EM ASIA CREDIT: MNI EM Credit Spread Moves - Asia

- We have witnessed a week full of calamity, with U.S. efforts to rebalance trade through large reciprocal tariffs raising fears of a global recession, which were not present a few weeks earlier. Tariffs have since been largely paused, except for China, but sovereigns will now tread more carefully and may seek to reduce trade risks with the U.S. going forward, regardless of any negotiated settlement.

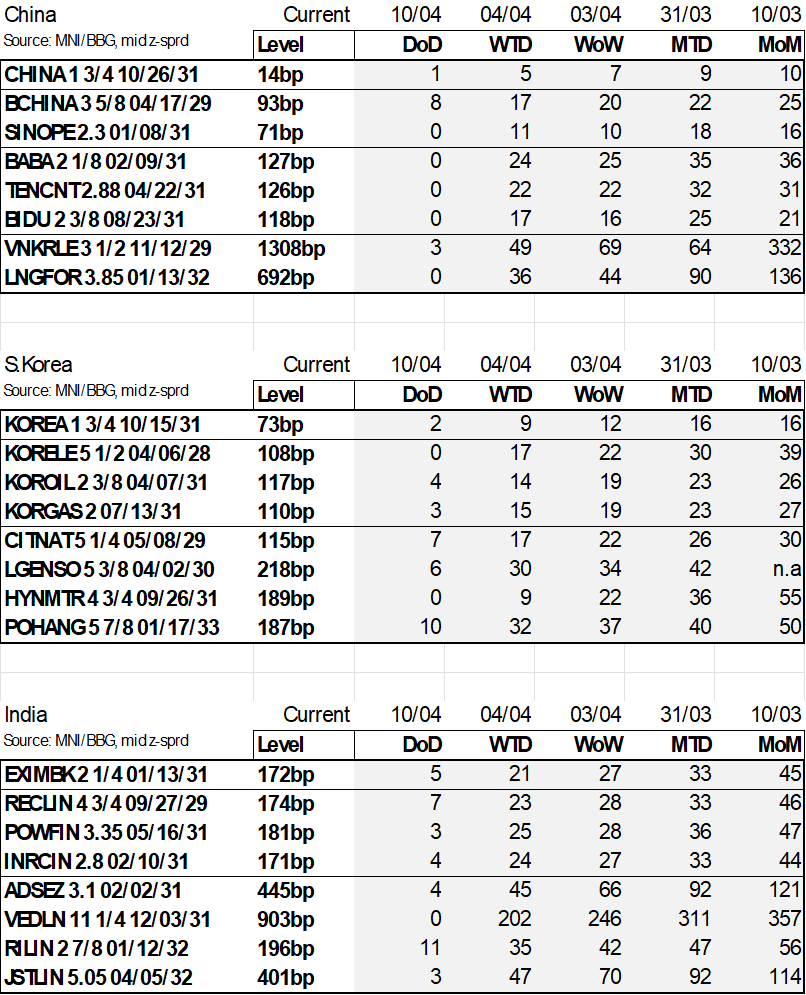

- In the table below we look at how USD denominated bond spreads have performed across corporate names as well as sovereign benchmarks for China, South Korea and India. We focus on the larger issuers in terms of amount outstanding. The table shows the sovereign or sovereign proxy (India) in the first row, any related State owned companies and private companies.

- India presents an interesting reflection of the market volatility in the last week, notably large spread moves, combined with low liquidity. Adani Ports (ADSEZ) $ 2/31 bonds for instance are +66bp wider week over week, but the min-max range over the week was 380bp - 620bp in z-sprd terms…a 240bp range. The initial moves wider seemed quite exaggerated for a company focused primarily on domestic business, thought trace data indicated limited trading volumes.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: USD Edges Up, But Still Close To Recent Lows, Risk Appetite More Stable

The USD BBDXY index has ticked up as the Wednesday Asia Pac session has unfolded. We were last just above 1268.0, up around 0.20% versus end Tuesday levels in NY. The index continues to oscillate around its simple 200-day MA and isn't too far from recent lows of 1264.63. EUR/USD is already above its simple 200-day MA, but USD/CNY bounced off the 200-day MA support zone today.

- Comments from US President Trump at a business roundtable around economic growth and downplaying recession fears, as aided risk appetite. Moving away from some tariff threats on Canada has also likely helped. Tariffs on steel and aluminium came into effect though, with no exemptions.

- US equity futures are modestly higher today, but Eminis remain sub 5600. This benchmark and Nasdaq futures are around 0.30% firmer at this stage. US yields are down slightly, off a little over 1bps for some of the key benchmarks, but this follows Tuesday's sharp rebound.

- USD/JPY is back above 148.00, last near 148.20/25, off around 0.30% in yen terms. Earlier remarks by BoJ Governor Ueda in parliament suggested little concern around the run up in local JGB yields and that there wasn't a big difference between the BOJ and the market's view. Such remarks should support the yen, but better risk appetite is likely offsetting.

- Data showed the PPI close to expectations, but import prices back in negative territory in y/y terms.

- AUD/USD has ticked back under 0.6290, with the A$ a clear laggard during this recent USD run lower (particularly against EU bloc currencies). Local equities are off 1.6%, with Australia not securing an exemption from steel and aluminium tariffs. NZD/USD has also edged down, last back close to 0.5705.

- EUR/USD has edged back to 1.0900, but is close to recent highs of 1.0947. EU equity futures are up around 0.85% so far today.

- US CPI for February is out later and forecast to show a 0.1pp moderation in headline and core to 2.9% y/y and 3.2% y/y respectively. February budget and real earnings data are also released. The BoC decision is announced and it is forecast to cut rates 25bp. The ECB’s Lagarde and Lane speak.

AUSSIE BONDS: Cheaper, No Steel/AL Tariff Exemption For Oz, US CPI Out Later

ACGBs (YM -6.0 & XM -7.5) are weaker but mid-range on a data-light session.

- “Australia has failed to secure an exemption from US steel and aluminum tariffs despite Prime Minister Anthony Albanese's government's lobbying efforts. Albanese called the tariffs "entirely unjustified" and "economic self-harm" on the part of the US, but said Australia would not take reciprocal measures and would instead work to diversify exports.” (per BBG)

- Cash US bonds are flat to 2bps richer in today’s Asia-Pac session. The February CPI report is the highlight of today’s US session, while some attention will be paid to the BoC which is expected to deliver a 25bp cut.

- Cash ACGBs are 5-8bps cheaper with the AU-US 10-year yield differential at +18bps.

- Swap rates are 5-8bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -1 to -5.

- RBA-dated OIS pricing is flat to 4bps firmer across meetings today. A 25bp rate cut in April is given an 8% probability, with a cumulative 65bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- Tomorrow, the local calendar will see Melbourne Institute inflation expectations for March. The previous month they jumped 0.6pp to 4.6%, the highest since November 2023.

OIL: Prices Higher, US CPI, OPEC Report & EIA US Inventories Released Later

Oil prices have continued rising during today’s APAC session driven by reduced excess supply expectations. WTI is 0.7% higher at $66.72/bbl after falling to $66.49 before rising to $66.84. Brent is up 0.7% to $70.03/bbl after an intraday low of $69.79 and a high of $70.13. The USD index is up 0.2%.

- OPEC’s March monthly report is published today with the IEA’s on Thursday. OPEC’s forecasts tend to be more optimistic. On Tuesday, the US’ EIA revised down its global excess supply expectations for both 2025 and 2026 due to the projected impact of tighter sanctions and enforcement on Iran and Venezuela.

- The supply outlook remains highly uncertain though with it still unclear if Iran and Venezuela will find ways to evade sanctions and if there will be an easing of restrictions on Russia. The US administration is also planning to increase US production, while higher tariffs have raised uncertainty around global demand substantially.

- The US 30-day ceasefire proposal will now be presented to Russia following Ukraine’s readiness to agree but Russia has said that it will only approve it on its own terms and not the US’. If it refuses, President Trump has threatened more sanctions and also tariffs on the country.

- Bloomberg reported that US crude inventories rose 4.2mn barrels last week after a drawdown the previous week, according to people familiar with the API data. Gasoline stocks were down 4.6mn while distillate rose 400k. The official EIA data is out later today.

- US CPI for February is out later (see MNI CPI Preview) and forecast to show a 0.1pp moderation in headline and core to 2.9% y/y and 3.2% y/y respectively. February budget and real earnings data are also released. The BoC decision is announced and it is forecast to cut rates 25bp. The ECB’s Lagarde and Lane speak.