NORGES BANK: MNI Norges Bank Review - March 2025: Easing Cycle Pushed Back

Mar-27 14:19

FOR THE FULL PUBLICATION PLEASE CLICK HERE

EXECUTIVE SUMMARY:

- Norges Bank held their policy rate at 4.50%, in line with consensus but against prior guidance for a 25bp cut. The recent uptick in inflationary pressures was unsurprisingly the main reason for the decision, with improved prospects for near-term activity and a lower-than-expected unemployment rate also cited.

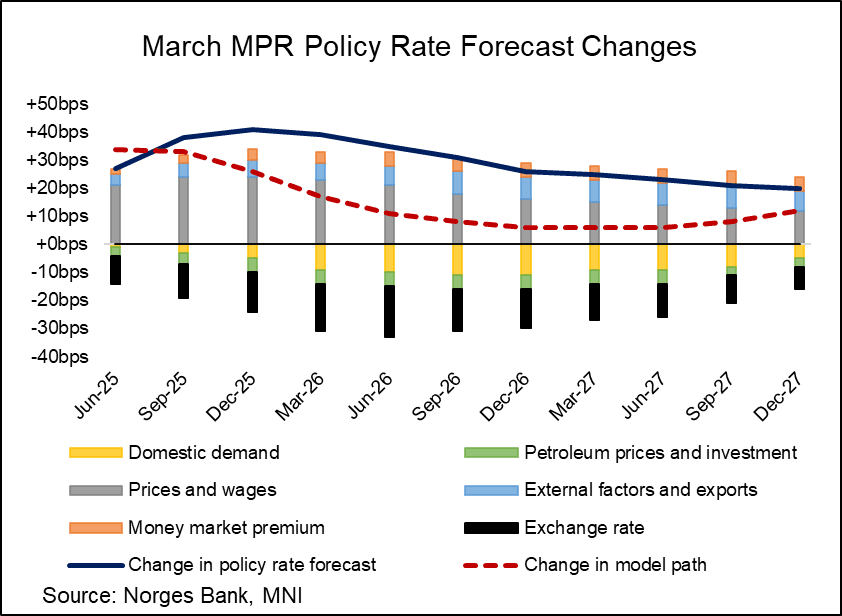

- The March MPR rate path saw an upward revision of between 25-40bps through the forecast horizon, which was broadly in line with the estimates MNI had seen ahead of the decision.

- The policy statement suggested the March rate path is consistent with 2x25bp cuts through the course of this year (i.e. a rate of 4.00%), which was re-iterated in the post-decision press conference. Notably, the policy statement does not include meeting-specific guidance.

- Uncertainty was a key theme in the policy statement and press conference. The Governor played down the decision to deviate from prior guidance, noting that the Committee always emphasises uncertainty with its future decisions.

- At the time of writing, analysts generally expect Norges Bank to deliver either one or two cuts in 2025. September appears the most favoured meeting for the start of the easing cycle, but some have highlighted risks of a move in June.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US: House To Vote On Budget Resolution At 18:30 ET 23:30 GMT

Feb-25 14:17

House Republican leadership has posted a note confirming that the House of Representatives is scheduled to vote at 18:30 ET 23:30 GMT on a budget blueprint that will underpin a multi-trillion-dollar reconciliation package.

- The vote comes as House Speaker Mike Johnson (R-LA) struggles to corral support for the blueprint. Johnson’s razor-thin one-seat majority leaves him vulnerable to both the fiscal hawks - who don’t believe Johnson’s budget does enough to address the deficit - and the moderates and frontline Republicans - who fear cuts to programmes like Medicaid, SNAP, and Pell Grants will endanger their re-election in 2026.

- As it stands, two GOP Reps are a ‘no’ on the blueprint – Rep Victoria Spartz (R-IN) and Rep Thomas Massie (R-KY). Johnson believes he can flip Spartz’s vote but Massie's voting history suggests he is likely to vote in line with his public statements. As a reminder, two dissenting GOP votes are enough to sink the budget if all Democrats are present and voting - although full Democrat attendance is not guarenteed.

- This evening's vote may determine the GOP strategy for reconciliation. A failed House vote could hand the initiative back to Senators who continue to advocate for a two-bill strategy and are on standby with an approved resolution for a narrow border security, defence, and energy package.

- CNN's Haley Talbot has a useful tracker with key votes to watch here.

- For additional analysis, see today's edition of the MNI US Daily Brief.

BUNDS: /SWAPS: Little Reaction As Political Leaders Talk Fiscal

Feb-25 14:15

No lasting reaction in German ASWs & swap spreads to a recent raft of comments from German political leaders, with a bid in wider core global FI markets underpinning bonds.

- Comments from the political sphere lean towards an extra defence spending fund being the first port of call for policymakers, in line with last night’s BBG source reports (priced into swap spreads early today before a pullback from lows).

- A reminder that suggestions are that a special defence spending fund could be tabled before the new Bundestag sits for the first time in late March, although the timeline is quite tight.

- CDU leader Merz notes that it is much too early to give any concrete details on fiscal reform, playing down the odds of a swift alteration to the debt brake. He also chooses not to confirm or deny plans for a fresh EUR200bln defence fund following the BBG report.

- CSU leader Soder pointed to support for a new special defence fund and pushed back against any suggestions of debt brake reform under the outgoing government.

- Elsewhere, Rolf Muetzenich, the head of the SPD caucus, said the party would be open to debt brake circumvention given the enormity of the security challenges Germany is facing but also made it clear that it won’t accept anything “that isn’t thought through.”

STIR: Effective Fed Funds Rate

Feb-25 14:06

- FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $292B

- Earlier Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.34% (+0.00), volume: $2.425T

- Broad General Collateral Rate (BGCR): 4.32% (+0.00), volume: $936B

- Tri-Party General Collateral Rate (TCR): 4.32% (+0.00), volume: $912B

- (rate, volume levels reflect prior session)