FOREX: Yen Up Over 1%, EUR/USD Stages Impressive Rebound

The USD BBDXY index sits new session lows, last close to 1263.10 (lows rest at 1262.8). March lows for the index rest at 1261.15. The index is off around 0.60%, with the USD mostly losing ground post tariff headline highs from earlier.

- Yen remains the standout, up over 1.1% at this stage. USD/JPY was last near 147.55/60, just up from session lows (147.53). We are comfortably sub 148.18 the March 20 low and also key short term support. 146.54 is the Mar 11 low and bear trigger. CHF is the next best performer, up 0.65%, last near 0.8760.

- Safe havens outperforming fits with the risk averse equity backdrop, although we are away from session lows for US and EU equity futures. Some regional Asia Pac markets, most notably China onshore, are also up from worst levels.

- US cash Tsy yields have fallen as well, but so have other key yield markets. US-JP yield differentials for the 10yr tenor are little changed so far today at +265bps.

- EUR/USD has also staged an impressive rebound, from the low 1.0800 region we are back up to 1.0915/20, +0.60% from end Wednesday levels in NY. This puts us back near levels that prevailed on the 10% tariff headline from late on Wednesday, which initially buoyed risk appetite/weighed on the USD.

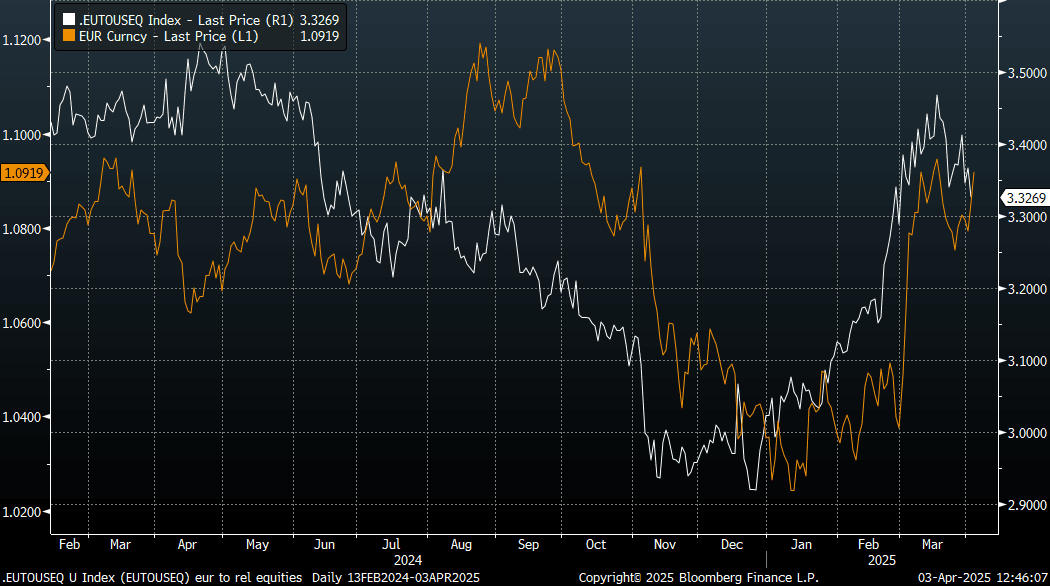

- The chart below shows EUR/USD versus the EU/US equity ratio. FX markets may be looking for more EU equity outperformance in light of the tariff announcements, particularly if more capital comes into the EU.

- EU equity futures are off -1.65%, versus Eminis -2.75% so far today. Liquidity is likely to be lighter in Asia Pac markets though. We will know more during the EU session and also get a sense of EU retaliatory measures. Japan and China responses so far have refrained from announcing any retaliatory measures.

- AUD and NZD are still down for the session, but are comfortably off earlier lows. AUD.USD last 0.6275/80, NZD/USD close to 0.5735/40.

Fig 1: EUR/USD Has Followed Relative EU/US Equity Trends In Recent Months

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Richer At Lunch Ahead Of 10Y Supply

At the Tokyo lunch break, JGB futures are stronger, +8 compared to settlement levels, after reversing overnight weakness.

- Outside of the previously outlined domestic data drop, there hasn't been much by way of domestic drivers to flag.

- “President Trump's latest criticism about a weak yen may be a good opportunity for Japan to think more seriously about how to fix the excessive depreciation of the yen, which has caused import-price inflation, says SMBC Nikko Securities strategist Makoto Noji.” (per BBG)

- Cash US tsys are 1-3bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s solid gains.

- Cash JGBs are flat to 3bps richer across benchmarks, with a flattening bias. The benchmark 10-year yield is 1.2bps lower at 1.402% ahead of today’s supply.

- This month, the 10-year auction offers an outright yield 10-15bps higher than last month but 7bps lower than its cyclical high of 1.466%. Additionally, the yield curve between 2- and 10-year bonds has steepened slightly compared to the prior month.

- Today’s auction is also likely to be supported by an improvement in sentiment toward global long-end bonds over the past two months. For instance, the US 10-year yield is roughly 65bps lower than its early January high.

- Swap rates are 1-3bps lower, with a flatter curve. Swap spreads are mostly tighter.

JGBS AUCTION: 10-Year JGB Supply Faces Higher Yield & Steeper Curve

The Japanese Ministry of Finance (MoF) will today sell Y2.6tn of 10-Year JGBs. This month, the 10-year auction offers an outright yield 10-15bps higher than last month but 7bps lower than its cyclical high of 1.466%.

- Additionally, the yield curve between 2- and 10-year bonds has steepened slightly compared to the prior month.

- Today’s auction is also likely to be supported by an improvement in sentiment toward global long-end bonds over the past two months. For instance, the US 10-year yield is roughly 65bps lower than its early January high.

- The relative affordability of 10-year JGBs versus futures— gauged by the 7- to 10-year spread — sits little changed relative to last month, after bouncing off the lower end of its range over the past year during the month.

- Amid this backdrop, it will be interesting to see if the current 10-year yield generates sufficient demand at today’s auction.

- Results are due at 0435 GMT / 1235 JT.

CHINA: Bond Futures Down as Markets Wait for NPC.

- Traditionally markets are quiet leading up to the National Party Congress and this year (despite the tariff threat impacting equity markets) bonds remain contained.

- The 10YR China bond future is trading flat today at 108.46, trending just below the 50-day EMA of 108.50 where it has been for several trading days.

- The 2YR China bond future is down by -0.03 at 102.64, trending back down towards the 200-day EMA of 102.63.

- Government bond yields are lower today with the CGB 10YR at 1.75% (-1bps).

- The CGB 10YR has traded in a tight range over the last week as bond markets await the outcome of the NPC with expectations growing for monetary policy and fiscal policy intervention to support economic growth.