EUROPEAN INFLATION: Belgium Services CPI Decelerates Materially in March Flash

Mar-28 11:46

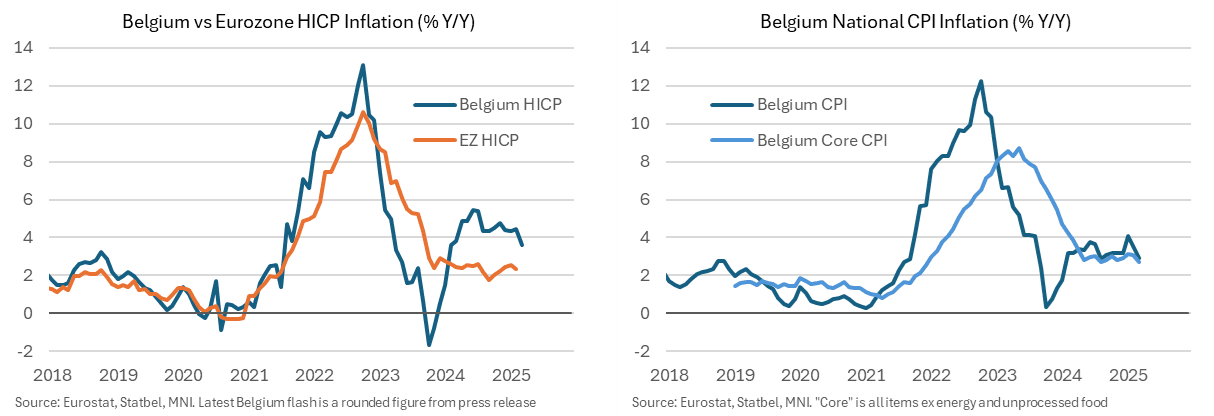

Belgian HICP inflation fell to 3.6% Y/Y in March according to the Statbel flash estimate, a 0.8pp drop from February's 4.4% and the lowest rate since February 2024. National CPI (non-HICP) inflation meanwhile also decelerated, to 2.91% from February's 3.55%.

- Sticking to the non-HICP details, core CPI (ex energy & unprocessed food) printed 2.71% Y/Y in March after 3.10% in February. This was driven by services inflation coming down to 3.88% Y/Y (from 4.34% Feb).

- Core CPI has broadly stabilized at an average 2.9% since May 2024, although on a rounded basis, this 2.7% is the joint lowest core print since Dec 2021.

- The press release notes that food (inc alcohol) inflation accelerated, as is expected for the Eurozone-wide release due Tuesday, now standing at 2.45% Y/Y vs last month's 2.22%. Energy inflation meanwhile continued its recent slowdown, to 5.48% from 8.17% in February and 15.89% in January. This means energy's contribution to headline CPI Y/Y is down to 0.59pp, from January's 1.32pp.

- For context, Belgium makes up 3.9% of the total Eurozone HICP basket in 2025.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Curve Approaches Flattest Since Dec FOMC Ahead Of Lighter Docket

Feb-26 11:46

- Treasuries have pared yesterday’s further rally since House Republicans narrowly passed a budget blueprint, moving away from recent highs that had been boosted by a disappointing consumer survey from the Conference Board.

- It’s a quieter docket today ahead of backloaded week for US data, giving greater prominence to 7Y supply (after a solid 2Y Mon and a fourth consecutive stop in the 5Y on Tue) before Nvidia results after the close.

- Cash yields are 1-3bp higher on the day, led by 5s.

- The bear flattening sees 2s10s at 19.4bps (-0.8bp) for some of its lowest levels since the Dec 18 hawkish FOMC.

- TYM5 takes the front contract with the quarterly roll well advanced, and at 110-12+ (-05+) has pulled back off yesterday’s high of 110-21.

- The bull cycle is seen remaining in play from a technical angle, with resistance at that 110-21 before 110-31 (Fibo projection of Jan 13 – Feb 7 – Feb 12 price swing).

- Data: MBA mortgage data (0700ET), New home sales Jan (1000ET)

- Fedspeak: Barkin (0830ET), Bostic (1200ET) – see STIR bullet.

- Coupon issuance: $28B 2Y FRN Note auction (1130ET), US Tsy $44B 7Y Note auction - 91282CMR9 (1300ET)

- Bill issuance: US Tsy $60B 17W bill (1130ET)

OUTLOOK: Price Signal Summary - USDJPY Bears Remain In The Driver's Seat

Feb-26 11:41

- In FX, short-term bullish conditions in EURUSD remain intact and price is trading at its recent highs. Attention is on resistance at 1.0533, the Jan 27 high and a reversal trigger. Clearance of this level would strengthen a bullish condition and pave the way for a climb towards 1.0630, the Dec 6 high. For bears, initial firm support to watch lies at 1.0401, the Feb 19 low. A breach of this support would signal a potential reversal threat.

- The trend condition in GBPUSD remains bullish and the pair is holding on to its recent gains. The latest recovery confirms a resumption of the uptrend that started Jan 13 and maintains the current sequence of higher highs and higher lows. An extension would strengthen the bullish condition and open 1.2767, the 50.0% retracement of the Sep 26 ‘24 - Jan 13 bear leg. Initial firm support to watch is 1.2528, the 50-day EMA.

- Bearish conditions in USDJPY remain in place and the pair is trading at its recent lows. A push lower on Tuesday resulted in a print below key support at 148.65, the Dec 3 ‘24 low, to strengthen the bearish condition. A clear break of this level would pave the way for an extension towards 146.95, the 61.8% retracement of the Sep 16 ‘24 - Jan 10 bull leg. On the upside, initial firm resistance to watch is 152.03, the 20-day EMA.

US TSY FUTURES: March'25/June'25 Roll Update: Winding Down

Feb-26 11:38

The latest Tsy quarterly futures from March'25 to June'25 below. Winding down after Tuesday's heavy volume, June taking lead quarterly this Friday. Current roll details:

- TUH5/TUM5 appr 111,600 from -7.5 to -7.0, -7.25 last, 85% complete

- FVH5/FVM5 appr 254,500 from -5.0 to -4.25, -4.75 last, 82% complete

- TYH5/TYM5 appr 277,500 from -1.0 to -0.25, -0.75 last, 85% complete

- UXYH5/UXYM5 appr 53,500 from 3.25 to 3.75, 3.25 last, 86% complete

- USH5/USM5 appr 95,100 from 8.0 to 9.0, 8.0 last, 78% complete

- WNH5/WNM5 appr 20,400 from 4.0 to 5.0, 4.25 last, 85% complete

- Reminder, March futures won't expire until next month: 10s, 30s and Ultras on March 20, 2s and 5s on March 31.