STIR: Downside Growth Risks Spur Near-term Dovish Repricing In Euribor Spreads

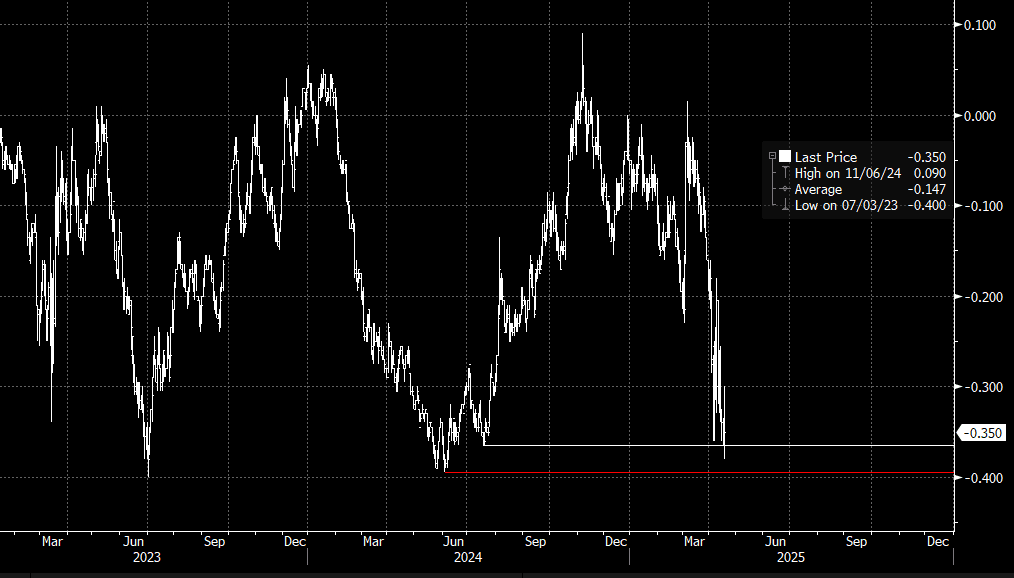

The ERM5/M6 spread pierced the July 2024 low of -36.5 ticks during the ECB’s press conference, reaching a low of -38.0 ticks. However, the spread has since steepened back to -34.5 ticks at typing, with dovish adjustments in the near-term offset by more hawkish moves further out the curve.

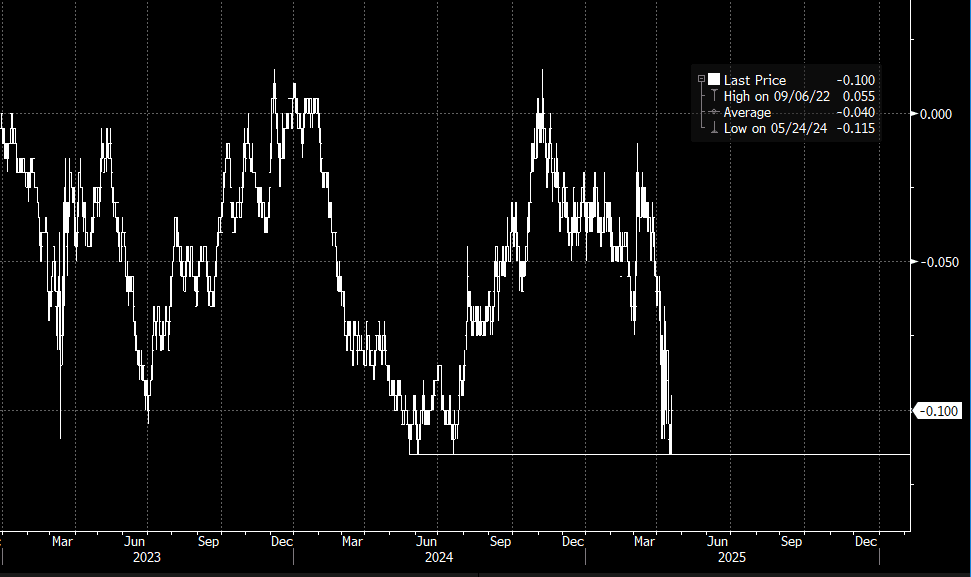

- The April 7 low in M5/U5 of -24.0 ticks was easily breached during the press conference, with President Lagarde building on the policy statement’s dovish commentary around downside growth risks. The spread is currently at -26.0 ticks.

- However, the May 2024 low of -11.5 continues to provide strong support for the U5/Z5 spread, while the lesser-traded Z5/H6 and H6/M6 spreads have moved to fresh session highs.

- Markets clearly view tariff-related growth risks as the near-term driver of ECB policy, particularly with Lagarde expressing continued confidence in the inflation outlook (bolstered by several references to the stronger EUR exchange rate since March).

- However, inflation risks may become more prevalent later in 2025/early 2026, stemming from both delayed tariff impacts and the early feedthrough of increased EU (particularly German) fiscal spending.

- ECB-dated OIS price 66bps of easing through year-end following today's 25bp cut, implying a deposit rate of ~1.59%. That's down from a ~1.70% implied deposit rate before the decision. A 25bp cut in June is ~90% implied, up from a ~70% implied probability prior.

Figure 1: ERU5/Z5 Spread

Figure 2: ERM5/M6 Spread

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US DATA: Industrial Production Jump Shows Hint Of Tariff Front-Running

Industrial production picked up strongly in February after a softer January, as a jump in manufacturing activity offset weaker utilities production.

- Overall IP rose 0.7% M/M (nearly rounding up to 0.8%) vs 0.2% expected and 0.3% in January (rev down 0.2pp), with the seasonally-adjusted index hitting an all-time high and capacity utilization reaching an 8-month high 78.2%.

- The manufacturing index rose by 0.9%, the quickest pace in 12 months, to hit a 28-month high (the release highlighted an 8.5% M/M rise in motor vehicles/parts production as driving the increase). That's vs 0.3% expected, and came with an upward revision to January (0.1% from -0.1%).

- Utilities came in on the soft side at -2.5% M/M but that's after a 6.1% rise in January (which was attributed to heating during an unusually cold month), and activity in the segment is still up 8.7% Y/Y.

- Momentum in both overall industry and manufacturing has picked up noticeably: while the Y/Y rates were up 1.4% / 0.7% respectively, the 3M/3M annualized rates came in at 5.2% / 2.8% respectively (both the fastest in 33 months).

- As such the upside breakout in production since late 2024 continues, and corresponds with ISM manufacturing returning to above-50 territory for the first two months of 2025.

- That's the good news. Whether this is the result of front-running tariffs is a major question, though, particularly given that the auto sector - one of the most vulnerable to Canada/Mexico trade disruptions - was such a major driver in the month.

- We will continue to watch forward-looking indicators, including in regional Fed surveys, PMIs, and ISMs, to see whether the post-November election bounce can be sustained: early incoming evidence is that it won't be, given sharply deteriorated sentiment.

GERMANY: Fiscal Bill Up For Vote By 14:19 GMT

The bill representing a step change to the German fiscal stance is live up for vote until 14:19 GMT in Bundestag. The bill is expected to go through after agreement with previously reluctant party "the Greens" was reached last week.

- This comes after an FDP bill proposing a 200bln increase to the defence special fund but no infrastructure debt brake softening just failed to go through in Bundestag a couple minutes ago - as expected.

EQUITIES: Fresh Selling For U.S. Equities

Equity weakness evident since the U.S. cash open, with questions surrounding the health of the U.S. economy continuing to do the rounds.

- While Treasury Secretary Bessent suggested that the U.S. economy is healthy, he also told Fox News that it would be silly to guarantee that there will not be a recession. The prevailing train of thought suggests that the Trump administration wants to get any economic pain out of the way quickly, as it looks to cut federal level spending.

- Elsewhere, Fitch were the latest to downgrade their ’25 U.S. GDP growth forecast.

- Some also point to the end of the Israel-Hamas ceasefire as a risk-negative, although this is probably at secondary factor for U.S. equities at this stage, at most.

- The tech sector feels the brunt of the move, with the NASDAQ 100 e-mini nearly 1.8% lower on the day.

- The S&P 500 e-mini is nearly 1.1% lower on the session.