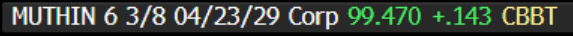

EM ASIA CREDIT: Muthoot Finance (MUTHIN, Ba2/BB+/BB) raises $250m in tap

"PRICED: Muthoot Finance $250m Tap of 2029 Note at 99.125" - BBG

Tap: $250m of 4/29

IPT: 6.812%

Final: 6.651%

Book: $740m (3x subscribed)

- Pricing after close yesterday. The Indian gold financing company, Muthoot Finance, tapped the $ 4/29 bond ($400m) for an additional $250m.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Cash Bonds Little Changed, 20Y Supply Due

In Tokyo morning trade, JGB futures are weaker, -7 compared to settlement levels, but well above overnight closing levels.

- According to MNI’s technicals team, a clear downtrend in JGB futures firmed further on the strong GDP print, with the latest fresh cycle lows reinforcing the condition. Note too that MA studies on the continuation chart are in a bear-mode setup, highlighting a clear downtrend. The 140.00 psychological handle has been pierced, and markets have shown through 139.38, a Fibonacci projection. For bulls, a reversal would open 142.73 and 144.48, the Dec 9 and Nov 11 high respectively. Gains would be considered corrective.

- “Japan will study details of US President Donald Trump’s auto tariff measures as they become clear, examine the impact on Japan and respond appropriately, Trade Minister Yoji Muto says at a regular press conference.” (per BBG)

- Cash US tsys are flat to 2bps cheaper, with a steepening bias in today’s Asia-Pac session after yesterday’s holiday.

- Cash JGBs are little changed across benchmarks. The benchmark 20-year yield is 0.3bps higher at 2.02% ahead of today’s supply.

- Swap rates are flat to 1bp lower, with swap spreads tighter.

US TSYS: Tsys Futures Edge Lower, Curve Bear-Steepens

- Tsys futures did little on Monday, with the US out for President's Day. As trading gets underway here in Asia, the long-end is underperforming, curves are bear-steepening. TU is -00⅜ at 102-24, while TY is -03+ at 109-06+

- Cash tsys yields are flat to 1.5bps higher. The 2yr is unchanged at 4.259%, while the 10yr is +1.2bps.

- Fed Governor Christopher Waller stated overnight that recent data supports holding rates steady, but if inflation moderates like in 2024, cuts could be appropriate later this year. While January’s CPI rise of 0.5% was "mildly disappointing," Waller highlighted that core PCE inflation remained around 2.6% YoY.

- He also questioned whether seasonal adjustments were inflating early-year CPI readings, echoing concerns from Philadelphia Fed President Patrick Harker. Despite economic uncertainty from new Trump administration policies, Waller cautioned against policy inaction and maintained that tariffs would have only a modest, temporary impact on prices.

- It is a rather quiet week for US data, fed fund futues are little changed so far this week, with the first cut pricing fully priced for the September meeting, with a cumulative 40bps of cuts priced by year end.

- Later today we have Empire Manufacturing and the NAHB Housing Market Index

JGB TECHS: (H5) Fresh Lows

- RES 3: 147.74 - High Jan 15 and bull trigger (cont)

- RES 2: 146.53 - High Aug 6

- RES 1: 142.73/144.48 - High Dec 9 / High Nov 11

- PRICE: 139.23 @ 15:37 GMT Feb 17

- SUP 1: 139.22 - Low Feb 17

- SUP 2: 138.87 - 3.000 proj of the Aug 6 - Sep 3 - 9 price swing

- SUP 3: 138.52 - 1.0% 10-dma envelope

A clear downtrend in JGB futures firmed further on the strong GDP print, with the latest fresh cycle lows reinforcing the condition. Note too that MA studies on the continuation chart are in a bear-mode setup, highlighting a clear downtrend. The 140.00 psychological handle has been pierced and markets have shown through 139.38, a Fibonacci projection. For bulls, a reversal would open 142.73 and 144.48, the Dec 9 and Nov 11 high respectively. Gains would be considered corrective.