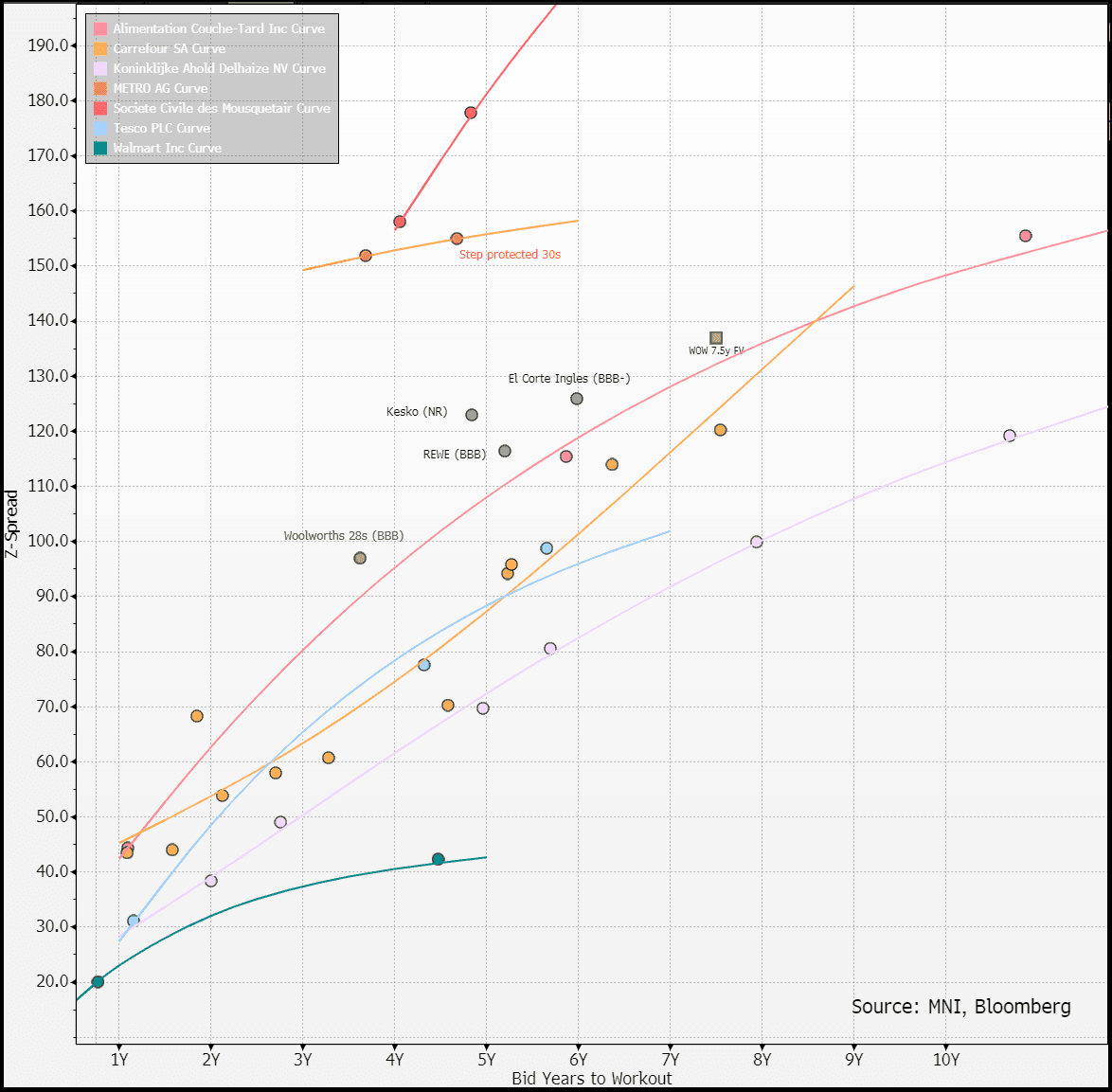

EU CONSUMER STAPLES: Woolworths: FV

• exp. €500m 7.5y, indic. FV below

Woolworths is Australia's largest grocer holding a 38% market share. Closest competitor, Coles, has a 29% share and together they run a effective duopoly - unlike most of our local issuers who operate in highly fragmented markets. It has translated to profitability - Woolworths runs sector leading margins (at near double French names). When paired with a typical mid-2 levered balance sheet it leaves it on Baa2/BBB ratings with ample headroom (1x below ceilings at both).

Still, Woolworth's is not our lowest beta pick in grocers (Tesco is) and that is on near term catalyst shifting more negative. This was triggered by consumer dissatisfaction on rising grocery prices. Inflation has since receded (running at ~3%) but the political and regulation pressure that emerged from it remains. Regulation was effectively resolved two weeks ago without harm and was a major credit positive (evidenced by both Coles and Woolworths mandating their bond issuance soon after). The political uncertainty remains given a election is one month away and is too close to call. Centre left (currently in power) is more soft on the grocers, centre right has said forcing the two operators into divestitures could be considered as last resort.

On Sunday New Zealand's Finance minister (who is not facing an election) said it would "actively seek a third player" and that advisors were also studying "a possible demerger of existing entities". In New Zealand the duopoly is held by Woolworths & Foodstuffs. The smaller country (pop. 25m vs. 5m) contributes 12% of WOW revenues but on inferior margins (EBIT 1.3% vs. Aussie food on 6%) contributes only 3% of group EBIT. We flag as the changes there may impact the consumer sentiment and political pressure in Australia.

Other real changes from above have been;

- CEO resigning a few days after a walking out on a media interview (last year). He was well respected by markets.

- Co guiding to MSD EBIT fall (ex. one-offs) this FY (12m to June) as it attempts to aggressively price and win back customer satisfaction

Other credit negatives we have with the co; - Its (seeming) refusal to put a leverage target in place which has held back rating upgrades

- We note this particularly with a new CEO and a ongoing portfolio review (latter unlikely to be a mover given core Aussie Food operations makes up 96% of EBIT)

Credit positives;

- 1x headroom to rating thresholds (can take a -30% fall in EBTIDA on unch debt levels)

- Sector leading profitability as the starting point to all the above

- Positive history on BS governance and stated commitment to "solid IG ratings"

On FV we have always had the view taking the illiquidity discount among the single country grocers screens more value then investing in tighter global operators ADNA & Carrefour. We spread Woolworths similar to REWE & El Corte Ingles. We see room for it tighten from there if some of the above uncertainty is resolved post-election. On that vein have a existing value view on the shorter WOWAU-28s.

Quick figures for reference (FY24/to June'24):

- AUD 68b (€39.5b) in sales, 12% of which in ecommerce

- AUD 6.0b (€3.5b) in EBITDA on a 8.8% margin

- AUD 3.2b (€1.9b) in adj. EBIT on a 4.7% margin

- AUD 16.8/15.5 g/n debt levered 2.8x/2.6x

WOW is a well covered equity name (similar to Tesco/Carrefour). FY25 consensus is currently at;

- Revenue +2%, EBITDA -4%, EBIT -12% on 4.2% margin (-50bps yoy)

- Note 1H EBIT was -14% but says ex. one-offs including industrial action, it would have been -7%. Guidance for 2H EBIT is MSD decline.

- On a conservative -10% EBITDA fall we see leverage rising to 3.1x/2.9x still well below thresholds (Moody's gross 4x, S&P net 3.75x)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: DDA 10-year 2.50% Jul-35 DSL: Book update

- Spread guidance revised to +25.0 to +26.5bps vs the 2.50% Feb-35 Bund (ISIN: DE000BU2Z049).

- (Initial spread guidance was +25.0 to +28.0bps).

- Books in excess of E26bln

- ISIN: NL0015002F72

US-RUSSIA: Sanctions Must Be Lifted To Normalise US-Russia Relations - Kremlin

Reuters carrying comments from Kremlin spokesperson Dmitri Peskov, speaking on major developments in the war in Ukraine, including possible sanctions relief and US President Donald Trump's decision to pause military aid to Ukraine.

- Peskov said it’s “too early to comment” on reports that the Trump administration is looking at possible sanctions relief for Russia but notes that sanctions are “illegal” and need to be lifted in order to normalise relations.

- Reuters reported overnight that the White House, “has asked the State and Treasury departments to draft a list of sanctions that could be eased for U.S. officials to discuss with Russian representatives in the coming days as part of the administration's broad talks with Moscow on improving diplomatic and economic relations.”

- The report adds: “The sanctions offices are now drawing up a proposal for lifting sanctions on select entities and individuals, including some Russian oligarchs…” The report also notes that sanctions on Russia’s oil sector could be eased to allow more punitive measures against Iran’s oil exports.

- Peksov: “Seems as if European countries will try to compensate Ukraine for the apparent loss of US military aid… We need to see how the situation develops on the ground… It is obvious that the US was the main supplier of this war.”

- Peskov: “If the United States stops these supplies, it will be the best contribution to the cause of peace… If the reports are true then this could encourage the Kyiv regime to seek peace.”

SONIA: Call spread buyer

SFIZ5 97.25/97.75cs, bought for 2 in 2k.