AUSTRALIA DATA: Positive Momentum In New Dwelling Approvals

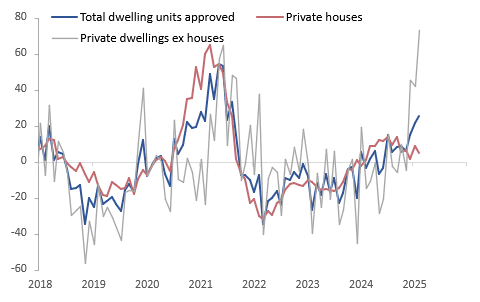

There was a small payback in February for the sharp rise in non-house building approvals over December/January but looking through the volatility the total number is trending robustly higher. While it fell 0.3% m/m in February, less than expected, it was up 25.7% y/y after 21.6% and 3-month annualised momentum continues to run just under 30%. There has been a significant demand/supply imbalance in Australian housing and the positive trend in building approvals is welcome news.

- Private house approvals rose 1.0% m/m in February, the second consecutive rise after a weak Q4, which was driven by NSW (+5.1% m/m). They are 5.2% higher than a year ago but still down 3% on September 2024.

- Recent strength has been in multi-dwelling approvals which posted double-digit monthly increases over December/January. There was only a small decline of 1.5% m/m in February and they are running 73% above a year ago, the fastest rate since June 2012.

- The value of total residential building rose 5% m/m to a new record high level, due to a 5.8% increase in new building while alterations fell 0.3% m/m.

Australia number of dwelling building approvals y/y%

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA: ASEAN Manufacturing Improves Driven By Stronger Orders & Output

February S&P Global manufacturing PMIs across the Asian region improved despite heightened global uncertainty around US trade policy. The ASEAN PMI rose to 51.5 from 50.4, signalling the fastest pace of growth in the sector since July 2024 driven by output and new orders, which supported job creation and improved business sentiment. The rise was predominantly driven by Indonesia but all countries saw an increase in the PMI except the Philippines, even if some are still recording a contraction in activity. Price & cost pressures remained subdued and were little changed.

- Indonesia outperformed the rest of ASEAN with the manufacturing PMI rising to 53.6 from 51.9, the highest since March last year. It has posted improvements for four straight months. A pickup in new orders (highest growth since March 2024) drove increases in output, hiring and purchasing as well as the most optimistic business confidence in almost three years. The improvement in orders was due to domestic demand as export orders fell slightly.

- The weak currency added to cost pressures from raw materials and other input costs. Producer selling price inflation though was subdued and at its slowest in four months.

- Thailand’s manufacturing activity growth returned to positive territory with the PMI rising to 50.6 from 49.6 in January due to a recovery in output. The index has averaged around the breakeven-50 mark over the last 6 months. Orders and employment levels were steady but productivity advances were cited. There were slight reductions in cost and selling price inflation in February.

- The Philippines outperformed ASEAN in H2 2024 but is seeing slower growth in the sector in Q1 2025 with the PMI dropping to 51.0 from 52.3 driven by slower output and orders growth with overseas demand also softer. Inflation trends also moderated.

ASEAN S&P Global manufacturing PMIs

CHINA: USD/CNY Fixing Steady, Fixing Error Steady (amended)

The USD/CNY fix printed at 7.1745, versus a BBG market consensus of 7.2859.

- Today's fixing outcome is little changed versus Friday's outcome. The fixing error re-widened to -1114pips.

- The fixing error has taken the bulk of the USD gains in terms of the higher market fixing estimate today.

- The authorities appear to be willing to continue to support the domestic economy with the regulator will boost availability of financing channels for private and small firms. al

- USD/CNH is down slightly so far today, last around 7.2894/99. CNH was steady prior to the fixing whilst regional peers weakened.

MNI: CHINA PBOC CONDUCTS CNY97 BLN VIA 7-DAY REVERSE REPO MON

- CHINA PBOC CONDUCTS CNY97 BLN VIA 7-DAY REVERSE REPO MON