THAILAND: Export Growth Rises As Thailand Negotiates With Major Partner The US

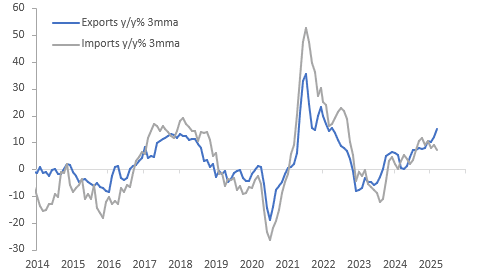

The Thai customs trade surplus narrowed more than expected in March to $973mn following $1988mn. This was despite stronger-than-expected export growth up to 17.8% y/y from 14% but imports also rose more than forecast at 10.2% y/y after 4.0% in February. The Commerce Ministry said that export growth may ease in April due to tariff worries.

Thailand customs exports vs imports y/y% 3-mth ma

Source: MNI - Market News/LSEG

- Q1 customs export growth picked up to 15.1% y/y from 10.5% in Q4, while imports slowed to 7.3% y/y from 10.5%.

- Thailand chose not to retaliate to the proposed 36% US tariff and talks are ongoing although they stalled at the start of the week. Thailand said today that it would be stricter with its certificate of origin and it has proposed to increase its imports of US commodities and reduce its own trade taxes, but the US also wants it to address baht manipulation.

- The Thai government has estimated that the US duty could reduce growth by 1pp in 2025.

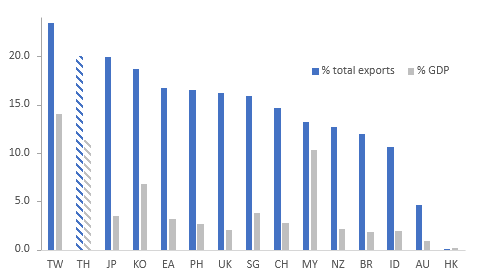

- Thailand’s economy is highly exposed to the US with 20% of its 2024 exports going there worth 11.4% of its GDP, only second to Taiwan in the region. Its exposure to China is a lot less but not immaterial at 12.7% of exports worth 7.2% of GDP and so its already subdued GDP growth could be impacted directly and indirectly from US trade policy.

- In Q1 Thailand ran a surplus with the US of $10.74bn but a deficit with China of $13.96bn.

- The baht has weakened against the greenback today with USDTHB up 0.4% to 33.57 after a low of 33.46 earlier in the session, as the USD is off its intraday low. The pair is still down 1.0% this month though and 4% since the April 9 peak of 34.98.

Merchandise exports to the US 2024 %

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD: Gold Snaps Three Days of Losses as Prices Jump

- Markets appear to be adjusting on the idea that the next round of tariffs from the Trump administration may not be as harsh as the first.

- It now appears a more targeted approach may be coming with the President suggesting that he may give a lot of countries a ‘break on levies.’

- If gold's price action as a safe haven investment is anything to go by, the risk of tariffs and the ensuing trade war has seen a 15% gain year to date.

- Gold opened at US$3,011.04 and despite a lackluster start to the day, bounced in afternoon trade to reach $3016.00

- Gold remains trading above all major technical moving averages with the closest being the 20-day EMA at 2,969.25.

- All key moving averages remain upward sloping, a sign that the bullish sentiment still has some momentum.

GLOBAL MACRO: Global Inflation Pressures Contained As Uncertainty Rises

G20 inflation moderated around 2pp over the 12months to January and it now stands at 4.8%. Concerns are growing over the inflationary impact of US tariffs but that remains highly uncertain as it is not yet clear whether they will be imposed broadly across countries and sectors, size of second round effects and what retaliation there will be. Developments in other global prices so far this year are mixed but are unlikely to cause concern.

- The NY Fed’s global supply chain pressure index has been fairly stable since mid-2024. It rose slightly in February but remained marginally negative signalling that supply chain pressures are close to neutral. However, it is no longer putting downward pressure on global inflation.

- Shipping rates have been mixed in March with the Baltic Freight Index sharply higher, which may reflect contract renewals, but still down 30.5%y/y but the FBX global container index is significantly weaker and down 22.9% y/y with rates from China to both the Mediterranean and North American east coast lower.

G20 CPI y/y% vs container rate

- After a prolonged period of deflation, the annual rate in FAO food prices turned positive in September and has trended higher since. In February, it rose 1.6% m/m and 8.2% y/y, highest since August 2022. The monthly increase was broad-based but annual strength is concentrated in dairy and oils. Cereals rose 0.7% m/m but were still down 1.1% y/y in February and they could fall in March with rice prices down on the month. They are down around 25% y/y helping to reduce Asian headline inflation.

- Industrial commodities are mixed with metal prices higher rising 3.4% m/m in March to be up 12% y/y but iron ore down 4.2% m/m and 6% y/y. After being weak for some time, wool is recovering up 3.1% m/m, sixth straight rise, to be up 7% y/y, but remains well below pre-Covid levels.

G20 CPI y/y% vs food & oil prices

Source: MNI - Market News/Refinitiv

BONDS: NZGBS: Closed Little Changed After Reversing Early Weakness

NZGBs closed on a strong note, reversing the negative spillover from yesterday’s heavy NY session for US tsys. NZ yields finished flat to 1bp richer after being 4bps cheaper across benchmarks early. NZ-US 10-year yield differential finished 5bps lower at +21bps.

- The local calendar was empty today and will remain so until Friday’s release of ANZ Consumer Confidence and Filled Jobs data.

- Cash US tsys are slightly richer in today's Asia-Pac session after yesterday's heavy session. Today’s US calendar will see Philadelphia Fed Non-Manufacturing, Richmond Fed Mfg, House Prices, New Home Sales and Building Permits data, as well as, Fedspeak from Kugler and Williams.

- Swap rates closed 1bp lower.

- RBNZ dated OIS pricing closed flat to 3bps firmer across meetings, with late 2025 / early 2026 leading. 24bps of easing is priced for April, with a cumulative 65bps by November 2025.

- On Thursday, the NZ Treasury plans to sell NZ$250mn of the 3.00% Apr-29 bond, NZ$200mn of the 4.25% May-36 bond and NZ$50mn of the 5.00% May-54 bond.