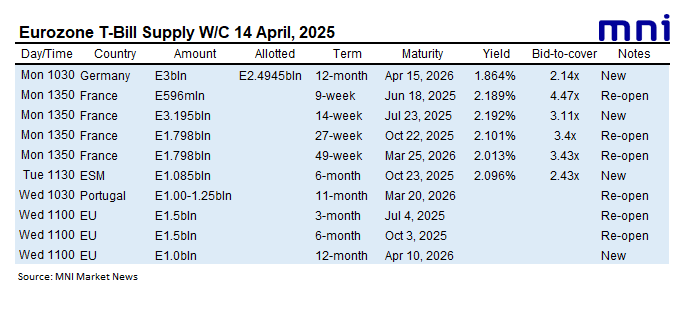

EUROZONE T-BILL ISSUANCE: W/C April 14, 2025

Portugal and the EU are still due to sell bills this week, while Germany, France and the ESM have already come to the market. We expect issuance to be E16.2bln, down from E30.8bln last week.

- Today, Portugal will sell E1.00-1.25bln of the 11-month Mar 20, 2026 BT.

- Finally today, the EU will sell up to E1.5bln of the 3-month Jul 4, 2025 EU-bill, up to E1.5bln of the 6-month Oct 3, 2025 EU-bill and up to E1.0bln of the 12-month Apr 10, 2026 EU-bill.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA STOCKS: Strong Day on China Stimulus

The China stimulus news has given equity markets in the region a boost, with most in the green today.

- The Hang Seng has led the day for China’s key bourses up +1.05% with Shanghai up just +0.17% whilst the CSI 300 is down -0.22% and Shenzhen flat.

- In Korea the KOSPI having a very strong day after a slow end the last week and is up +1.50% today, making it one of the best regional performers.

- Malaysia’s FTSE KLCI continues its recent good run, rising +1.13%.

- Indonesia’s Jakarta Composite remains in a challenging period, having finished the end of last week with heavy losses, is weak again today down -1.00% one of the worst regional performers.

- Other key indices are positive with the FTSE Straits Times of Singapore +0.66% and Philippines +0.66%

- India’s NIFTY 50 is opening in positive territory also, up +0.35% in early trading.

OIL: Crude Higher Boosted By Geopolitical Tensions & China Stimulus Hopes

Oil prices are off their intraday highs but are still moderately stronger on the session. They were boosted early in trading by news of intensive US strikes against Houthi positions in Yemen due to the resumption of their targeting of vessels in the Red Sea. WTI is 0.7% higher at $67.68/bbl after a peak of $68.37 where it found resistance (initial resistance at $68.36). Brent is up 0.7% to $71.10/bbl following a high of $71.80, still below resistance at $71.92. The USD index is little changed.

- There is significant uncertainty around both the demand and supply outlooks for oil with tariffs likely to weigh on the former and higher OPEC and US output increasing the latter. The degree additional supply will be offset by tighter sanctions on Iran and Russia is not yet known.

- Goldman Sachs has reduced its Brent forecast by $5 to $71/bbl for December 2025 for these reasons, according to Bloomberg. It expects Brent to trade between $65 and $80 and average $68 in 2026.

- China’s activity data for February was mixed but IP, investment and retail sales printed better than expected. Plans to stimulate consumption and stabilise the troubled property market have helped to support oil prices.

- The outlook for Russian sanctions is also unclear with talks regarding a ceasefire in Ukraine ongoing. US President Trump is due to speak to Russian President Putin on Tuesday.

- Later US March Empire manufacturing and February retail sales print. ECB President Lagarde appears.

JGBS: Twist-Steepener Ahead Of US Retail Sales, BoJ Decision On Wednesday

JGB futures are stronger, +16 compared to settlement levels, but off the session’s best level.

- The local data calendar has been empty today.

- The market’s focus is on Wednesday’s BoJ decision. The BoJ is widely expected to maintain its policy rate at 0.50%. The BoJ’s January rate hike marked a significant policy shift, bringing short-term rates to levels unseen since 2008. However, policymakers do not appear to see an urgent need for another increase at the March meeting.

- Market expectations point to a gradual path toward policy normalisation. The BoJ is projected to raise its policy rate to 0.75% by July or September and to reach 1.0% by the first quarter of 2026.

- Cash US tsys are flat to 1bp richer in today’s Asia-Pac session after Friday’s modest sell-off. The Fed remains in Blackout until after Wednesday's FOMC policy announcement. Monday's US data highlight is Retail Sales.

- Cash JGBs are 2bps richer to 7bps cheaper across benchmarks, with a steepening bias. The benchmark 10-year yield is 0.2bps higher at 1.518% versus the cycle high of 1.58%.

- Swap rates are 1bp lower to 3bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see the Tertiary Industry Index and Tokyo Condominiums for Sale data alongside 1-year note supply.