STIR: Destination Remains The Same For BOC Pricing: 50bp Of Further 2025 Cuts

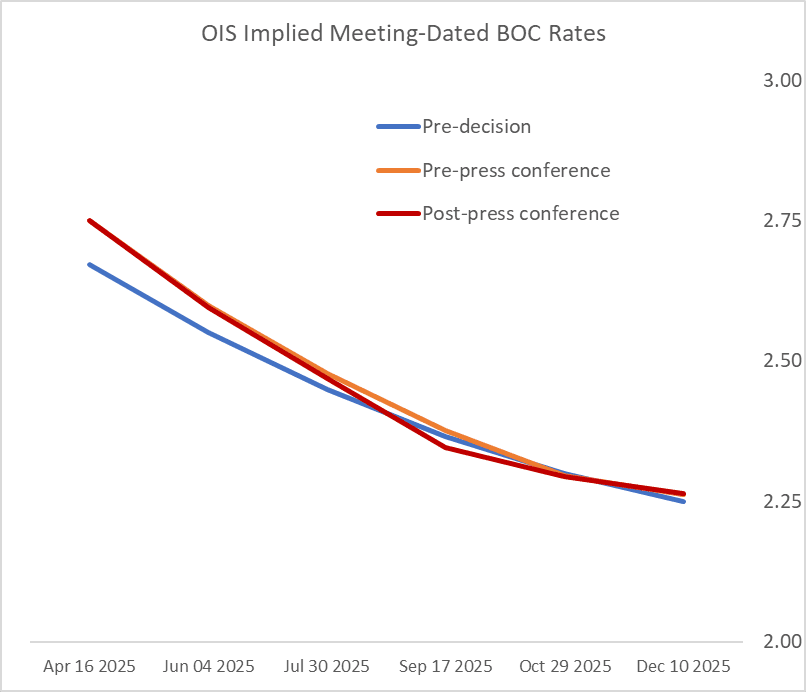

The BOC decision to hold may not have been fully priced, but the decision made almost no difference to market perceptions of the path of rates for the rest of the year - befitting the BOC's communications which revealed little new in terms of its preferences for easing at an upcoming meeting amid major tariff-related uncertainty.

- The near-dated OIS curve shifted very slightly bear flatter. In effect, there was uncertainty coming into this meeting over whether the next cut would be in April or in June, with 20bp of cuts by the latter but April as a 35% proposition.

- Following the April hold June is now seen as having a 60+% chance of a cut. But through July's meeting it's basically the same 30bp of total easing seen, with 50bp through December.

- Current OIS pricing for cumulative cuts through the next 5 meetings: 16bp (Jun), 28bp (Jul), 40bp (Sep), 46bp (Oct), 49bp (Dec).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US STOCKS: Late Equities Roundup: Oil & Estate Management Continue to Lead

- Stocks quietly extended session highs in Monday's second half, SPX eminis back to March 10 levels amid a lack of any specific headline driver as policy uncertainty over global trade remains. Currently, the DJIA trades up 467.25 points (1.13%) at 41956.15, S&P E-Minis up 58.25 points (1.02%) at 5750.75, Nasdaq up 143.4 points (0.8%) at 17898.4.\

- Energy and Real Estate sectors continued to outperform in late trade, oil and gas stocks leading gainers as crude prices rebounded (WTI +.40 at 67.58): Targa Resources +3.50%, Marathon Petroleum +3.43%, Valero Energy +3.20% and ONEOK +2.85%.

- Investment trusts and management shares buoyed the Real Estate sector: BXP +4.99%, Simon Property Group +3.20%, Iron Mountain +2.91% and Digital Realty Trust +2.67%.

- On the flipside, Consumer Discretionary and Communication Services sectors underperformed in late trade, Tesla -4.61%, Garmin -1.07%, Ulta Beauty -0.80% and Deckers Outdoor -0.60%.

- Meanwhile, interactive media and entertainment shares weighed on the Communication Services sector: Meta Platforms -0.41%, Alphabet -0.21% and Paramount Global +0.04%.

GBPUSD TECHS: Bull Cycle Remains In Play

- RES 4: 1.3175 High Oct 4 2024

- RES 3: 1.3119 76.4% retracement of the Sep 26 ‘24 - Jan 13 bear leg

- RES 2: 1.3048 High Nov 6 ‘24

- RES 1: 1.2995 High Mar 17

- PRICE: 1.2985 @ 16:25 GMT Mar 17

- SUP 1: 1.2862 Low Mar 12

- SUP 2: 1.2778 20-day EMA

- SUP 3: 1.2656 50-day EMA and a short-term pivot support

- SUP 4: 1.2556 Low Feb 28

The GBPUSD trend outlook remains bullish. Moving average studies are in a bull-mode position, highlighting a clear dominant uptrend. The pair has recently pierced a Fibonacci retracement at 1.2924, 61.8% of the Sep 26 ‘24 - Jan 13 bear leg. A clear break of this price point would open 1.3048, the Nov 6 2024 high. Initial firm support is 1.2656, the 50-day EMA.

CANADA: CPI Seen Accelerating Amidst End Of Tax Holiday Uncertainty

- Headline CPI is seen accelerating from 1.9% to 2.2% Y/Y in tomorrow’s February report, owing to a strong non-seasonally adjusted 0.6% M/M (or 0.7% M/M in the below median).

- There’s another wide range to analyst forecasts, ranging from 2.0-2.7% Y/Y in the Bloomberg survey after the 1.9% in January.

- Our review below covers 2.1-2.7%, including CIBC and JPMorgan at 2.1% and RBC at 2.5% (not in Bloomberg survey) and Scotia at 2.7%.

- This uncertainty is likely down to the ending of the GST/HST tax holiday mid-month after its two-month window started mid-Dec.

- GS on the matter: “our forecast assumes 36bp of payback following the removal of the sales tax holiday in mid-February, although we acknowledge some uncertainty around how the cumulative 56bp boost will be distributed across February and March.”

- Core CPI meanwhile (the average of CPI-median and CPI-trim), which will continue to not be directly impacted by the indirect tax changes, is seen accelerating a tenth further to 2.8% Y/Y for what would be its strongest since October.

- Three- and six-month run rates stood at 3.0% and 3.1% annualized respectively in January.

- The BoC forecast from the January MPR saw headline CPI averaging 2.1% Y/Y in Q1 (and more recently saw it at circa 2.5% specifically in March per last week’s decision statement) and core CPI averaging 2.5% Y/Y in Q1 with those core forecasts having got off to a bad start for the quarter.

- BoC-dated OIS currently has 10-11bp of cuts priced for the April BoC decision, after the Bank cut its overnight rate target by 25bps last week to 2.75% for the middle of its estimated neutral rate range of 2.25-3.25%.