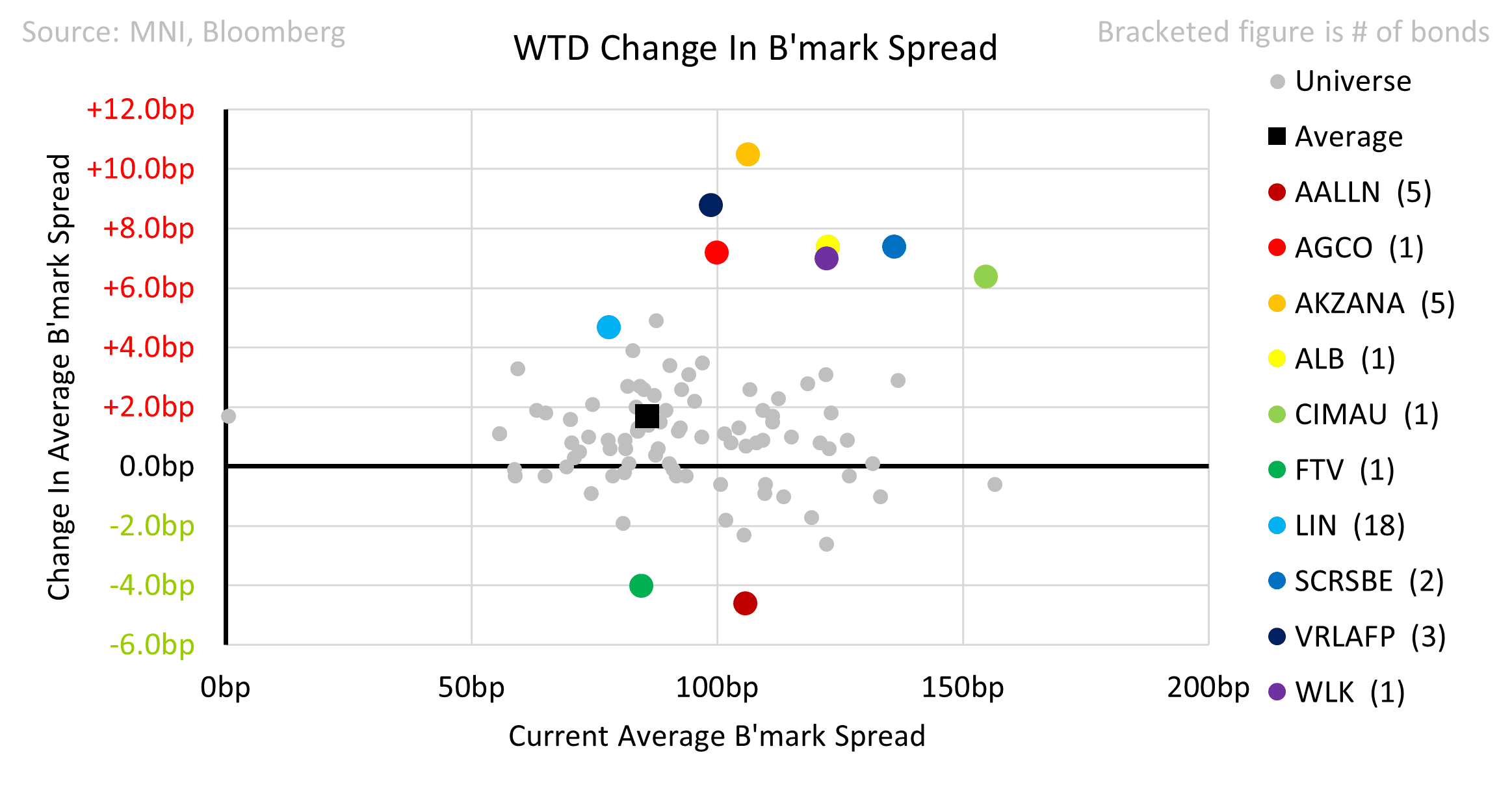

- Industrial spreads performed marginally better than the overall market at +2bp, despite some bigger moves among small issuers. AALLN spreads were helped by tenders.

- Earnings from chemicals names continue to show the hoped-for recovery remains elusive, with the outlook generally flat. Westlake posted disappointing margins. BASF reported a soft outlook, having previously released preliminary results. Covestro EBITDA missed, but FCF beat. Arkema results were in line.

- Rolls-Royce posted a beat and raised mid-term guidance. Shareholder returns were stepped up however.

- Kion had already published preliminary results; guidance was upbeat.

- It was a busy but uneventful week for building materials earnings with Heidelberg Materials, CRH, Holcim and Wienerberger results all largely in-line. Saint-Gobain posted a small beat.

- Dow was put on outlook negative by S&P, mainly due to extended weakness in petrochemicals. Asset sales and cost cutting should protect the rating.

- CNH Industrial was also put on outlook negative, with the agricultural slump set to put margins outside rating thresholds for two years. It will need the expected 2026 recovery to play out.

- Primary took an interesting twist with TCC’s euro debut getting pulled on apparent book weakness. Emerson priced a dual tranche 8-10 wide to our FV. PPG priced with a 5bp NIC. Caterpillar priced a GBP 10 wide to our FV.

Dow launched a short dater tender, with Anglo American targeting further out the curve.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Larger FX Option Pipeline

Jan-29 12:30

- EUR/USD: Jan30 $1.0450-60(E1.0bln); Jan31 $1.0400(E1.7bln), $1.0450(E1.0bln), $1.0500(E1.4bln), $1.0520-30(E2.7bln); Feb03 $1.0400(E1.7bln)

- USD/JPY: Jan31 Y155.00($1.0bln)

- AUD/USD: Jan31 $0.6200-20(A$1.2bln)

- USD/CAD: Jan30 C$1.4490-00($1.2bln); Jan31 C$1.4400-20($1.2bln); Feb03 C$1.4400($1.5bln)

EUROZONE ISSUANCE: DSTA Calendar Update

Jan-29 12:20

DSTA has announced the following on its issuance calendar for Q1:

- It confirmed to hold DSL auctions on February 11 and March 25, details tba. That means the potential auction dates on February 25 and March 11 will not be exercised.

- It also confirmed it will sell E4.0-6.0bln of the Jul-35 DSL (ISIN tba) via DDA on March 4.

EURIBOR OPTIONS: Call Condor vs Call Fly

Jan-29 12:19

ERM5 97.75/97.875/98.00c fly vs 98.00/98.125/98.25/98.375c condor, bought the condor for 0.25 in 8k.