EM LATAM CREDIT: MNI EM Credit Market Wrap - LATAM (03 Apr)

Source: BBG

Measure Level Δ DoD

5yr UST 3.73% -15bp

10yr UST 4.03% -10bp

5s-10s UST 29.7 +6bp

WTI Crude 66.7 -5.1

Gold 3115 -19.1

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 1050bp +48bp

BRAZIL 6 1/8 03/15/34 288bp +15bp

BRAZIL 7 1/8 05/13/54 380bp +12bp

COLOM 8 11/14/35 422bp +20bp

COLOM 8 3/8 11/07/54 505bp +18bp

ELSALV 7.65 06/15/35 524bp +31bp

MEX 6 7/8 05/13/37 287bp +9bp

MEX 7 3/8 05/13/55 348bp +7bp

CHILE 5.65 01/13/37 171bp +9bp

PANAMA 6.4 02/14/35 355bp +18bp

CSNABZ 5 7/8 04/08/32 617bp +41bp

MRFGBZ 3.95 01/29/31 343bp +23bp

PEMEX 7.69 01/23/50 696bp +31bp

CDEL 6.33 01/13/35 229bp +13bp

SUZANO 3 1/8 01/15/32 232bp +19bp

FX Level Δ DoD

USDBRL 5.63 -0.03

USDCLP 949.68 -5.22

USDMXN 19.9 -0.26

USDCOP 4155.54 +0.33

USDPEN 3.67 -0.00

CDS Level Δ DoD

Mexico 140 5

Brazil 190 5

Colombia 236 13

Chile 64 5

CDX EM 96.78 (0.50)

CDX EM IG 100.28 (0.34)

CDX EM HY 91.13 (0.76)

Main stories recap:

· Concerns about the economic consequences of US tariffs led a melt down in global equities and a flight to quality with US Treasuries as much as 15 bps lower in yield earlier in the day.

· More defensive names were quoted 20bps wider in CEEMEA and LATAM. Some African sovereign spreads were 65-130 bps wider, and a similar pattern could be seen in high yield LATAM bonds.

· Argentina sovereign bonds widened 40 bps while quasi sov YPF widened 20 bps. High yield Brazil names like BRASKM and CSNABZ moved out 40-50 bps.

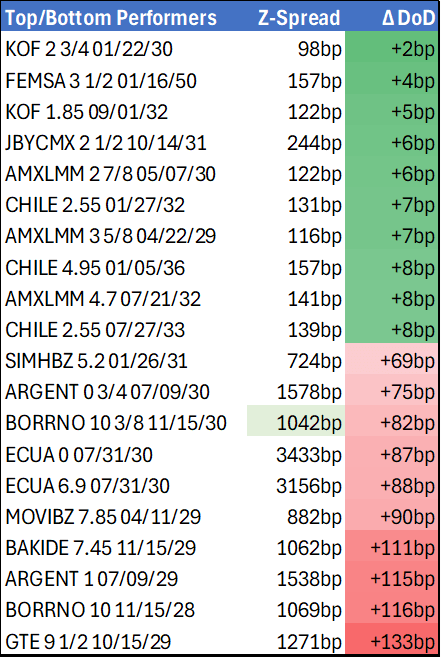

· Worst performers were less liquid high yield corporate bond names like Bakide and MOVIBZ that were down 2-3 points, translating into a widening of 90-110bps.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ECB: Macro Since Last Decision: Growth - Firmer Mfg PMI Vs Softer Services [2/2]

- More timely PMIs showed improved manufacturing sentiment but a moderation in services, which could threaten the ECB’s current forecast for real GDP growth to 0.3% Q/Q in 1Q25. Germany and France continue to lag.

- Specifically, the final Eurozone manufacturing PMI saw a 0.3pp upward revision to 47.6 in February to extend its modest climb from 46.6 in January. It’s the highest in two years but has been in contractionary sub-50 territory since June 2022.

- From the report "Factory production came close to stabilising, with reductions in new orders – both total and from abroad - at their softest in nearly three years". Notably, "Eurozone factories continued to cut their workforces, however. The rate of job shedding even accelerated, reaching its most substantial in four-and-a-half years".

- Final service PMIs for February are published tomorrow (Mar 5) but the flash saw service activity weaker than expected at 50.7 after 51.3 in January.

ECB: Macro Since Last Decision: Growth - Q4 GDP Disappoints [1/2]

- The advance and preliminary Q4 GDP releases in the intermeeting period saw real GDP growth initially miss already weak analyst forecasts of 0.1% Q/Q with 0.0% before being revised back to that 0.1% (0.05% unrounded).

- Regardless, it was a sharp pullback from a solid 0.4% in Q3 and underwhelmed relative to the 0.2% the ECB forecast in its December projection round.

- It was the softest sequential quarter of 2024 whilst the Y/Y rate levelled out at 0.9% Y/Y as its acceleration from 0.0% Y/Y back in 3Q23 stalled. The final Q4 release lands the day after the ECB decision.

- Real productivity per employee meanwhile fell 0.1% Q/Q in Q4 after three consecutive positive readings. It meant productivity rose 0.2% Y/Y after 0.0% in Q3 for the highest since Dec 2022, but this was still below the ECB's December MPR projection of 0.5%.

- A cyclical recovery in productivity growth is key to the ECB's projection for a rebound in economic activity. Although the declining trend in productivity growth appears to have been arrested over the past few quarters, evidence of an upswing is still lacking.

USDCAD TECHS: Bull Cycle Extends

- RES 4: 1.4793 High Feb 3 and key resistance

- RES 3: 1.4700 Round number resistance

- RES 2: 1.4641 76.4% retracement of the Feb 3 - 14 bear leg

- RES 1: 1.4548 61.8% retracement of the Feb 3 - 14 bear leg

- PRICE: 1.4513 @ 16:33 GMT Mar 4

- SUP 1: 1.4370/4296 Low Mar 3 / 50-day EMA

- SUP 2: 1.4151/4107 Low Feb 14 / 50.0% of Sep 25 - Feb 3 bull run

- SUP 3: 1.4011 Low Dec 5 ‘24

- SUP 4: 1.3944 61.8% retracement of the Sep 25 ‘24 - Feb 3 bull cycle

The USDCAD correction / bull cycle that started Feb 14 remains in play for now and the pair is holding on to its recent gains. Monday’s gains reinforce current conditions and sights are on a climb towards 1.4548, a Fibonacci retracement point. The short-term bear trigger has been defined at 1.4151, the Feb 14 low. Initial firm support to watch lies at 1.4296, the 50-day EMA. A break of this average would highlight an early reversal signal.