THB: USD/THB Slumps To Multi Month Lows As Onshore Mkt Return

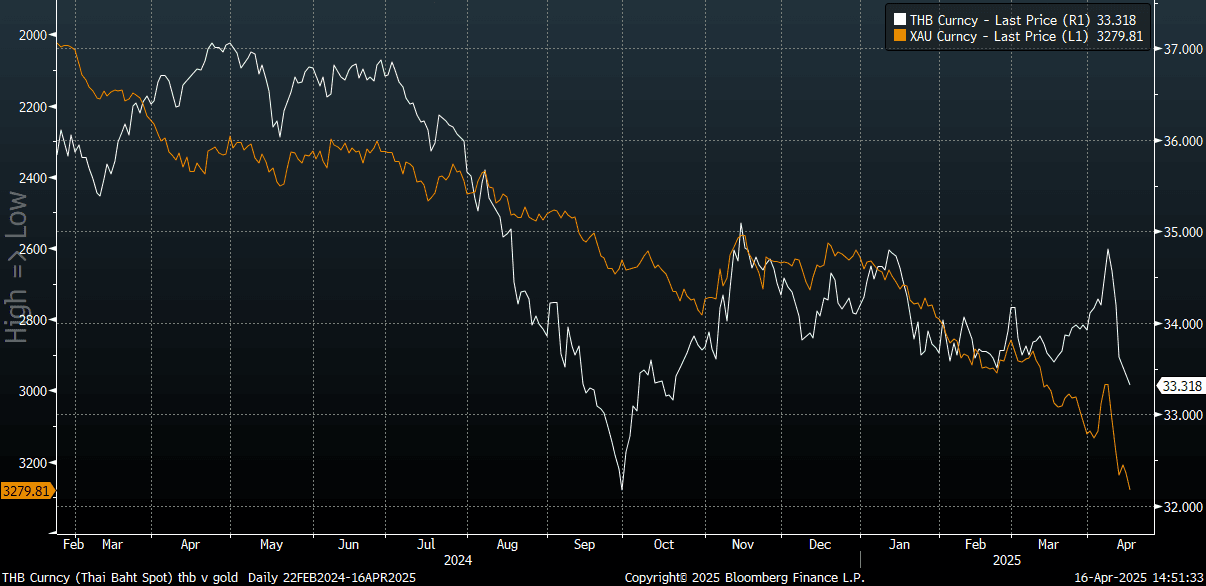

After being out for the first two session this week, Thailand markets have returned today and USD/THB is sharply lower, last near 33.30/35 (+0.95% in baht terms of the session). Catch up with broader USD softness is a likely driver, although current BBDXY levels are only marginally below end levels from the US last week. Cross asset trends, particularly in terms of gold, are also helping, see the chart below (note the gold price, in orange is inverted on the figure).

- Current levels for USD/THB are fresh lows back to October last year. There doesn't appear much in the way of further support levels until the low 33.00 region. On the topside, key EMAs are near 34.00, but before that March lows around 33.55 may act as a resistance point.

- Local equities are struggling for meaningful upside today, but are above recent lows. Offshore investors have mostly remained net sellers of local equities, albeit not in the same aggregate size as other markets within the region. Bond flows have remained positive though.

- The local data calendar is quiet into the end of this week. Focus will rest on how Thailand officials navigate trade negotiations with the US. Officials are expected to meet US trade officials in Washington next Monday. Earlier headlines noted that Thailand has already agreed to raise energy imports from the US.

Fig 1: USD/THB Spot & Gold Price (Inverted)

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD: Unable to Hold at New Highs.

- Gold opened Monday strongly initially touching $2,994.20 before lower at $2,987.25

- The Belgian government is considering the sale of a portion of its gold reserves (valued at €20bn) to bolster its defense budget, according to L’Echo newspaper.

- Ramelius Resources Ltd. will acquire Spartan Resources Ltd. in a deal valuing the latter at A$2.4 billion with the combined entity expected to become a leading Australian gold producer, with output exceeding 500,000 ounces a year by 2030.

- The relentless demand for gold ETF’s in India continued in February with net inflows of US$260m. Whilst down from January it still represented the second highest total since records began.

- Gold finished Friday at US$2,984.16 up +2.5% for the week.

- Having reached a new high, trading through $3,000 briefly, gold’s retreat looks driven by profit taking rather than a change in its fortunes. .

- Many strategists have revisited their gold forecasts for 2025 with some suggesting $3,500 as their target.

AUSSIE BONDS: Subdued Session Ahead Of US Retail Sales, Jobs Data On Thursday

ACGBs (YM flat & XM +1.0) are little changed.

- Today, the local calendar has been empty. The next event on the local calendar is Sarah Hunter's, Assistant Governor (Economic) speech at the AFR Banking Summit tomorrow.

- However, the highlight of the week is likely to be Thursday’s jobs data for February. Jobs have consistently printed stronger than expected with January up 44k. Bloomberg consensus is forecasting a 30k rise in new jobs with the unemployment rate stable at 4.1% and the participation rate at 67.3%. It will also be important to monitor the underemployment, youth unemployment and hours worked. The RBA said that the strong labour market would have been the key reason to leave policy on hold in February.

- Cash US tsys are flat to 1bp richer in today’s Asia-Pac session after Friday’s modest sell-off.

- Cash ACGBs are 1bp richer, with the AU-US 10-year yield differential at +10bps.

- Swap rates are flat.

- The bills strip is modestly weaker, with pricing -1 to -2.

- RBA-dated OIS pricing is flat to 4bps firmer across meetings today. A 25bp rate cut in April is given a 7% probability, with a cumulative 65bps of easing priced by year-end (based on an effective cash rate of 4.09%).

US TSYS: Futures Give Early Strength Ahead Of Retail Sales

In today's Asia-Pac session, TYM5 is 110-20+, unchanged from closing levels, after giving up early strength. Today's high has so far been 110-26.

- According to MNI’s technical team, initial technical support is at 110-12.5/110-00 (Low Mar 6 / High Feb 7).

- Cash US tsys are flat to 1bp richer in today’s Asia-Pac session after Friday’s modest sell-off. Cash tsys finished Friday weaker amid a cautious rise in risk sentiment, with the 2-year yield 6bps higher at 4.02% and the 10-year 4bps higher at 4.31%.

- Fed remains in Blackout until after Wednesday's FOMC policy announcement. Monday's US data focus is on Retail Sales, Empire Manufacturing and NAHB Housing Market Index measures.