EU CONSUMER CYCLICALS: L'Oréal; Tariff impact (low)

(ORFP; Aa1/AA) {OR FP Equity}

27% exposed to North America (can assume ~24% US) within with; "we produce more than half of the business in the US in the US" - L'Oréal CEO, CNBC (https://tinyurl.com/4b9cfde5).

• It will be mass-beauty (more affordable segment) heavy on local production while luxury and dermatological brands will be more likely to be coming from Europe.

• Only has 13% market share in the US - and hence (saw) opportunity for growth there.

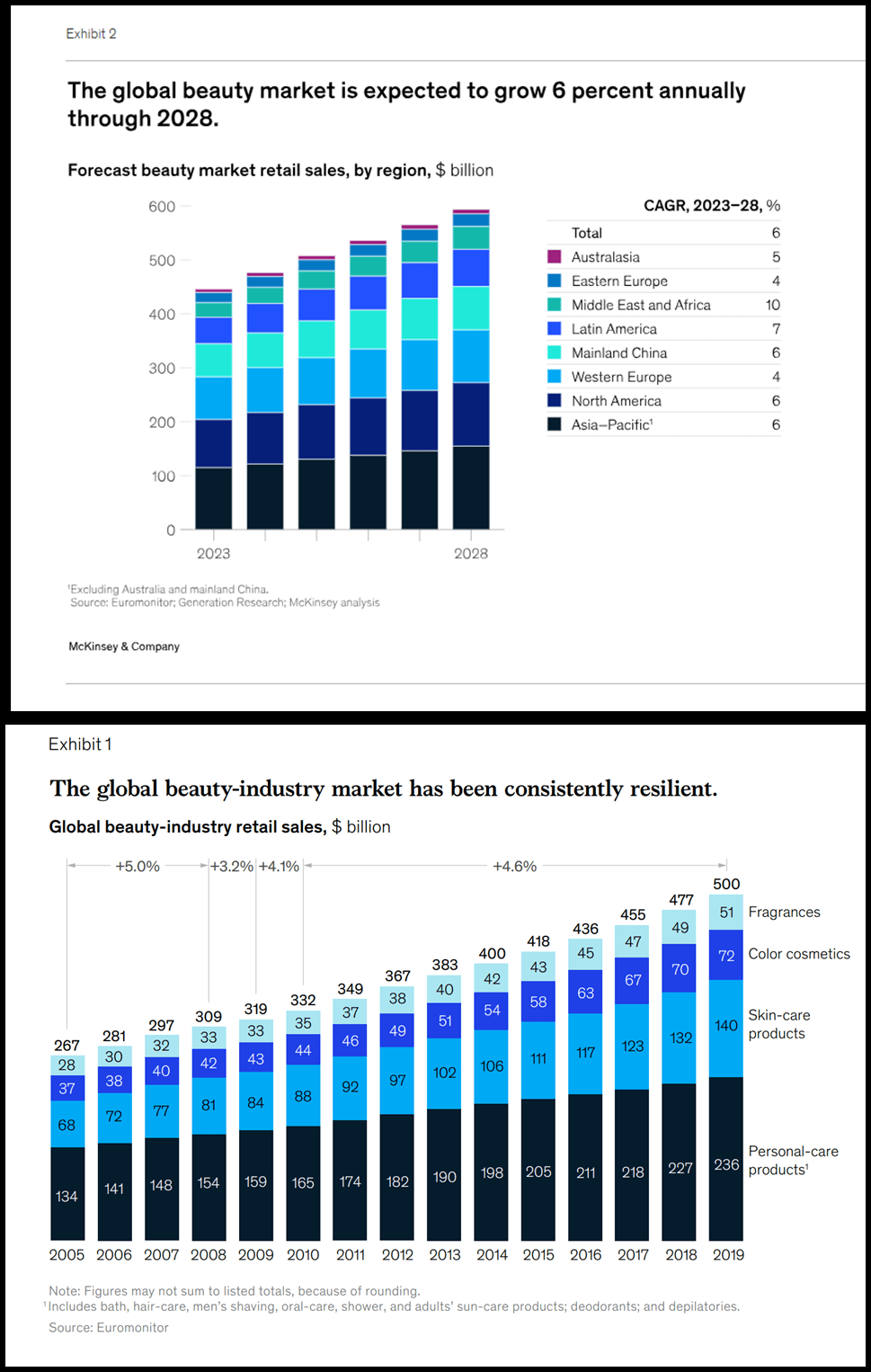

We have always had a favourable view on L'Oréal partly because it is exposed to structural growth segment - Beauty. The catalyst for that is the social media fuelled rising beauty obsession levels. L'Oréal specifically is the largest in the sector and outspends its main competitor - American Estee Lauder - by over 4x on R&D.

Equities and credit seem to agree with above - former down only 2% and trading on above 25x multiple while new €31s are -4bps tighter (!) YTD (vs. index +15). As peers sell-off on RV it will look tad unattractive - but equally we don't see the need for longer term investors to panic.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: UBS Recommend Receiving April '25 ECB OIS

Back on Friday UBS wrote that “the ECB emphasised that its monetary policy is becoming meaningfully less restrictive, but real rates will remain elevated in the year ahead so we would receive the April ’25 meeting”.

- They went on to note that “the ECB itself said that risks to economic growth remain tilted to the downside. In addition, the euro area economy will also have to digest the increase of higher sovereign and swap rates. We think that European growth could stagnate or even decelerate in 2025 if tariffs on EU exports to the U.S. materialize in early April. We still think that the market will price a terminal rate below 2% in this cycle”.

EGBS: Supported By Pullback In Risk Appetite, PGBs Underperform

A pullback in European equity futures has lent support to core EGBs this morning, though Friday’s high in Bund futures at 128.29 remains untested. Bunds are +12 ticks at 127.78 at typing, now off earlier session highs. The recovery from last Thursday’s lows in Bunds has allowed an oversold condition to unwind a little, though a bearish theme remains intact. Initial firm resistance to watch is 129.41, the Jan 14 low.

- We have highlighted several drivers for today’s risk off action: Continued US growth worry, signs of tension within German fiscal negotiated and a possible reignition of tensions between Israel and Hamas.

- German yields are 1.5-2.5bps lower, with the 10-year point underperforming a little.

- German January industrial production was stronger than expected at 2.0% M/M (vs 1.5% cons), but had little net impact. The March Eurozone Sentix investor confidence survey also exceeded forecasts at -2.9 (vs -9.3 cons, -12.7 prior). Survey data was collected between March 6 - March 8, so includes the fallout from last week's German fiscal announcement.

- 10-year EGB spreads to Bunds trade quite resiliently despite the equity selloff. PGBs underperform (10-year spread to Bunds ~1.5bps wider at ~52.5bps) amid signs the Socialists will oppose the minority government’s no-confidence vote tomorrow.

- ECB’s Nagel is scheduled to speak at 1300GMT.

EGB OPTIONS: RXJ5 126.50/125.50 Put Spread Lifted

RXJ5 126.50/125.50 put spread paper paid 18 on 10K.