UK: Despite DST Concession Offer UK Set To Be Hit By US Tariffs

Since US President Donald Trump's re-election, the UK gov't has seemingly sought to act as a diplomatic bridge between the US and Europe. UK PM Sir Keir Starmer has taken a non-combative stance towards the US with regards to tariff action. Whereas the EU imposed retaliatory tariffs in March following the initial US tariffs on steel and aluminium, the UK held off. With the UK gov't talking up a potential economic agreement with the US, the Starmer gov't has been reluctant to rock the boat on the issue.

- Ahead of the 'reciprocal' tariffs to be announced by Trump this evening, the EU has said that 'all options are on the table' in terms of retaliation. In contrast, UK Education Secretary Bridget Philipson said earlier this morning, "...what business and industry wants, is to for us to maintain a calm and quite pragmatic approach during this time and not engage in a kneejerk response, because the last thing that anybody would want is a trade war with the US.”

- However, even with the supposed offer of a cut in the digital services tax (DST) for American tech giants, the US is expected to include the UK as part of the 'big bang' of tariff impositions.

- The EU's threat of hitting US services will cause concern in Westminster. The UK's trade exports to the US skew heavily in favour of services, which are not set to be part of today's announcement. The EU bringing services into the mix could risk the Trump administration imposing its own tariffs on services across the board, not just against the EU, risking a much more significant hit to the UK economy.

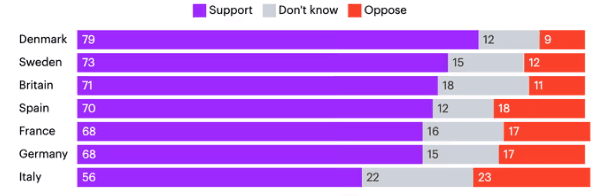

- Opinion polling shows that the UK public would be largely in favour of retaliatory tariffs (see chart below), but with the governing Labour party and main opposition Conservatives both opposed, it appears unlikely that there will be a change in tack, at least in the short term.

Chart 1. Opinion Poll, 'If the US were to place tariffs on EU* goods imported to the US, would you support or oppose the EU responding by placing tariffs on American goods imported to the EU? % *Question referred to British/UK goods in the Britain survey'

Source: YouGov, Fieldwork 6-24 March 2025

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

NORGES BANK: Maintains Banking System Reserves At Avg NOK35bln

Norges Bank will aim to maintain banking system reserves at an average of NOK35bln, with a symmetric interval of +/-NOK5bln around this level. The total reserve quota (the maximum amount of total bank reserves that bank can be renumrated at the deposit rate) is set at NOK45bln.

- Previously, if Norges Bank's foreign exchange asset portfolio increased in value, the central bank would issue debt on behalf of the Government to prevent an increase in banking system reserves.

- As of this year, the government is no longer issuing government bonds to sterilise increases in banking system reserves. As such, Norges Bank has elected to sell foreign exchange (i.e. cap the asset side of its balance sheet) to keep banking reserves contained. The mechanism by which this occurs is sketched out in the following:

- Norges Bank's foreign exchange assets increase in value. On the liability side of the balance sheet, the bank's capital increases.

- Norges Bank sells FX (i.e. purchases NOK) to cap the foreign exchange asset side of the balance sheet. On the liability side, this drains NOK central bank reserves from the system.

- Norges Bank's foreign exchange assets are now unchanged from before the increase in value. On the liability side, the proceeds from FX sales (reflected as an increase in the bank's capital) are transferred to the Government's account.

- As the Government spends this money, it will filter back into central bank reserves. At the end of the process, the asset/liability mix is unchanged.

- In March, Norges Bank will sell NOK126mln/day of FX to fund the transfer of dividends to the government (i.e. buy NOK). However, this is offset by NOK400mln/day of regular FX purchases (i.e. sell NOK) on behalf of the government to place into the Government Pension Fund Global (since petroleum revenues exceed the amount needed to finance the non-oil budget deficit). As such, net purchases of FX in March will amount to NOK274mln/day (i.e. sell NOK).

HKD: BYD Share Sale Could Raise HKD Cash Demand, Distort Fwd Market

Worth noting for HKD cash demand: China's BYD to offer 118mln shares for their Hong Kong listing (ticker is 1211 HK), seeking to raise equivalent of $5.2bln in HKD.

- Sizeable demand for securities (e.g. IPOs and other share sales) can help narrow the HKD forward discount,

which has proved sensitive in recent years to a pick-up in capital markets activity, as the uptick in cash demand in turns adds upward pressure to HIBOR. - The $5.2bln raise is of decent size - not the largest share sale in recent years, but is comfortably the biggest capital raise of 2025 so far. Adds to the expected pipeline that also includes the long-awaited Chery Automobile IPO - seen raising as much as $14bln at some point this year.

- The HKD 12m forward discount narrowed to 300 points in October last year, but has drifted since - any narrowing could prove stickier should further fundraising headlines cross in the near-term.

SECURITY: Fragmentation Of West Has Begun - Kremlin Spox Peskov

Reuters reporting comments from Kremlin spokesperson Dmitri Peskov, speaking at his daily press conference in Moscow.

- Addressing yesterday’s Ukraine summit in London, hosted by UK PM Keir Starmer, Peskov said: “Statements were made on increased funding to Ukraine – which is not aimed at peaceful settlement… it is very important that someone forces [Ukrainian President Volodymyr Zelenskyy] to change his position and seek peace.”

- Peskov declined to comment on contact between Russian President Valdimir Putin and US President Donald Trump: “There have been no additional contacts that should be made public.”

- Peskov said “any constructive initiative [to resolve the conflict] is in demand right now,” but warned, “if Russian assets are given to Kyiv there will be grave legal consequences,” noting a European proposal to use frozen Russian sovereign assets to fund Ukraine’s war effort.

- Polish Prime Minister Donald Tusk said yesterday the EU does not have a "united stance" on giving Ukraine frozen Russian assets.

- Peksov said, on Friday’s Oval Office meeting between Trump and Zelenskyy: “What happened certainly showed how difficult it will be to get onto the path of settlement on Ukraine.”

- Peskov said, “Ukraine is refusing to settle through negotiations,” adding Zelenskyy “does not want peace.”

- Peskov said the “fragmentation of the West has begun… one section of the West wants Ukraine war to continue.” He added: “Russia continues dialogue with the United States on normalising bilateral ties

- Peskov said Zelenskyy’s remarks about not ceding territory to Russia, “shows an unwillingness to accept the reality on the ground.”