EUROPEAN INFLATION: Yearly Price Resets Seen Key For 2025 Services Trends

Apart from the seasonal adjustment methodology, this month's inflation round will also bring a January reset effect, which affects around a quarter of all services subcategories according to Barclays (and around half the services weighting according to Morgan Stanley), meaning prices in the respective categories tend to be updated in January and see little change during the remainder of the year. This results in yearly inflation rates being heavily influenced by such a January reset – examples include healthcare and insurance prices.

- The general view amongst analysts appears to be that the price resets are set come in lower than in 2024 as they are at least partially linked to headline inflation in the respective past year, which has declined materially in ’24 vs ‘23.

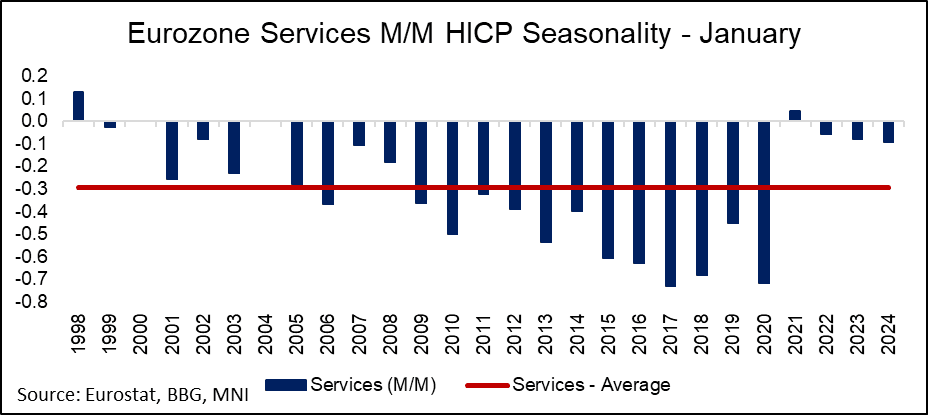

- Société Générale see a 0.1pp reduction throughout 2025 for the yearly on the basis of that effect, while Barclays projects “that annual resets should cause a c.0.2pp drag on euro area services inflation in January”, and Morgan Stanley “expect a strong January 2025 for services, way above what we used to see before 2019, but a touch less than in 2024” (for a comparison of the monthly services pace in January see the chart below).

- As mentioned above, ECB President Lagarde highlighted insurance prices in particular in this context – first indications of developments in that category specifically should be possible from the German state-level data released at 9am GMT on Friday.

- Dec'24 EZ services: 4% Y/Y, 0.8% M/M. Jan 2024 -0.1% M/M vs -0.36% 2017 - 2024 M/M avg

- Dec'24 EZ insurance : 10.1% Y/Y, 0.6% M/M. Jan 2024 4.1% M/M vs 1.3% Jan’23, 0.4% Jan’22, 0.6% Jan’21

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURJPY TECHS: Pullback Appears Corrective

- RES 4: 166.69 High Oct 31

- RES 3: 166.31 2.0% 10-dma envelope

- RES 2: 166.10 High Nov 6

- RES 1: 165.04 High Nov 15 and a key short-term resistance

- PRICE: 163.08 @ 16:11 GMT Dec 30

- SUP 1: 162.82 Low Dec 30

- SUP 2: 162.31/159.82 20-day EMA / Low Dec 18

- SUP 3: 158.67 Low Dec 11

- SUP 4: 157.87 Low Dec 09

EURJPY has pulled back from Monday’s high, but a bullish short-term condition remains intact for now. Initial firm support lies at 162.31, the 20-day EMA. The cross has recently breached all the relevant Fibonacci retracement points of the bear leg between Oct 31 - Dec 3. A resumption of gains would open 165.04, the Nov 15 high. Clearance of this hurdle would open 166.69, the Oct 31 high and the next major resistance.

BTP TECHS: (H5) Bears Remain In The Driver’s Seat

- RES 4: 123.34 High Dec 11 and key resistance

- RES 3: 122.85 High Dec 12

- RES 2: 121.94 High Dec 13

- RES 1: 120.70/121.03 High Dec 20 / 20-day EMA

- PRICE: 119.98 @ Close Dec 30

- SUP 1: 119.41 Low Dec 27

- SUP 2: 119.11 Low Nov 18

- SUP 3: 118.80 76.4% retracement of the Nov 7 - Dec 11 bull cycle

- SUP 4: 118.51 Low Nov 8

A corrective cycle in BTP futures has resulted in a pullback from its recent highs and last Friday’s sell-off highlights and extension of the current bear cycle. The contract has recently breached the 20-day EMA and sights are on 118.80, a Fibonacci retracement point. Key resistance and the bull trigger has been defined at 123.34, the Dec 11 high. Initial firm resistance is seen at 121.03, the 20-day EMA.

CHINA PRESS: PBOC To Cut RRR, Interest Rates Timely

The People's Bank of China should cut the reserve requirement ratio and interest rates in a timely way and make good use of monetary tools including open market operations to maintain ample liquidity to continuously increase support for the real economy, wrote Han Wenxiu, deputy director of the Office of the Central Financial and Economic Affairs Commission in an article published by the party-run People's Daily. It's also necessary to maintain relatively fast credit growth and lower financing costs, while stablising the currency at an equilibrium level, said Han.