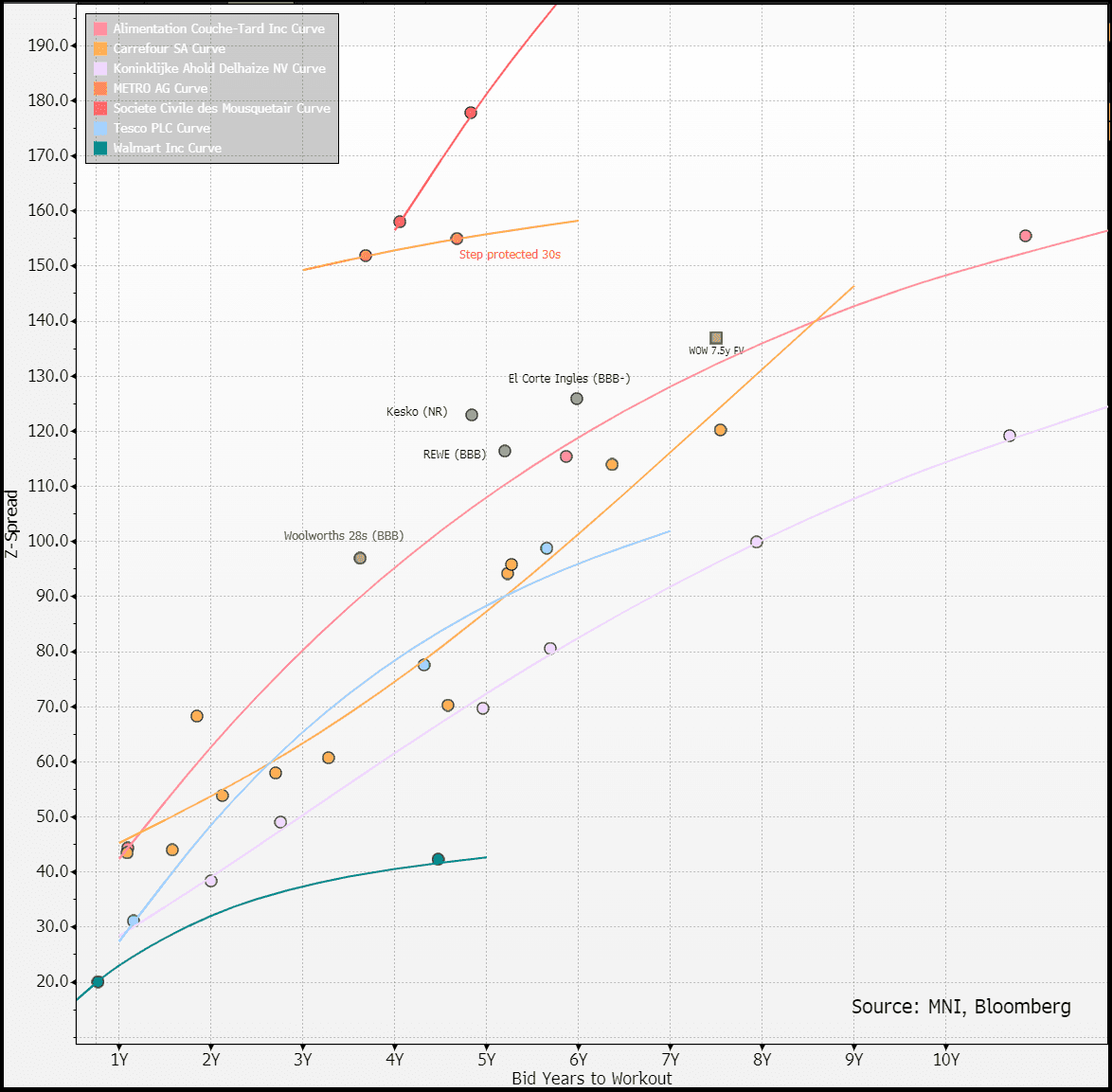

EU CONSUMER STAPLES: Woolworths: FV

(WOWAU; Baa2/BBB; Stable)

- exp. €500m 7.5y FV +137, pricing tomorrow

- we see no CoC (but no significant equity holders either)

Woolworths is Australia's largest grocer holding a 38% market share. Closest competitor, Coles, has a 29% share and together they run a effective duopoly - unlike most of our local issuers who operate in highly fragmented markets. It has translated to profitability - Woolworths runs sector leading margins (at near double French names). When paired with a typical mid-2 levered balance sheet it leaves it on Baa2/BBB ratings with ample headroom (1x below ceilings at both).

Still, Woolworth's is not our lowest beta pick in grocers (Tesco is) and that is on near term catalyst shifting more negative. This was triggered by consumer dissatisfaction on rising grocery prices. Inflation has since receded (running at ~3%) but the political and regulation pressure that emerged from it remains. Regulation was effectively resolved two weeks ago without harm and was a major credit positive (evidenced by both Coles and Woolworths mandating their bond issuance soon after). The political uncertainty remains given a election is one month away and is too close to call. Centre left (currently in power) is more soft on the grocers, centre right has said forcing the two operators into divestitures could be considered as last resort.

On Sunday New Zealand's Finance minister (who is not facing an election) said she would "actively seek a third player" and that advisors were also studying "a possible demerger of existing entities". In New Zealand the duopoly is held by Woolworths & Foodstuffs. The smaller country (pop. 25m vs. 5m) contributes 12% of WOW revenues but on inferior margins (EBIT 1.3% vs. Aussie food on 6%) contributes only 3% of group EBIT. We flag as the changes there may impact the consumer sentiment and political pressure in Australia.

Other real changes from above have been;

- CEO resigning a few days after a walking out on a media interview (last year). He was well respected by markets.

- Co guiding to MSD EBIT fall (ex. one-offs) this FY (12m to June) as it attempts to aggressively price and win back customer satisfaction

Other credit negatives we have with the co;

- Its (seeming) refusal to put a leverage target in place which has held back rating upgrades

- We note this particularly with a new CEO and a ongoing portfolio review (latter unlikely to be a mover given core Aussie Food operations makes up 96% of EBIT)

Credit positives;

- 1x headroom to rating thresholds (can take a -30% fall in EBTIDA on unch debt levels)

- Sector leading profitability as the starting point to all the above

- Positive history on BS governance and stated commitment to "solid IG ratings"

On FV we have always had the view taking the illiquidity discount among the single country grocers screens more value then investing in tighter global operators ADNA & Carrefour. We spread Woolworths similar to REWE & El Corte Ingles. We see room for it tighten from there if some of the above uncertainty is resolved post-election. On that vein have a existing value view on the shorter WOWAU-28s.

Quick figures for reference (FY24/to June'24):

- AUD 68b (€39.5b) in sales, 12% of which in ecommerce

- AUD 6.0b (€3.5b) in EBITDA on a 8.8% margin

- AUD 3.2b (€1.9b) in adj. EBIT on a 4.7% margin

- AUD 16.8/15.5 g/n debt levered 2.8x/2.6x

WOW is a well covered equity name (similar to Tesco/Carrefour). FY25 consensus is currently at;

- Revenue +2%, EBITDA -4%, EBIT -12% on 4.2% margin (-50bps yoy)

- Note 1H EBIT was -14% but says ex. one-offs including industrial action, it would have been -7%. Guidance for 2H EBIT is MSD decline.

- On a conservative -10% EBITDA fall we see leverage rising to 3.1x/2.9x still well below thresholds (Moody's gross 4x, S&P net 3.75x)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0300(E1.0bln), $1.0375-85(E1.3bln), $1.0400(E691mln), $1.0450-55(E873mln), $1.0480(734mln), $1.0520-30(E1.9bln), $1.0545-50(E884mln)

- USD/JPY: Y148.30($686mln), Y148.90-00($555mln)

- AUD/USD: $0.6335(A$1.2bln)

- USD/CAD: C$1.4315-25($1.2bln), C$1.4395-10($2.0bln), C$1.4425($529mln)

- USD/CNY: Cny7.2610($574mln)

STIR: ISM Mfg Helps Steer Fed Rates Back Towards Recent Dovish Extremes

- Fed Funds implied rates hold most of their decline with the dust settled on the ISM manufacturing survey, which firmly contradicted the “noticeable upturns in both production and new orders” seen in the US S&P Global PMI.

- Whilst a cut on Mar 19 is still seen as firmly off the table, there is now 9.5bp of easing priced for March (+2bp post-ISM) whilst the 67bp of cuts for 2025 (+3bp) is back close to last week’s recent dovish extremes of 70bps.

- For recent context, 2025 cut expectations have ranged from 25bp after the January CPI report on Feb 12 and pricing is back close to levels prior to the hawkish Dec 18 FOMC decision which includes a dot plot with a median 50bp of cuts for the year.

SEK: Fresh Wave Of Strength Prompts Breach Of 0.9500 In NOKSEK

SEK has seen a fresh wave of buying interest over the past ~60 minutes, helping NOKSEK push through key multi-year support at 0.9500, now 1.1% lower today at 0.9462. A close below 0.9500 would be an important bearish development and expose the November 2020 low at 0.9274 as the next downside target.

- The 0.9500 level has capped downside in the cross three times since mid-2023, while also providing support back in 2016.

- EURSEK is also through the Feb 22nd 2024 of 11.1385, exposing the December 2023 low at 11.0030.

- There hasn’t been an obvious headline trigger for the latest wave of SEK strength, though Bloomberg did run a piece on the role of increased defence spending prospects in supporting the krona at 1440GMT: {NSN SSCBLZDWRGG0 <GO>}

- While we sympathise with the argument that Sweden’s economy and the krona can benefit from increased Eurozone defence spending (Swedish defence exports as a % of nominal GDP are higher than the likes of France, Germany, the UK and the US according to data from the UK Govt and the IMF), it’s worth noting that a similar argument could also be made for Norway – see chart. That fact hasn’t provided a similar tailwind to the NOK today.

- Today’s 11% rally in Saab shares on the OMX30 has been joined by a 16% rally in Kongsberg Gruppen shares on Oslo Børs.

- The next key Swedish data release is February flash inflation on Thursday, particularly following the much stronger than expected January reading.