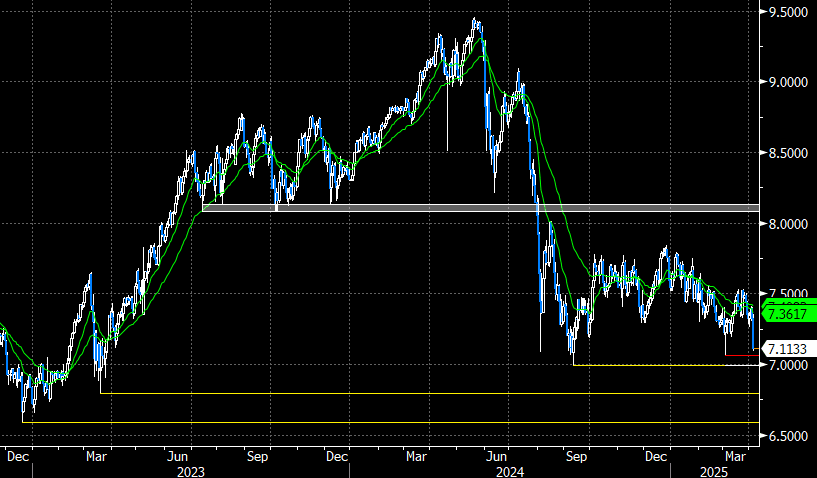

MEXICO: MXNJPY Session Declines Reach 3% Once More

- A resumption of weakness for major US equity indices after the cash open keeps the Mexican peso under pressure, as USDMXN hovers just below the pre-Liberation Day announcement around 20.4750. We have highlighted that key short-term resistance has been defined at 20.5425, the Apr 1 high. Clearance of this level would instead highlight a bullish development and open 20.9982, the Mar 4 high.

- Standing out on Friday is the 3% weakness for MXNJPY, which now reapproaches the prior session lows of 7.0918. The cross has substantially narrowed the gap to the blowout March low, located at 7.0651. A breach of this level would place renewed focus on the 2024 low at 6.9908.

- Below here, medium term targets for a more protracted move lower come in at 6.7911 and 6.5885.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CANADA DATA: Canadian Labor Productivity in Q4 Shows Fastest Growth In A Year

- Canadian businesses Q4 labor productivity +0.6%, the highest in a year.

- For 2024, +0.6% after three years of decline.

- Business output doubled in Q4 +0.8% QOQ driven by service sector. Hours worked +0.2%, half the rate of Q3.

- YOY productivity in Q4 +0.8%.

SCHATZ TECHS: (M5) Gap Lower Highlights A Bearish Threat

- RES 4: 107.120 High Mar 4 and key resistance

- RES 3: 107.000 Round number resistance

- RES 2: 106.905 Intraday high

- RES 1: 106.735 Low Feb 19 and a recent breakout level

- PRICE: 106.730 @ 13:34 GMT Mar 5

- SUP 1: 106.685 Intraday low

- SUP 2: 106.644 123.6% retracement proj of the Feb 19 - Mar 4

- SUP 3: 106.600 Round number support

- SUP 4: 106.542 138.2% retracement proj of the Feb 19 - Mar 4

Schatz futures gapped lower today and the subsequent impulsive intraday sell-off, highlights a bear threat. The move down also undermines a recent bullish theme. The contract has breached a key support at 106.735, the Feb 19 low. Clearance of this level strengthens a bearish theme and signals scope for a deeper sell-off, towards 106.644 next, a Fibonacci retracement. Key short-term resistance has been defined at 107.120, the Mar 4 high.

ITALY DATA: Decent Upward Revision To Q4 GDP, GFCF Growth Solid

Italian Q4 GDP saw quite a notable upward revision to 0.14% Q/Q (to 2dp) from a -0.01% flash reading. This was likely a driving force behind the upward revision to the Eurozone-wide quarterly print (0.1% Q/Q vs 0.0% flash on a rounded basis) in the second release last month.

Looking at the expenditure-level details of the print, which are not available in the flash release:

- Consumption grew 0.2% Q/Q (vs 0.6% prior), contributing 0.11pp to the quarterly GDP print. However, January real retail sales (also released this morning) began the year on a soft note, falling 0.6% M/M SA.

- Government spending growth was 0.2% Q/Q (vs 0.3% prior), contributing 0.03pp to quarterly GDP.

- Gross fixed capital investment was the largest contributor to GDP (0.36pp to the quarterly reading), growing 1.6% Q/Q (the first positive sequential reading since Q4 2023). This was driven by “other buildings and structures” and “Machinery and equipment and weapon systems” components, with dwelling instead dragging.

- Net exports contributed 0.05pp, with export growth at -0.2% Q/Q and imports at -0.4% Q/Q. Export growth has been weak for some time, amid subdued conditions in major trading partners such as Germany.

- Inventory investment was a negative contributor, pulling quarterly growth down by 0.42pp.